March 18, 2025

Market Overview 12-03-2025 to 18-03-2025

A period of growth marked by new price records. This is how the last 7 days can be described on the precious metals exchange. The rise of price in precious metals was driven by a sharp increase in geopolitical tensions in the Middle East and the weakening of the dollar due to the aggressive economic policy of the USA. New fiscal decisions in the German and Chinese markets are also contributing to the rise in precious and semi-precious metals prices.

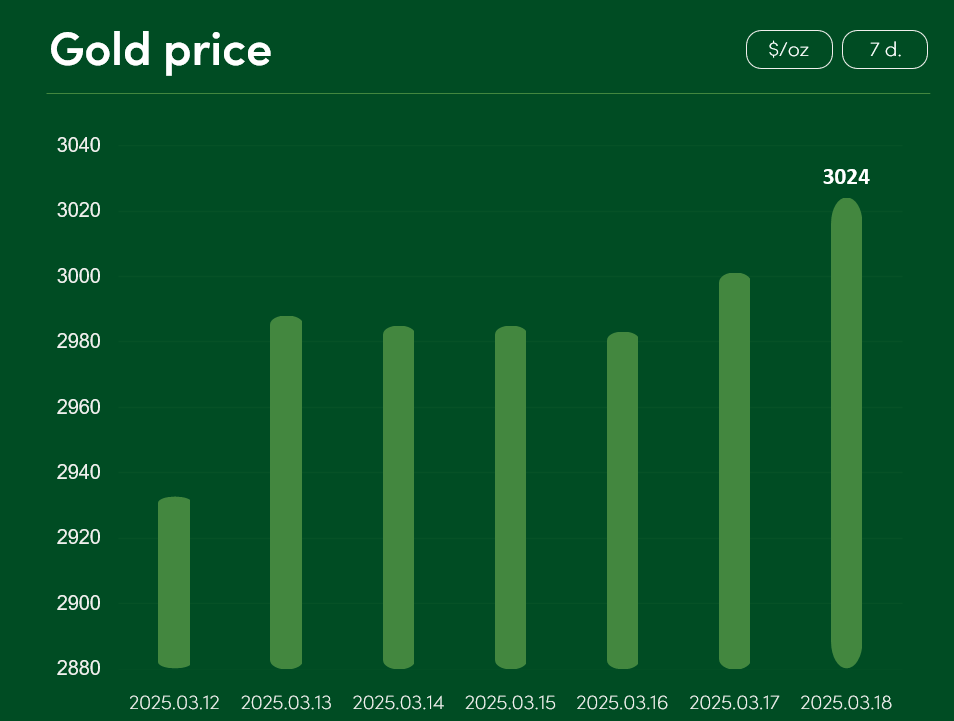

The gold price, which has set several new all-time highs in recent days, rose by ~3.1% between 12 and 18 March to a point of $3024/oz.

The rise in gold prices is driven by the increasing geopolitical risks in the Middle East. Over the past week, the US military has carried out airstrikes against Yemen’s Houthi rebels, while the Israeli military has carried out large-scale airstrikes in the Gaza Strip. As the risk of wider armed conflicts increases, so does the demand for gold as a safe haven investment.

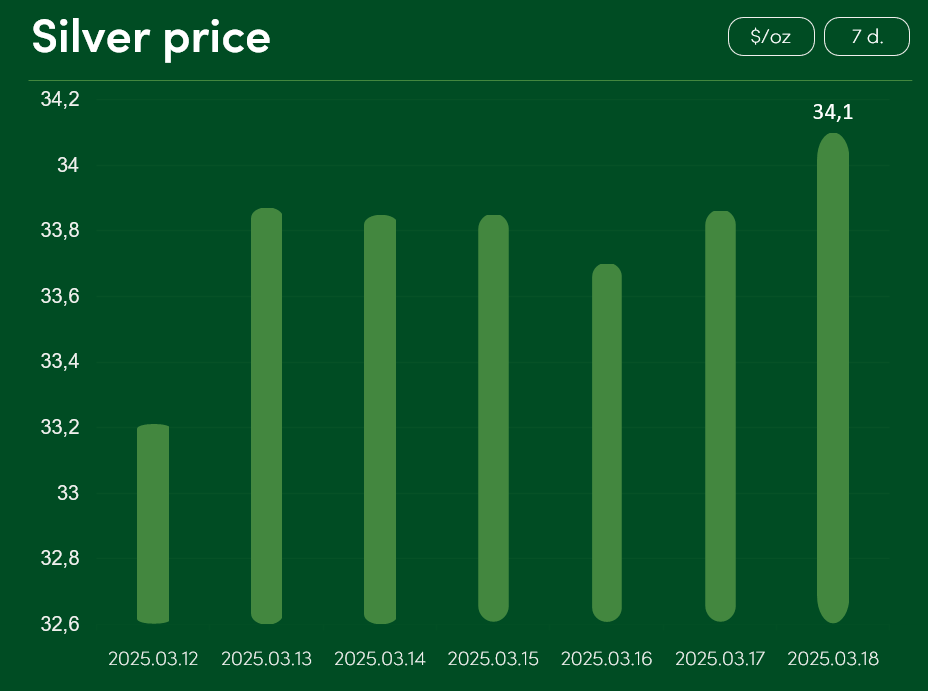

The global silver price rose by ~2.7% between 12 March and 18 March to $34.1/oz.

The exceptional interest in silver is undoubtedly driven by the large variety of applications for this metal. Current industrial demand for silver is being supported by the Chinese government’s decision to issue debt securities worth hundreds of billions of dollars and the country’s ambition to meet its 5% GDP growth target this year. The agreement reached by the forming ruling coalition of German government to create a €500 billion defence-infrastructure fund is also contributing to industrial demand for silver.

Meanwhile, the demand for silver as an investment hedge is boosted by the intensifying global trade war. With the US imposing global tariffs on steel and aluminium imports and engaging in a trade tax conflict with Canada, China and Mexico, US president Trump was quick to threaten tariffs of 200% on European imports of wine, champagne and other alcoholic beverages. In an uncertain international trading environment, investors are more likely to choose a safe and time-tested option of silver investing.

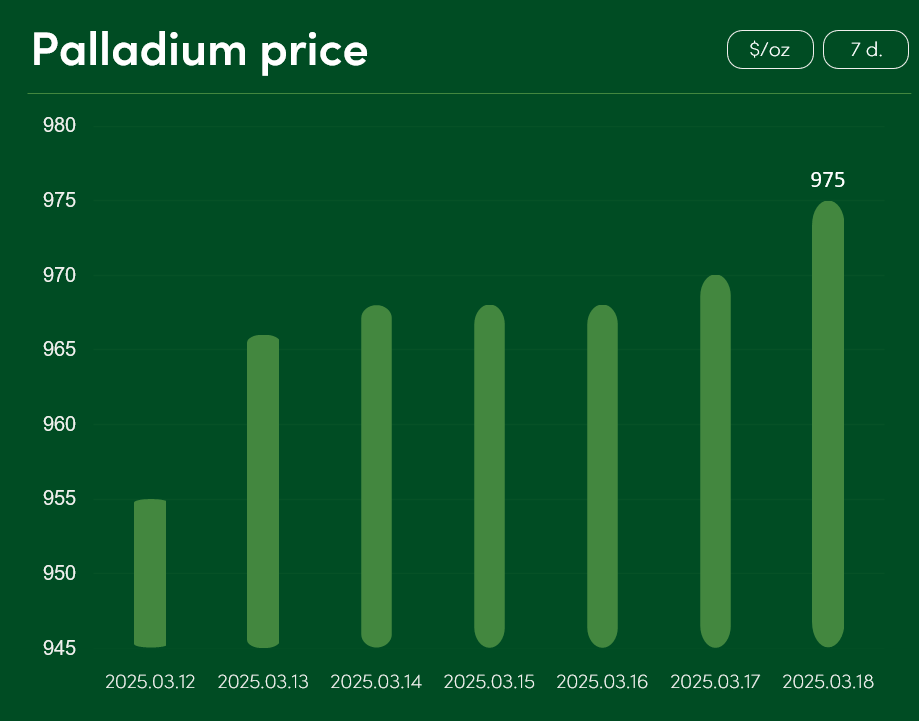

The global palladium price rose by >2% between 12 March and 18 March to reach a price point of $975/oz.

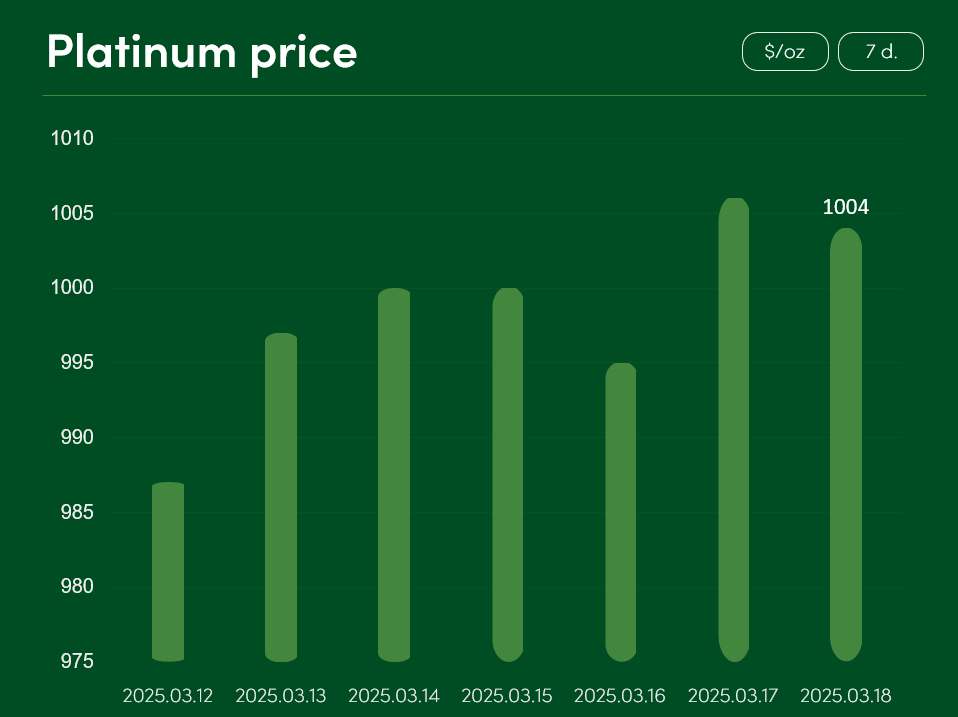

Meanwhile, the global platinum price has increased by ~1.75% over the last 7-day period and reached $1004/oz.

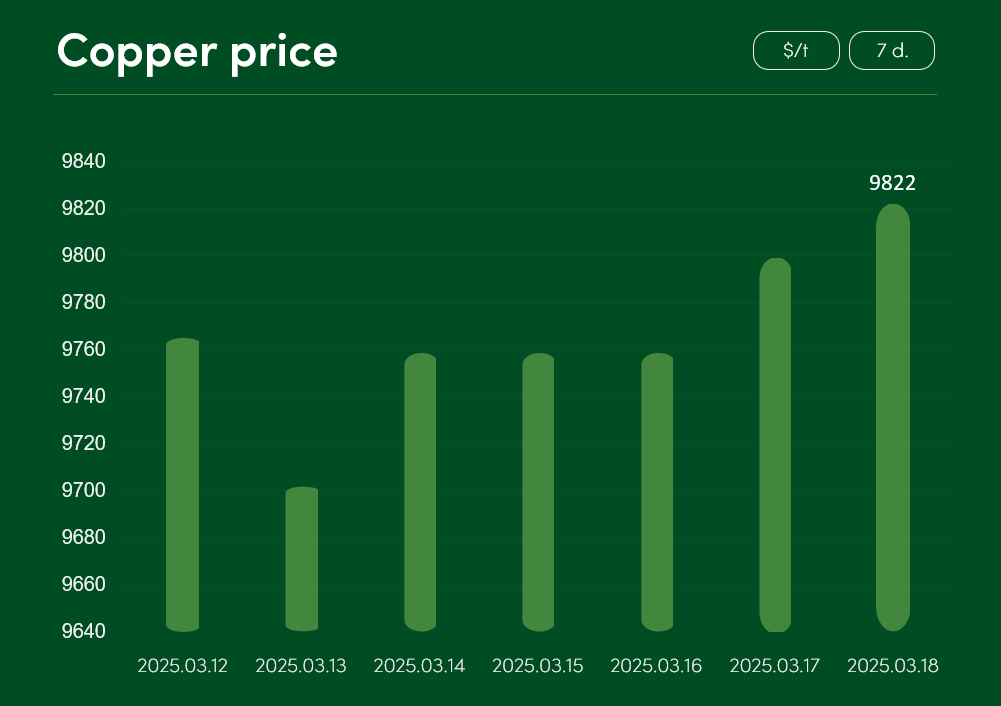

The global copper price increased by ~0.59% between 12 March and 18 March to reach $9822/t.

The progress of the copper metal price towards $10000/t is not only driven by the large-scale fiscal stimulus programme of the Chinese market. Investors are also much more active in this semi-precious metal because of the apparent imbalance in copper supply-demand.

Jinlong Copper Co. and Chifeng Jingtong Copper Co., both owned by China’s largest copper smelting company, Tongling Nonferrous, have recently reduced their copper concentrate processing volumes by 10%. This decision was taken in order to combat the negative copper treatment and refining rates in the Chinese market. As the markets watch the decline in copper concentrate processing volumes and fear the possible imposition of tariffs on imports of this metal in the United States, global demand for copper is naturally increasing.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.