February 18, 2025

Market Overview 12-02-2025 to 18-02-2025

Last week, the global economic and political landscape was full of events of strategic importance that could significantly contribute to shaping the price dynamics of precious metals in the years to come. The gradually easing geopolitical situation and the changing global trading order may become significant circumstances for wide-ranging changes in precious metals investment sphere and international supply chains.

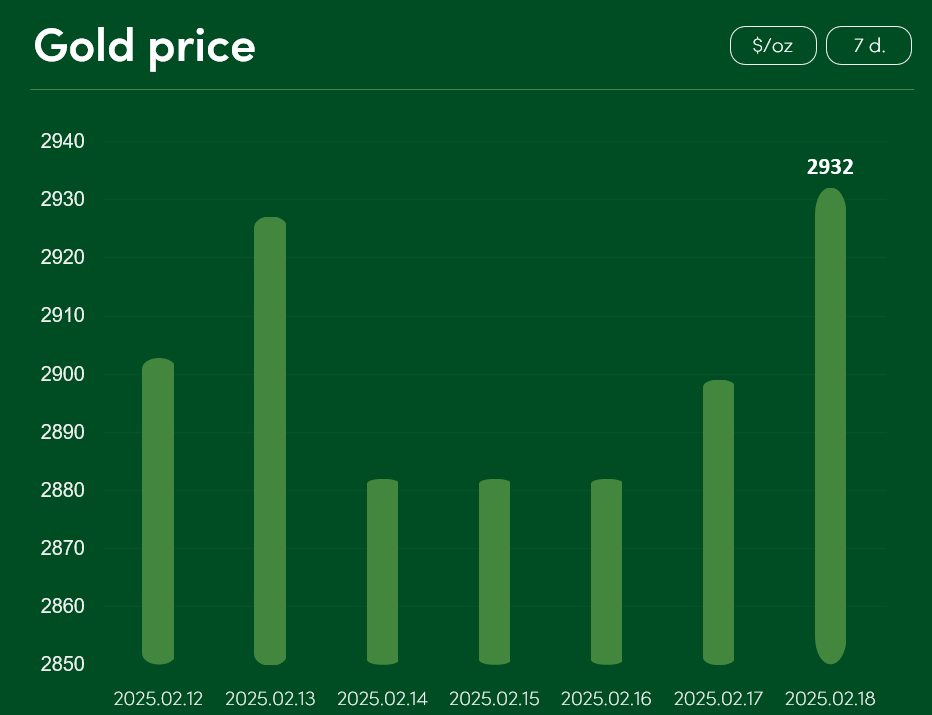

The global gold market price experienced a 1% increase between 12 and 18 February. On 18 February, the precious metal reached $2932/oz.

Although gold has experienced periods of record growth both in 2024 and at the beginning of this year, investors’ hesitations about further increases in the metal’s price have been fuelled by the growing global geopolitical stability. The fragile ceasefire between Israel and Hamas continues to hold, with the release of Israeli hostages and imprisoned Palestinians continuing last week.

There have also been more pronounced attempts to move towards peace agreement and a halt to the war in Ukraine. After a diplomatic meeting in Saudi Arabia, the representatives of Russia and the US achieved tangible results. After the talks, US Secretary Rubio stated that both sides agreed to set up a high-level diplomatic team for the Ukrainian peace negotiation process and decided to explore possible economic-investment opportunities after the war in Ukraine.

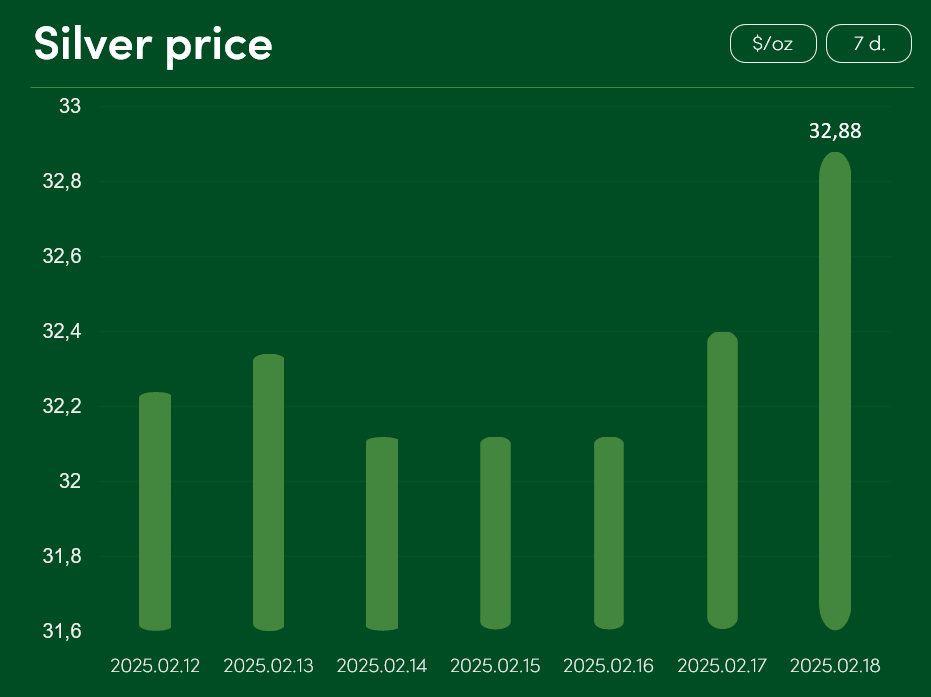

The global silver price rose by ~2% between 12 February and 18 February to $32.88/oz.

Although increasing geopolitical stability adds to the uncertainty of further silver price increases, the global overall demand for the precious metal, which is widely used in industrial production, is highly supported by the demand for silver in the renewable energy sector.

China, the main consumer of silver, has been shown to have increased its solar and wind energy production by as much as 357 gigawatts last year. China’s aggressive development of renewable energy is contributing significantly to the demand for silver in industrial production.

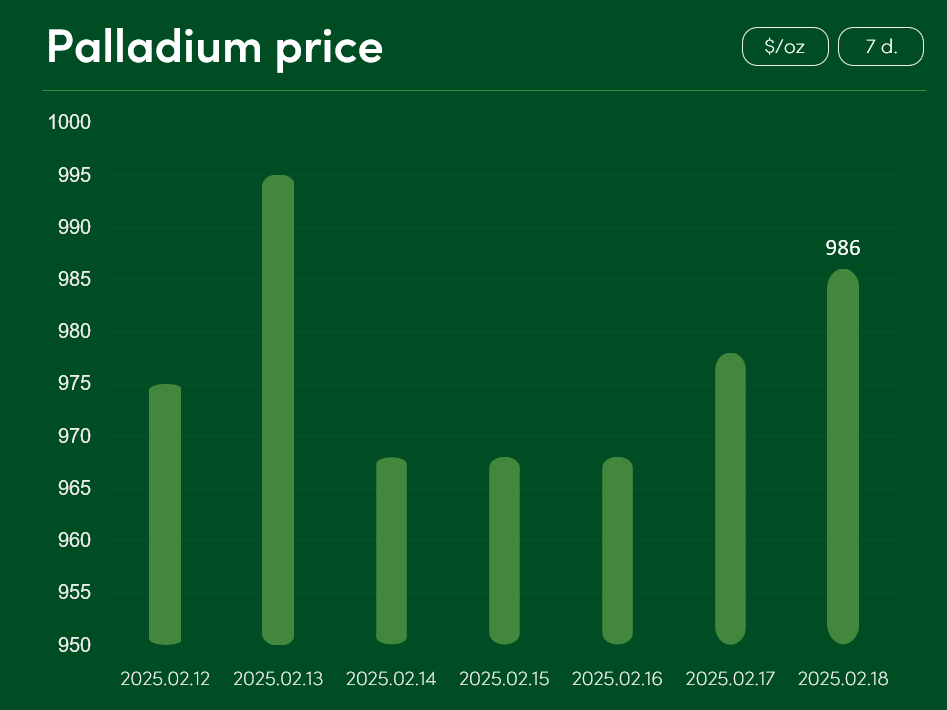

The global palladium market price experienced a slight increase of ~1.2% between 12 and 18 February, reaching $986/oz.

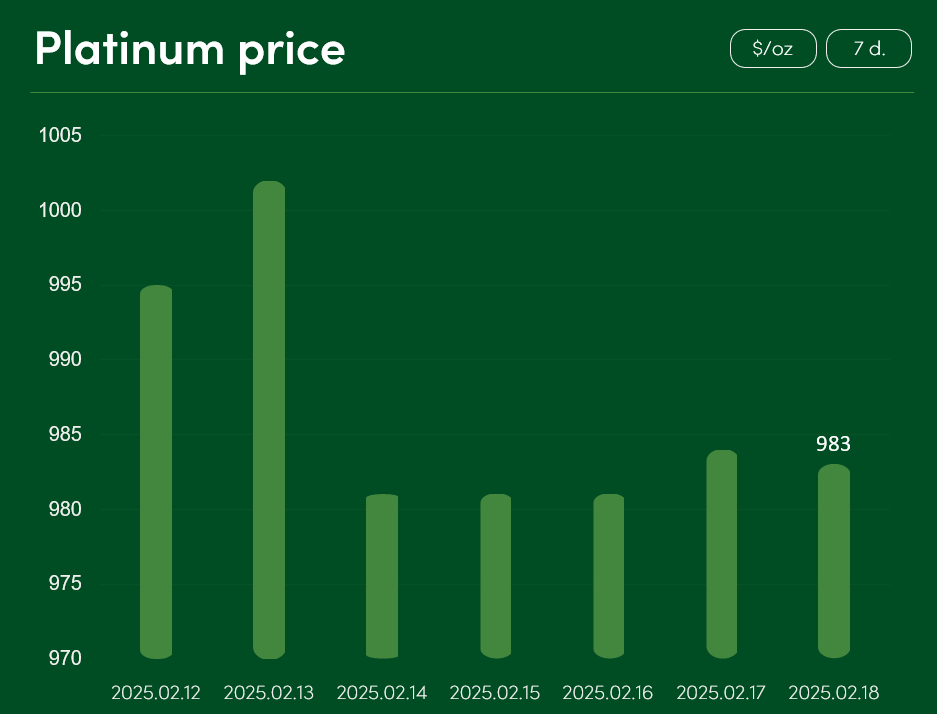

The global platinum price experienced a slight correction of ~1.2% between 12 February and 18 February, reaching 983 $/oz on 18 February.

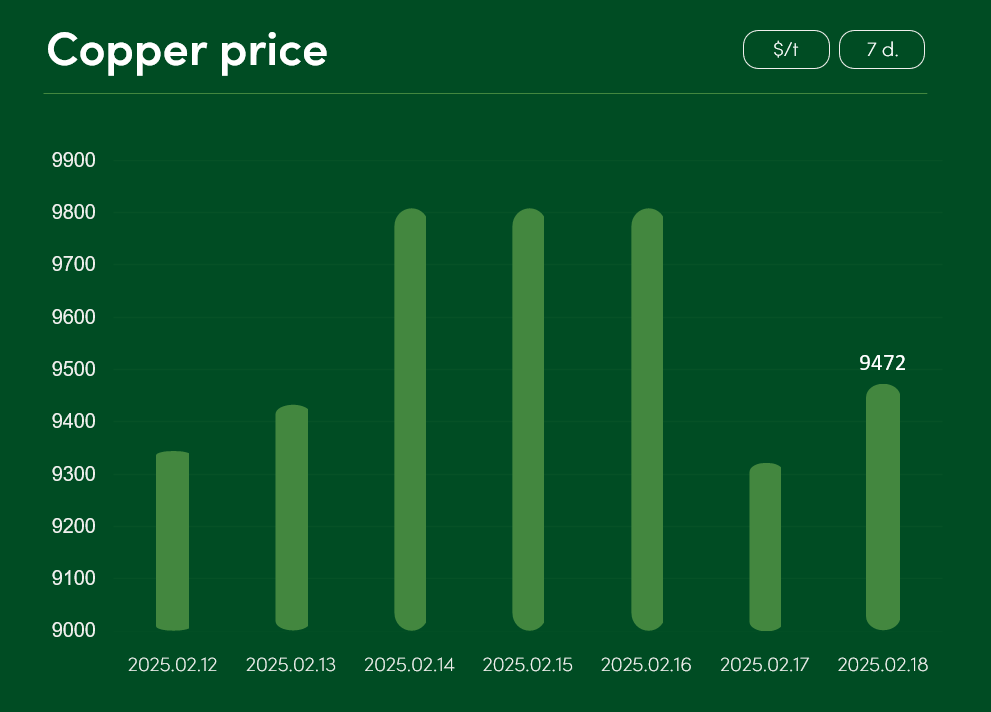

The global copper price is showing a very optimistic growth this month. Between 12 and 18 February, copper price on the global metals market increased by ~1.4% to $9472/t.

When assessing the likely price dynamics of copper in the upcoming years, it is important to consider the current supply-demand balance for the metal in the major industrialised markets.

While the US, Chinese and German markets have recorded positive growth in various industrial production-purchase data, China’s copper concentrate processing and refining sector has been recording a consistent decline in service charges since November last year. Such result is driven by a shortage of copper concentrates in the Chinese industrial sector. The latter factor is contributing to both the global increase in copper prices and the consolidation of metal price at higher levels.

The expected recovery and growth of the copper sector is being assessed by governments and private businesses in various countries. KGHM, the Polish silver and copper producer, has announced a likely expansion of investments in its business activities in response to the government’s plans to reduce the copper output tax. Meanwhile, Southern Copper, another copper mining giant, expects to start copper mining at its USD 1.8 billion Tia Maria mine in Peru as early as 2027.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.