December 17, 2024

Market Overview 11-12-2024 to 17-12-2024

Major precious metals experienced price corrections of varying magnitude levels during the last week. The decline in market optimism can be partly explained by investors’ uncertainty about future interest rate cuts in the US market. The persistent stagnation in market growth and the real estate crisis in mainland China also contributed to the negative price course.

The gold price fell by ~2.8% between 11 December and 17 December to reach $2640/oz.

Since the beginning of the year, gold prices have risen by ~29%, beating many analysts’ forecasts. Naturally, an asset class that is growing at a much faster-than-normal pace may often face a higher number of short-term corrections. This week’s decline in gold prices is actively linked to investors’ doubts that the US will continue to actively adopt monetary policy decisions that are supportive of the growth of investment assets in the coming year.

Although markets are pricing in as much as a 96% probability that US interest rates will be cut by a further 0.25% (25 basis points) at the Fed’s meeting on 18 December, investors fear that the pace of rate cuts could slow down sharply during the next year. According to analysts at TradingEconomics, US private sector activity recorded a faster growth rate this December. This is likely to contribute significantly to a rise in inflation rates and encourage easing of further Fed rate cuts policy. The latter decision may reduce demand for various investment instruments, including gold.

The silver price declined by ~5% between 11 December and 17 December, reaching a price point of $30.29/oz.

The correction in silver was not only triggered by investors’ doubts about the favourability of further US monetary decisions, but also by worrying data from China, one of the most important industrial users of silver. TradingEconomics analysts note that the recent weakness in Chinese market consumption is reflected in indicators such as the slowdown in the growth rate of Chinese retail sales in November.

Also, the huge Chinese market, whose new residential property prices have fallen for the 17th month in a row due to the internal crisis, has recently become increasingly involved in a trade war with the US. Le Monde reports that at the beginning of December the Chinese announced their decision to stop issuing US export licences for chemical elements such as gallium, germanium and antimony. Falling demand for metals and rising global trade tensions are encouraging investors to be more cautious about the short-term outlook for various precious metals.

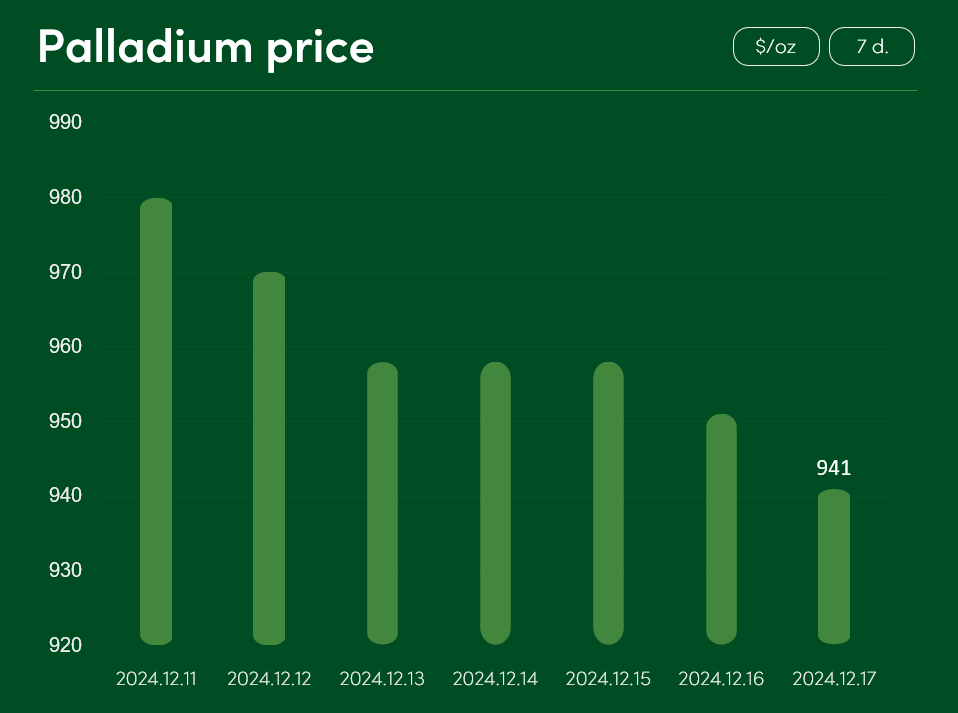

The price of palladium declined by ~4% between 11 December and 17 December to $941/oz.

Meanwhile, platinum metal, which has been facing controversial market sentiment this week, recorded a much more modest correction of ~1.25% over the last 7 days and reached $928/oz.

Although platinum has already recorded a ~14% price decline since this May, the outlook for the metal’s price in 2025 is not characterised by pessimism. According to the World Platinum Investment Council (WPIC), the global platinum market in 2025 will see the third consecutive year of deficit for this metal. The total global deficit in 2024 will amount to 682 thousand ounces. This shortage is likely to be a significant cause of price consolidation and growth for a metal that is used extensively in both transport catalysts and jewellery.

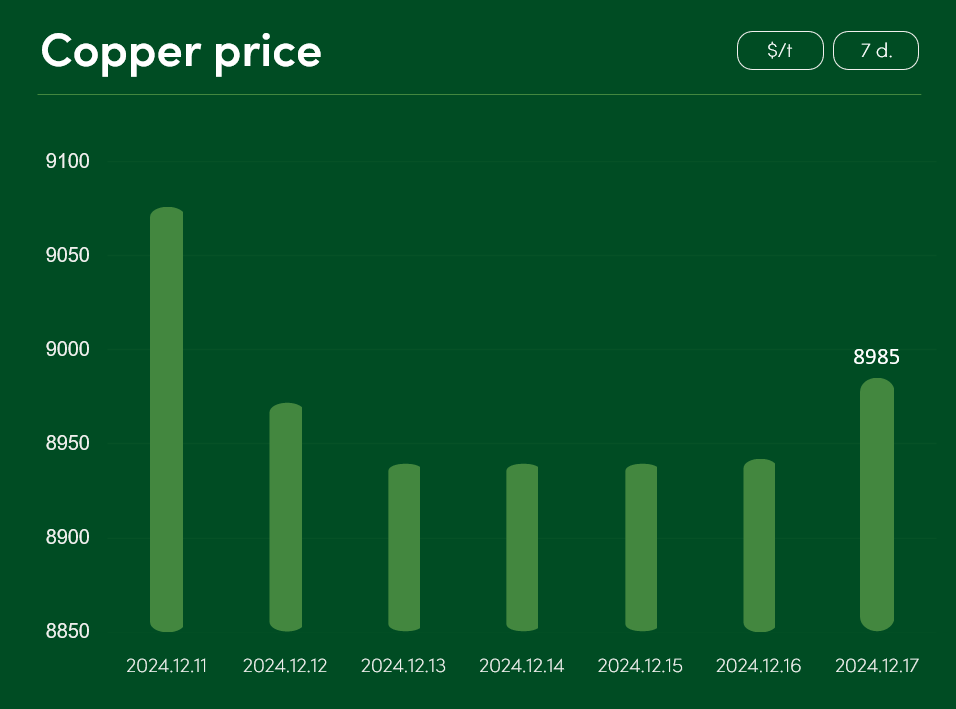

Copper market prices experienced a fairly normal temporary correction of ~1% between 11 December and 17 December, with the market recording a price of $8985/t.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.