September 17, 2024

Market Overview 11-09-24 to 17-09-2024

Precious metals markets recorded impressive price gains last week. This was partly due to optimistic sentiment, which is actively felt in the global banking sector. While the world is waiting for the official confirmation of the Fed’s interest rate cut in the US, the European Central Bank took the unexpected decision on 12 September to cut bank interest rates in the euro area. The protracted military conflicts in the Middle East and Ukraine and the tense political situation in the United States is also fuelling the markets’ lean towards the safe haven of precious metals.

The global gold price rose by more than 2.5% between 11 September and 17 September, reaching $2583/oz, thus recording new all-time price highs. This sharp rise was partly due to the optimistic interest rate situation: according to the analytical forecasts provided by TradingEconomics, the meeting of the Fed (Federal Reserve) board members scheduled for 18 September will certainly result in a cut in US bank interest rates.

The only disagreement is on the size of the expected rate cut: the markets predict a 67% probability of a 50-basis point (0.5%) cut in US interbank rates and a 33% probability of a 25-basis point (0.25%) cut in interest rates in this country.

In any case, one thing is clear: the easing of monetary policy in the world’s most powerful economy will definitely contribute to fuelling the autumn rise in precious metals prices. The tense global geopolitical situation will also undoubtedly contribute to such scenario. The ongoing armed conflicts in Ukraine, the Middle East, and Africa are not the only global political problems. Deepening political tension in the US can be clearly felt due to the recent second assassination attempt of Donald Trump.

The price of silver also recorded a successful rise last week. Silver’s price gain of more than 7% between 11 and 17 September allowed this precious metal to reach a price of $30.72/oz on the world market on 17 September.

The rise in the price of silver was not only supported by the optimistic economic outlook in the US market. The European Central Bank (ECB) made its second interest rate cut of the year last Thursday (09-12), cutting bank interest rates in the euro area by 25 basis points (0.25%). This easing of monetary policy is undoubtedly leading to a greater diversion of direct and indirect European investment into the precious metals sector.

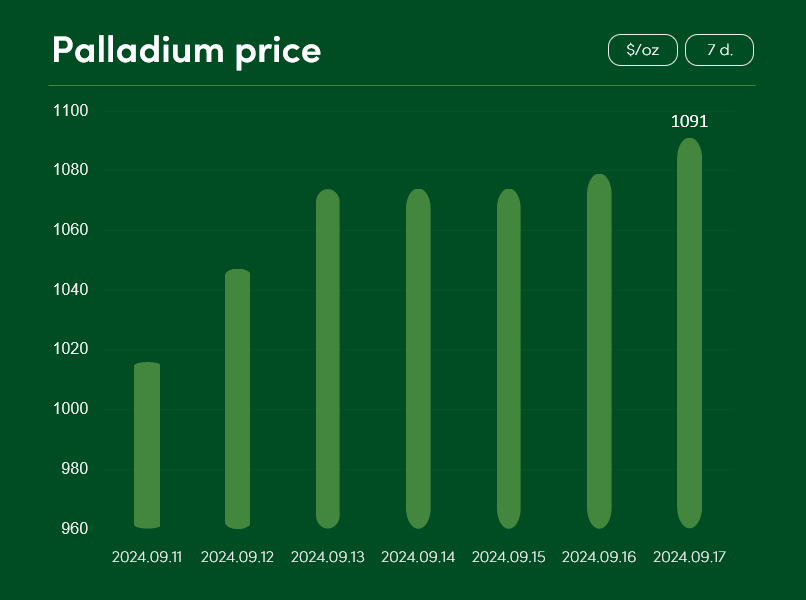

Palladium metal delighted the markets last week with a record price increase of >7%, which allowed this precious metal to reach a price of 1091 $/oz on 17 September.

Platinum metal also recorded a solid increase in market price. Between 11 September and 17 September, the platinum price rose by ~3% and reached a price level of $984/oz.

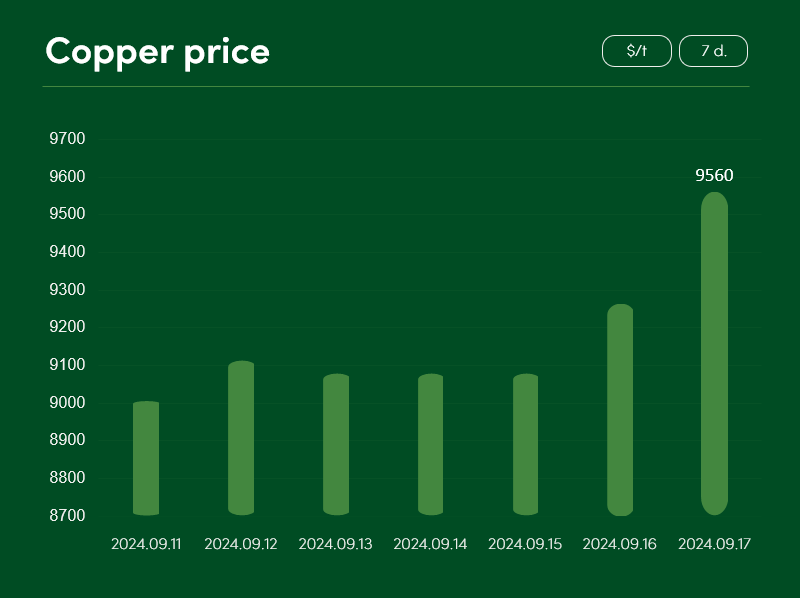

Perhaps the most appealing and unexpected price rise in the metal market during the last week was the rush of copper prices. This semi-precious metal recorded a price increase of more than 6% between 11 September and 17 September, which helped copper to successfully restore the price of $9560/t that prevailed on the market until the corrections of late August and early September.

While the long-term outlook for copper prices looks very optimistic, the current economic performance of China, a major copper buyer, is a huge concern in the short term. According to TradingEconomics experts’ comments, China, which is facing a real estate crisis in its domestic market, is showing declines in industrial production, retail sales and fixed asset investment. On the other hand, the Chinese government, which is actively trying to resolve the situation, has already allocated financial resources and is very likely to allocate even more in the near future in order to stabilise the economic situation and stimulate the country’s economic growth.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.