June 17, 2025

Market Overview 11-06-2025 to 17-06-2025

During the last week, political and economic developments prompted a stronger return to precious metals among market participants. Rising geopolitical threats in the Middle East, increasing prices of essential production materials, and the uncertain interest rate environment in the U.S. are encouraging investors to favour the time-tested safe haven of precious metals in the short to medium term.

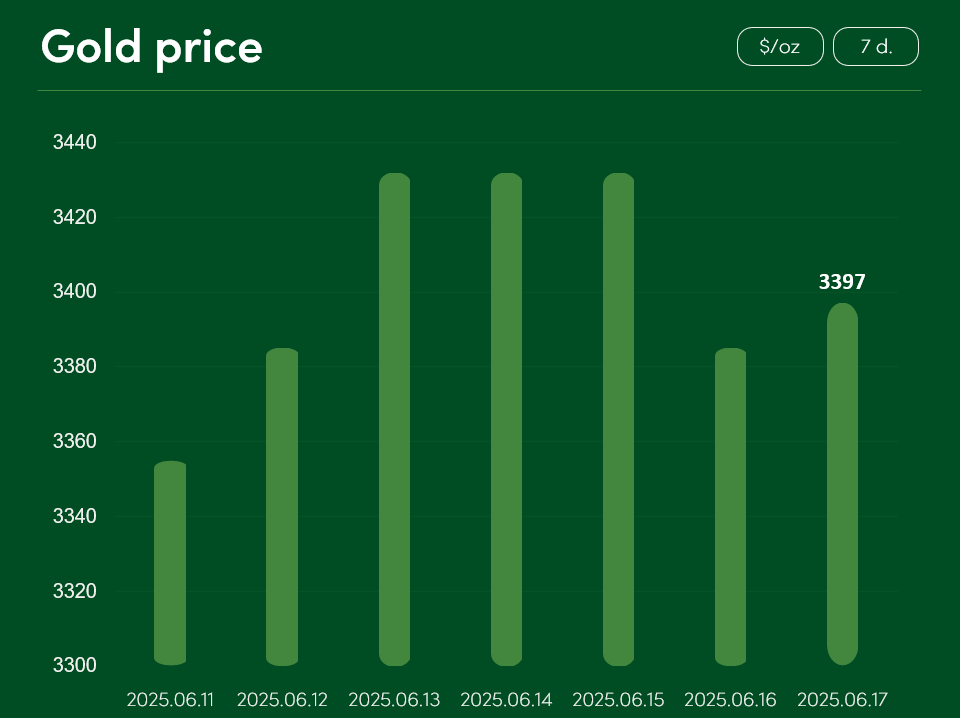

The global gold price rose by approximately 1.25% from June 11 to June 17, reaching $3,397/oz.

A significant factor contributing to increased investment demand for gold has been the deepening crisis in the Middle East. Following Israel’s airstrikes targeting Iran’s military and nuclear infrastructure, as well as key individuals in these sectors, a swift response from Iran’s armed forces followed. As both nations continued exchanging strikes, residents of Tehran—Iran’s capital—received an evacuation call from the U.S. president. Fearing a large-scale armed conflict, investors increasingly turned to gold-backed assets.

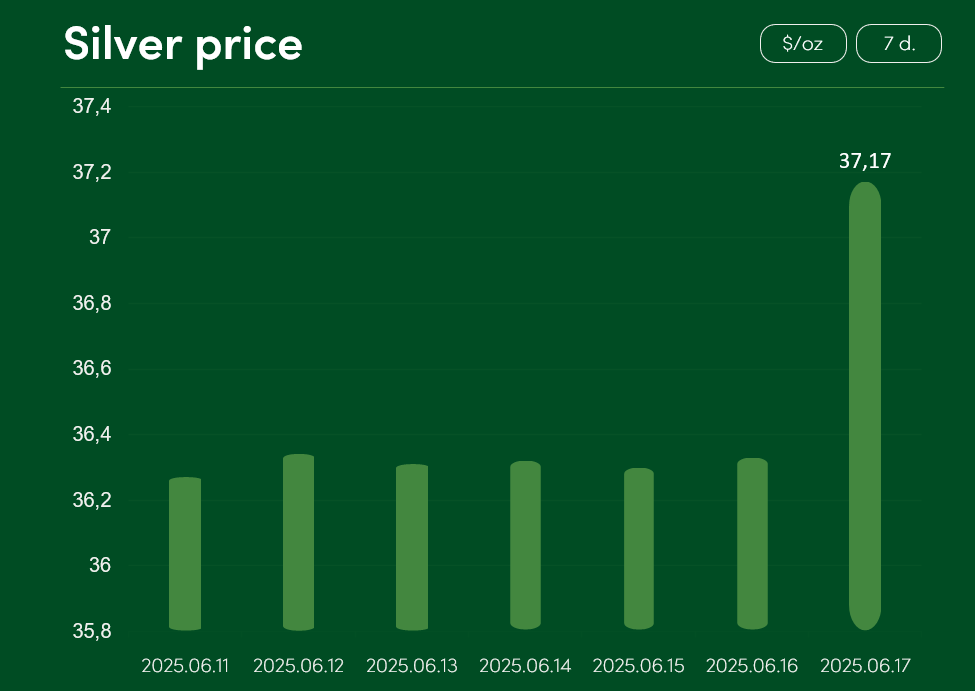

The global silver price increased by around 2.5% between June 11 and June 17, reaching $37.17/oz.

The recent growth and consolidation of silver prices at higher levels are being driven not only by deepening geopolitical crises and a projected supply deficit but also by an optimistic outlook on upcoming changes in U.S. monetary policy. Although the upcoming Federal Reserve meeting, just a day away, is expected with nearly 100% certainty to maintain current interest rates, the market is eagerly waiting for any signals about possible rate cuts in the coming months. Such a decision would weaken the U.S. dollar and act as an additional incentive for foreign markets to invest in the dollar-denominated precious metals sector.

The sharp increase in silver prices at the beginning of this week was also influenced by disappointing news in international trade. Japanese Prime Minister Shigeru Ishiba officially stated that he and U.S. President Donald Trump have yet to reach a U.S.-Japan trade agreement. This statement further fuelled investor anxiety and increased the appeal of precious metal assets.

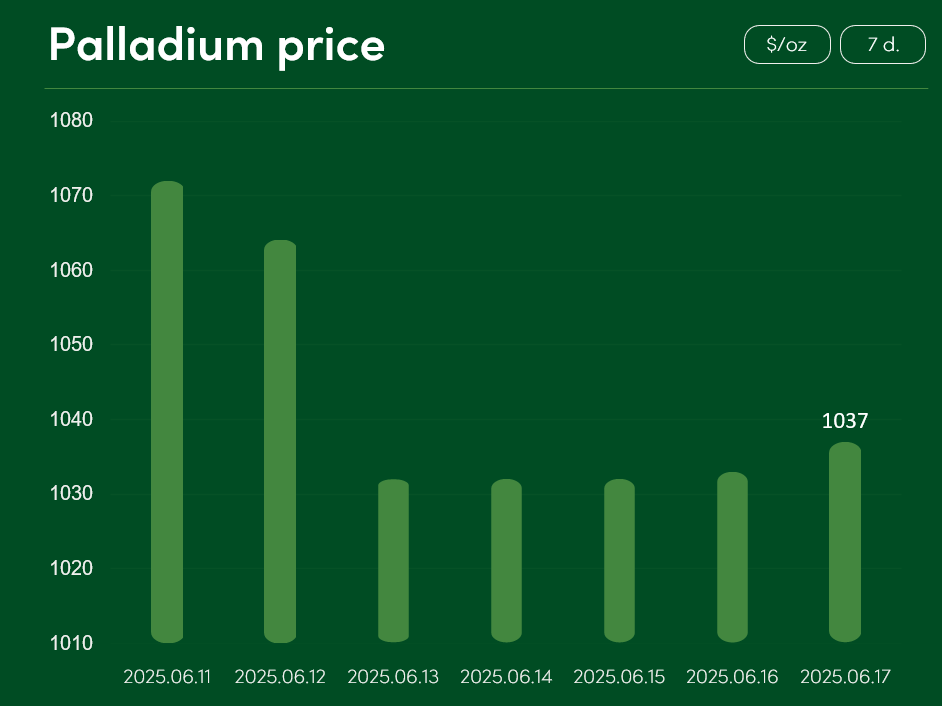

The global palladium price declined by approximately 3.25% from June 11 to June 17, falling to $1,037/oz.

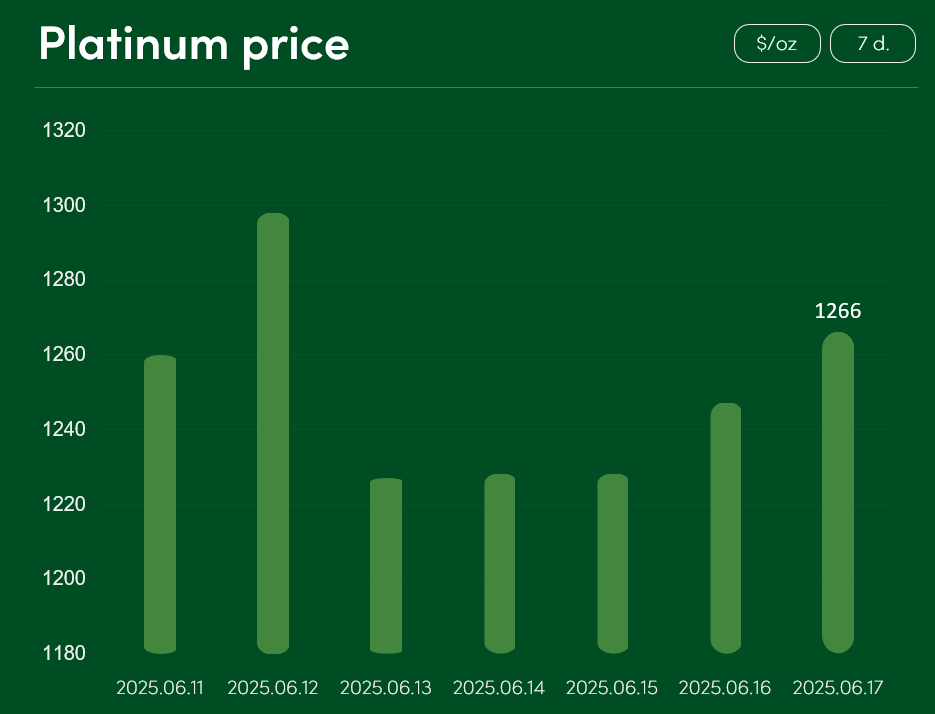

The global platinum price remained relatively stable during the same period, with a recorded price level of $1,266/oz on June 17.

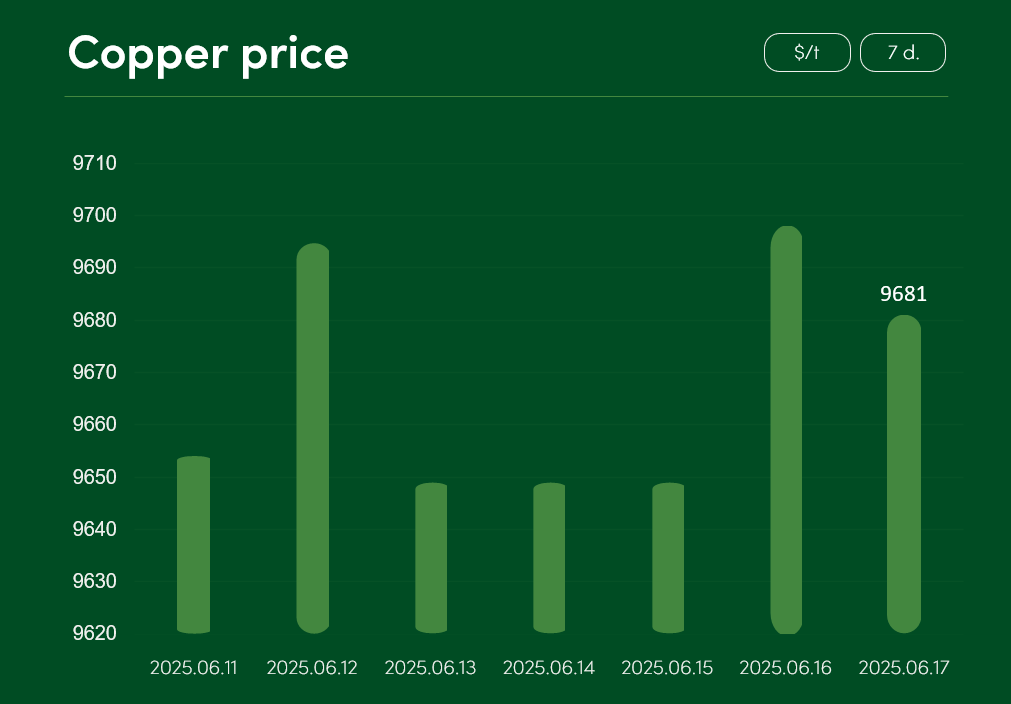

The global price of copper posted a minor gain of approximately 0.28% from June 11 to June 17. On June 17, the price of copper reached $9,681/t.

The growth prospects for copper and other industrial metals are indirectly influenced by Israel’s military attacks in the Middle East. As the Israel-Iran conflict intensifies, the Brent crude oil price index surged by around 8% from June 12 to June 17. If this upward trend in oil prices continues, rising oil costs could lead to higher prices for industrial metals and various everyday goods. Such a scenario may ultimately result in decreased demand and lower prices for specific industrial non-ferrous and ferrous metals, including copper itself.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.