February 17, 2026

Market Overview 11-02-2026 to 17-02-2026

Precious Metals Markets Enter a Period of Price Declines

Last week, precious metals markets experienced a period of price declines of varying intensity. This trend was driven by positive signals in the sphere of geopolitical tensions and by the unusual operating schedules of several Asian exchanges due to the celebration of the Lunar New Year.

At the same time, there remains no shortage of factors supportive of precious metals price growth. Markets are actively discussing increasingly likely Federal Reserve rate cuts, as well as softer-than-expected inflation data in the US.

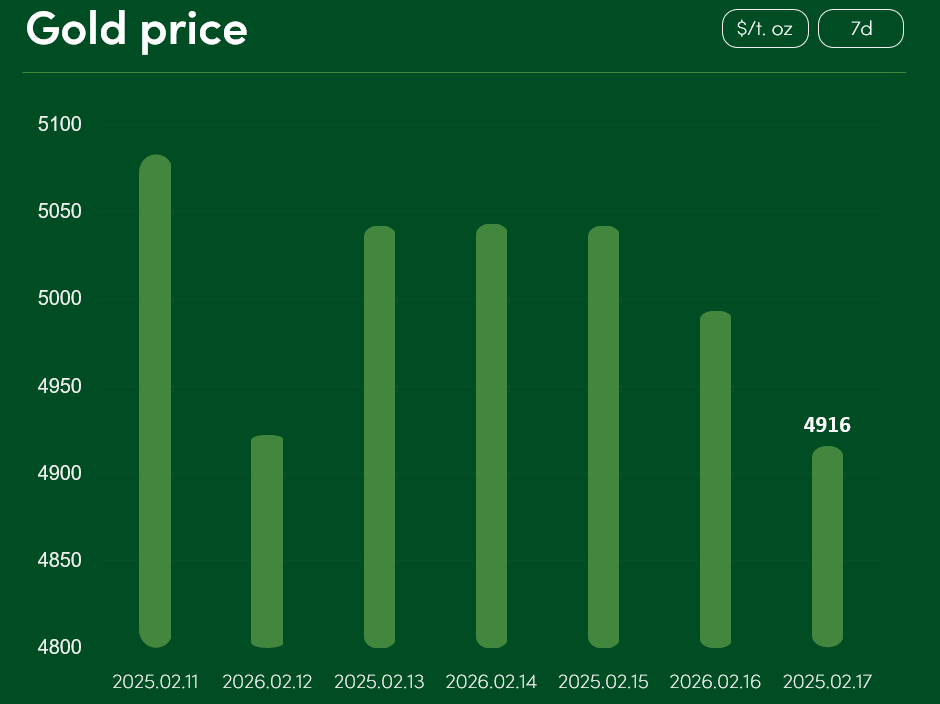

The global gold price declined by approximately 3.3% between February 11 and February 17, reaching USD 4,916 per troy ounce. The average gold price level in February stands at USD 4,960 per troy ounce.

Gold price weakness has been partly influenced by active political negotiations aimed at de-escalating geopolitical crises. Following two rounds of trilateral meetings in Abu Dhabi, representatives of the United States, Russia, and Ukraine are beginning a third round of peace talks in Geneva this Tuesday. Meanwhile, Ukrainian President Volodymyr Zelensky has noted that even ahead of the Geneva meeting, the Russian army has no orders other than to “continue striking Ukraine.”

A second round of negotiations between the United States and Iran is also beginning in Geneva. Commenting on the situation to the media, US President Donald Trump urged Iranian representatives to conclude a nuclear agreement and hinted that he would become “indirectly” involved in the negotiation process.

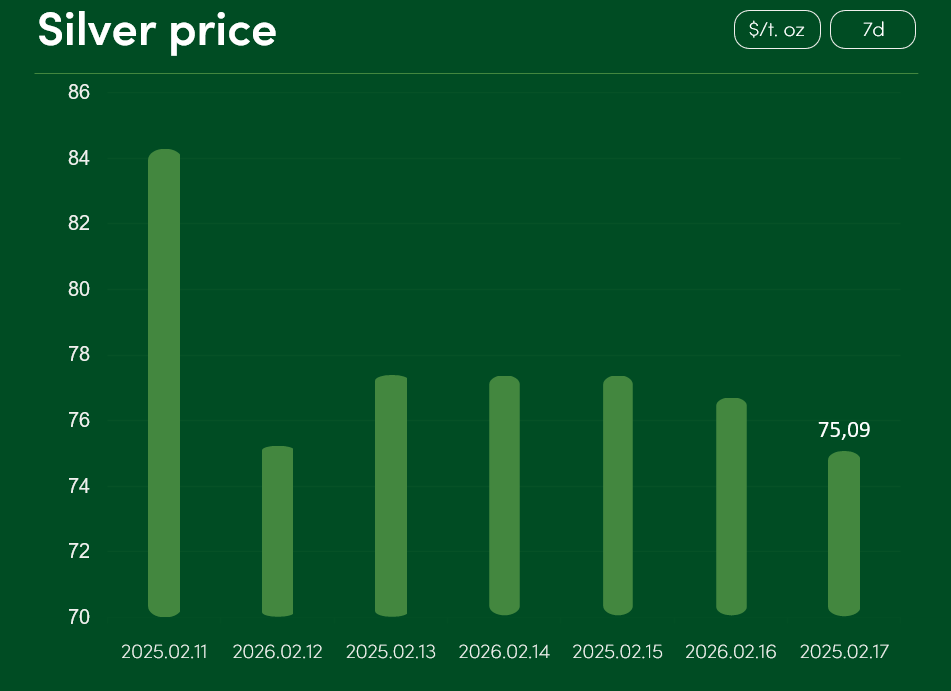

The global silver price fell by more than 10.9% between February 11 and February 17, reaching USD 75.09 per troy ounce. The average silver price in February stands at USD 82.33 per troy ounce.

The unexpected decline in silver prices may have been driven not only by investor hopes for greater geopolitical stability. As many Asian countries celebrated the Lunar New Year, markets in China, Hong Kong, South Korea, and other regional markets were temporarily closed. The holiday period creates additional supply-demand imbalances and contributes to price volatility in an already highly fluctuating silver market.

At the same time, there are also factors supportive of silver price growth. Following the release of softer-than-expected January inflation data in the United States (2.4%), expectations for Federal Reserve rate cuts increased. According to current market pricing, investors assign a 51% probability that the Fed will cut interest rates by 0.25 percentage points (25 basis points) at its June meeting.

The probability that the Fed’s interest rate will be reduced by 0.5 percentage points in July, compared to the current level, has now risen to 31%. Should this scenario materialize, a correction in the US dollar exchange rate is likely, increasing the attractiveness of dollar-denominated precious metals (gold, silver, etc.) for holders of foreign currencies.

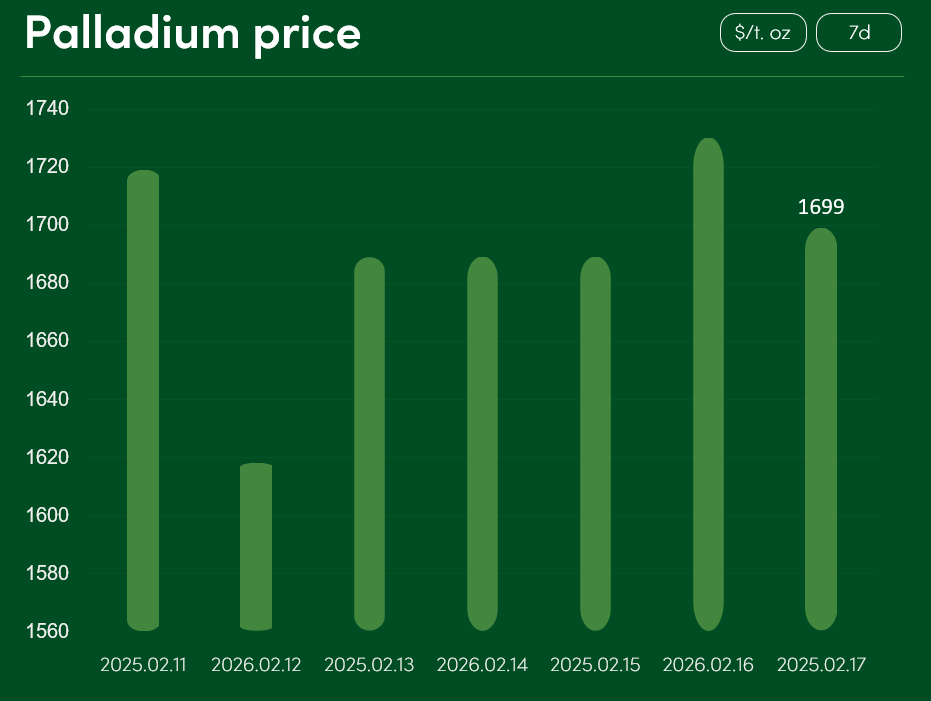

The global palladium price experienced only minor changes between February 11 and February 17, reaching USD 1,699 per troy ounce. The average palladium price in February stands at USD 1,733 per troy ounce.

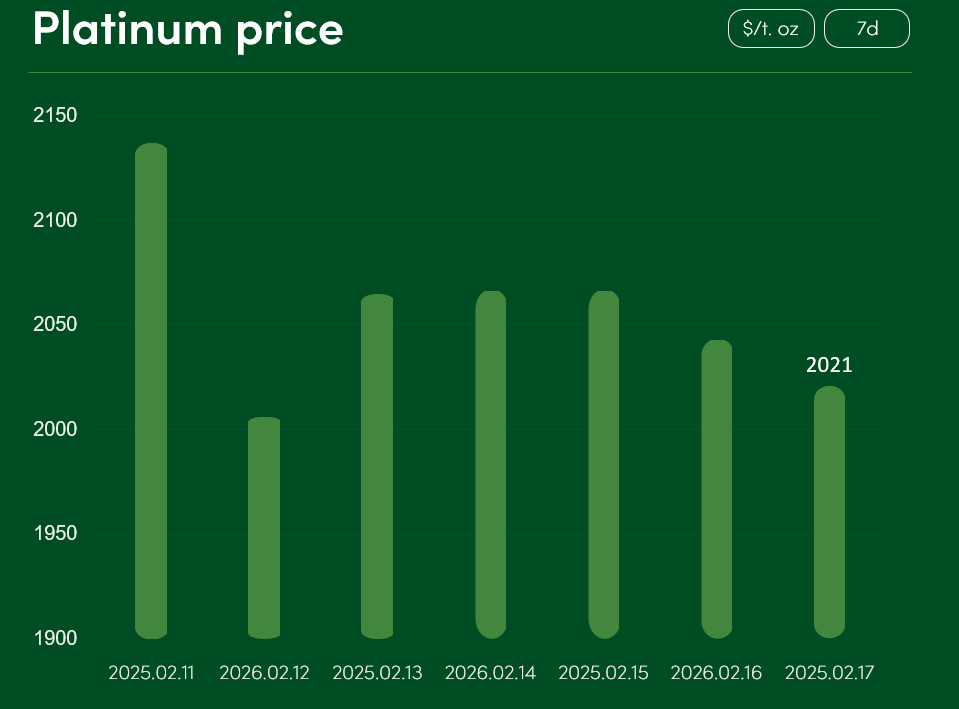

The global platinum price declined by 5.4% between February 11 and February 17, reaching USD 2,021 per troy ounce. The average platinum price in February stands at USD 2,131 per troy ounce.

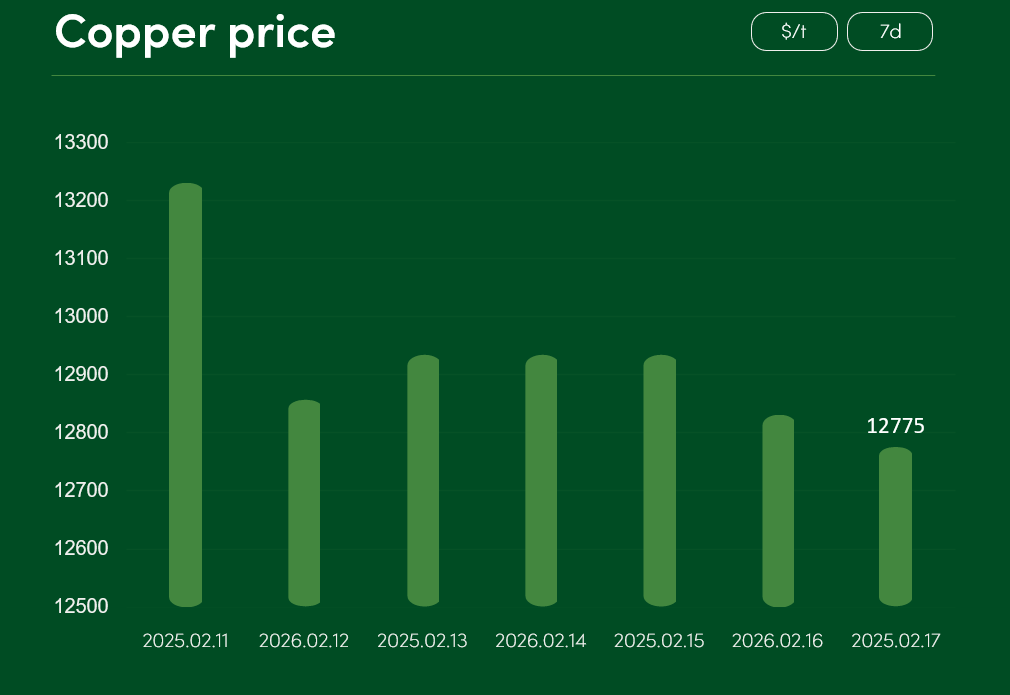

The global copper price fell by more than 3.2% between February 11 and February 17, reaching USD 12,775 per tonne.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.