December 16, 2025

Market Overview 10-12-2025 to 16-12-2025

Precious Metals Market: New Silver Price Records

Last week, the major precious metals markets experienced a period of price growth. The record-breaking performance of silver was supported by factors such as the Federal Reserve’s interest rate cut and rising demand in the retail sector. Gold price growth continues to be driven by both a shift away from sovereign currencies and bonds, as well as strong demand from central banks worldwide.

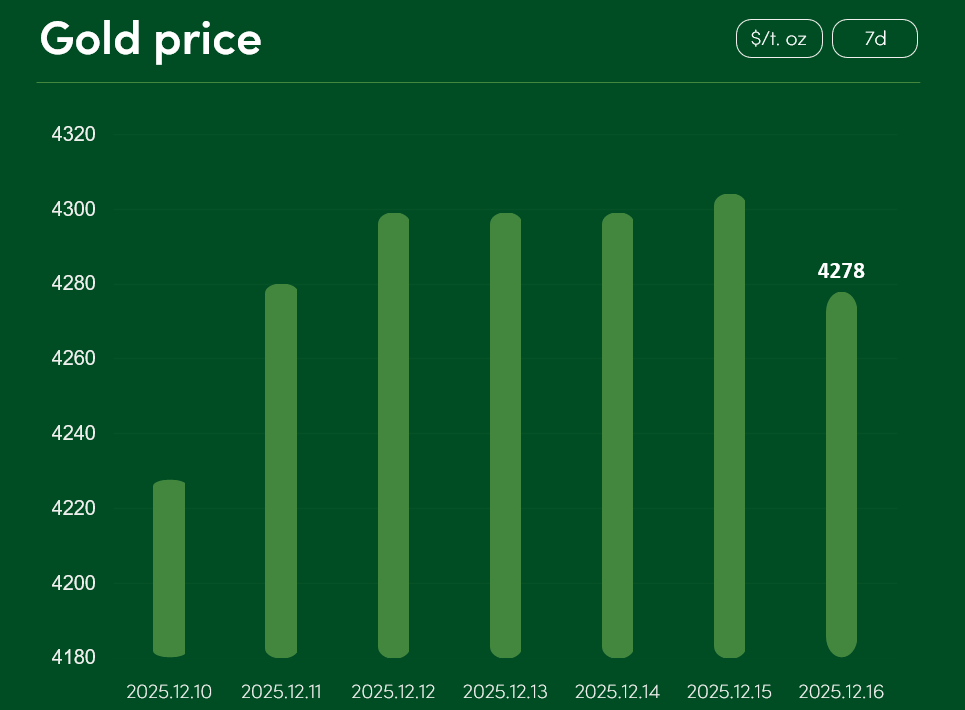

From December 10 to December 16, the global gold price increased by approximately 1.2% and reached $4,278 per troy ounce.

In October this year, total global central bank gold purchases reached as much as 53 tonnes (36% more than in September). Analysts at Goldman Sachs expect that strong purchasing trends were also maintained in November. Experts at one of the world’s leading banks forecast that the global gold price will reach $4,900 per troy ounce by the end of next year.

Although growing geopolitical stability in the Russia–Ukraine war contributed to gold price corrections in late autumn, the metal’s popularity has recently been supported by political crises such as the U.S.–Venezuela conflict. After the United States seized a sanctioned oil tanker used for Venezuelan oil transportation near Venezuela’s coast, markets interpreted this decision as a dangerous precedent increasing the risk of armed conflict escalation.

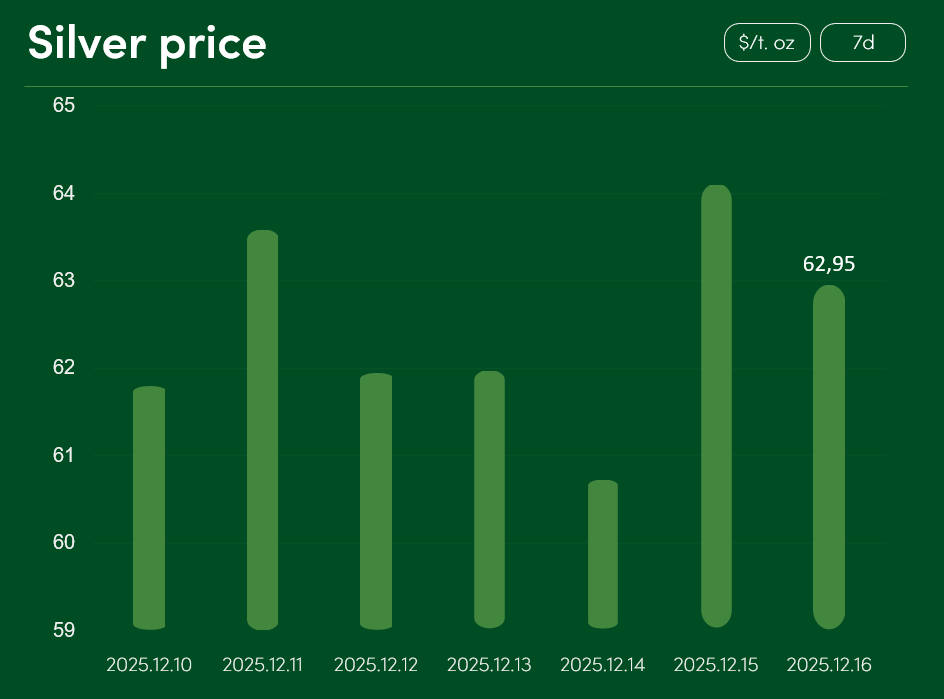

The global silver price recorded new all-time highs between December 10 and December 16. During this period, the precious metal’s market price rose by more than 1.8% and reached $62.95 per troy ounce.

Recent silver price growth has been strongly supported by the Federal Reserve’s decision to cut interest rates by 0.25% in the U.S. market. Lower interest rates contribute to corrections in the U.S. dollar exchange rate and make U.S. dollar-denominated precious metals (gold, silver, etc.) relatively more attractive to holders of foreign currencies.

Global silver demand has also been supported by the U.S. decision to include silver in its list of critical minerals. This decision has increased the likelihood that silver may be subject to new U.S. import tariffs in the future.

The global palladium price rose by approximately 6.5% between December 10 and December 16, reaching $1,568 per troy ounce.

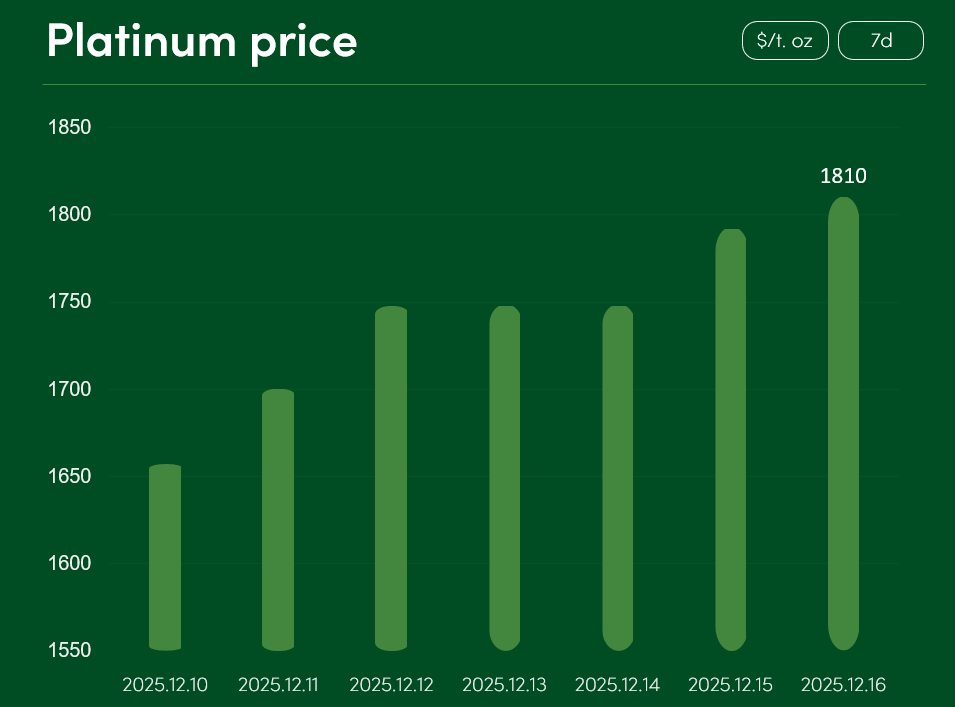

Over the same period, the global platinum price increased by more than 9% and reached $1,810 per troy ounce.

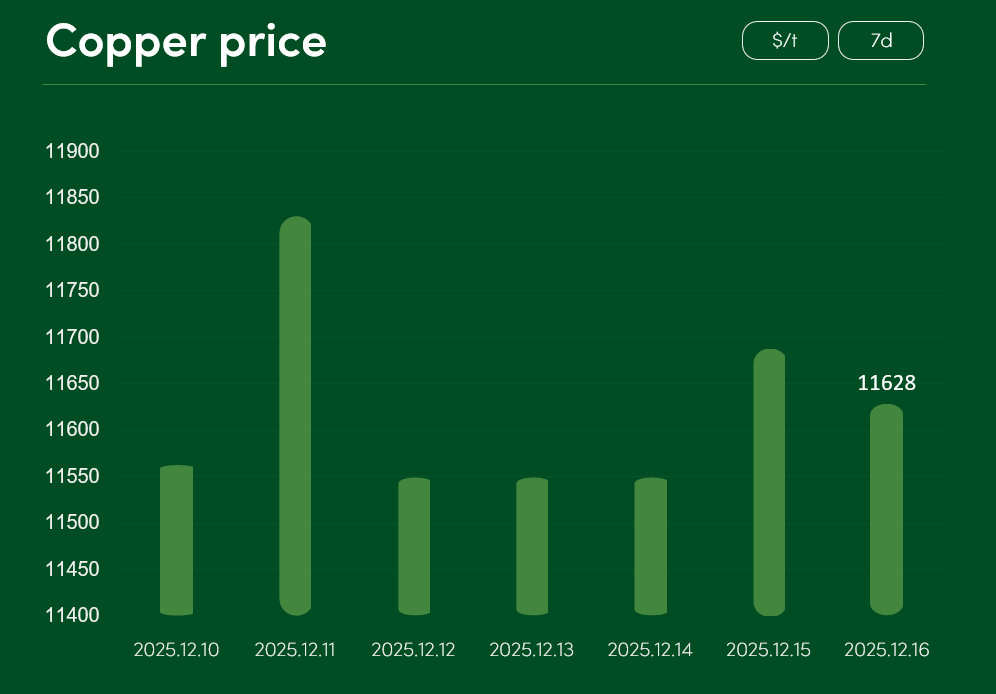

The global copper price recorded minimal changes between December 10 and December 16. On December 16, copper prices reached $11,479 per tonne.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.