September 16, 2025

Market Overview 10-09-2025 to 16-09-2025

Last week, various precious metals markets recorded new periods of record price growth. This was driven by increasing geopolitical tensions in Europe and the Middle East, monetary policy plans favourable to precious metals by central banks, and uncertainty in the sphere of U.S. trade agreements.

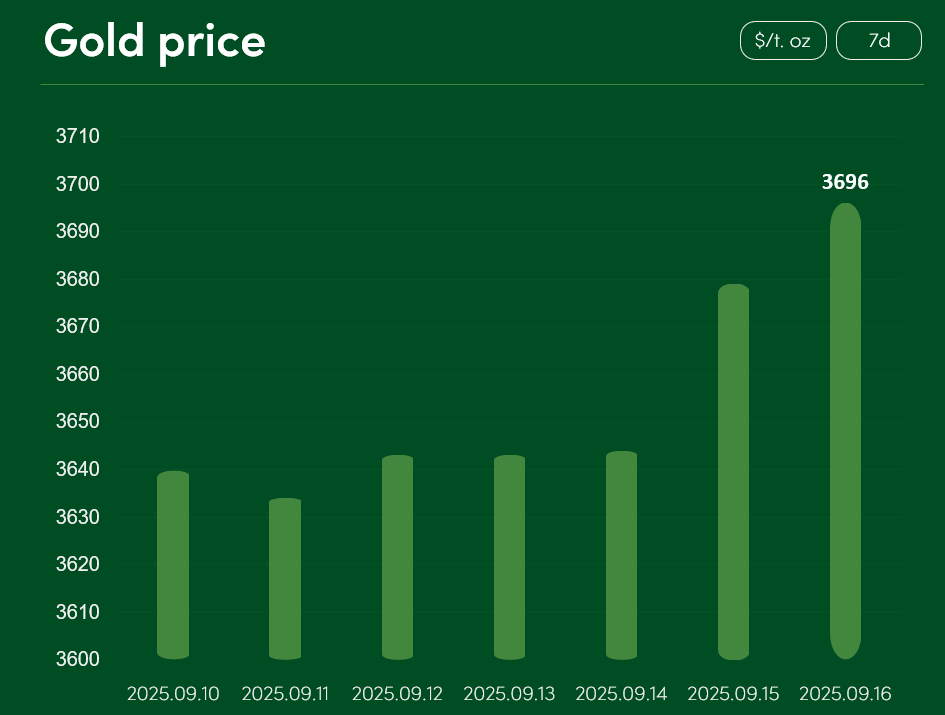

Global gold price rose by more than 1.5% from September 10 to September 16, reaching $3,696 per troy ounce.

The growth in gold price is strongly supported by monetary policies of the world’s most powerful economies, which remain favourable to this metal. At the September 17 meeting, the Federal Reserve is almost guaranteed to cut U.S. interest rates by at least 25 basis points (0.25%). It is also likely that the Bank of Canada will lower its rates in the near future. There are even discussions that China – the main economic and trade competitor of the United States – may follow suit.

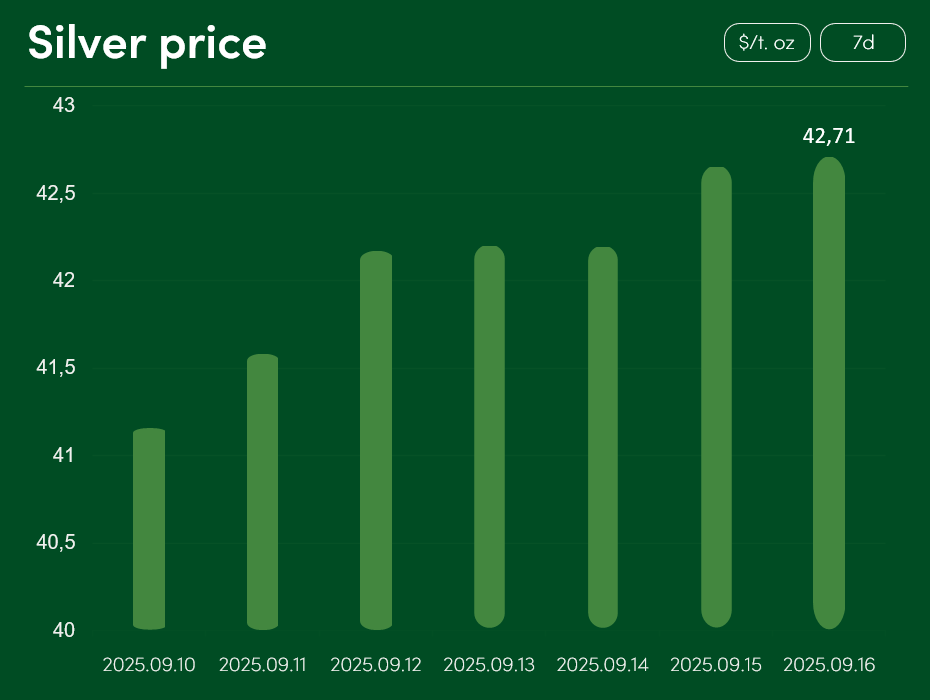

Silver price increased by more than 3.7% between September 10 and September 16, reaching $42.71 per troy ounce.

This record silver price surge allowed the metal to mark a new 14-year high. Investor interest is being driven not only by monetary policies of the world’s largest economies, which are favourable to precious metals, but also by escalating geopolitical threats. With Israel’s invasion of Palestine continuing, the country’s military forces launched a large-scale attack on Gaza City. Israeli forces also struck Hezbollah’s headquarters in southern Lebanon.

The problematic situation in the Middle East almost coincided with rising tensions in Europe. Last week, Polish airspace was violated by as many as 19 Russian drones. This incident was quickly assessed as a deliberate provocation; in the short term, it is likely to encourage the investor community to turn even more toward buying precious metals.

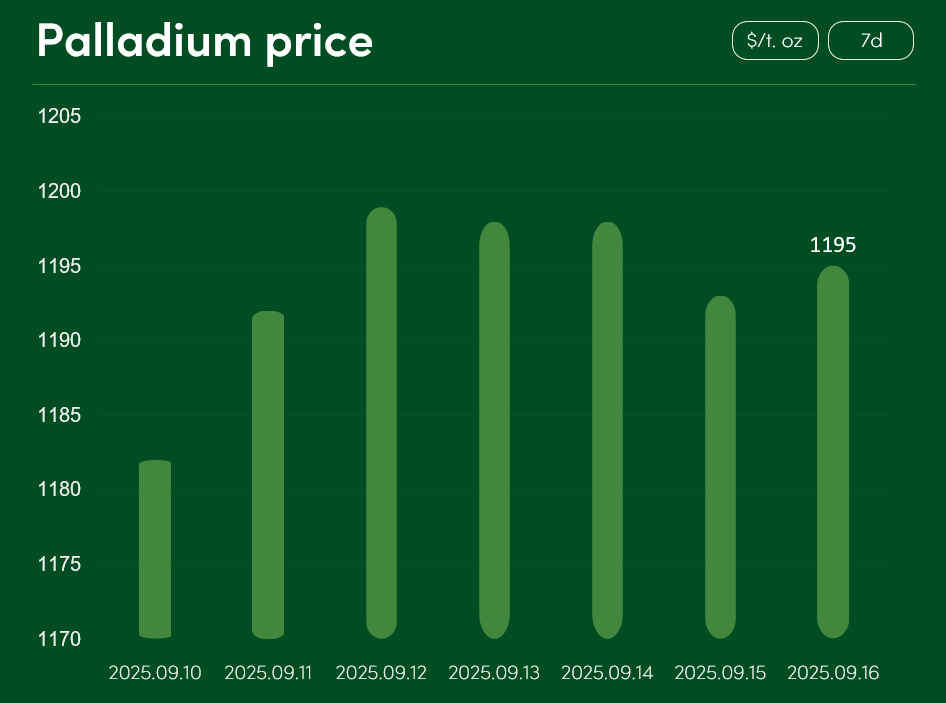

Global palladium price rose by more than 1% between September 10 and September 16, reaching $1,195 per troy ounce.

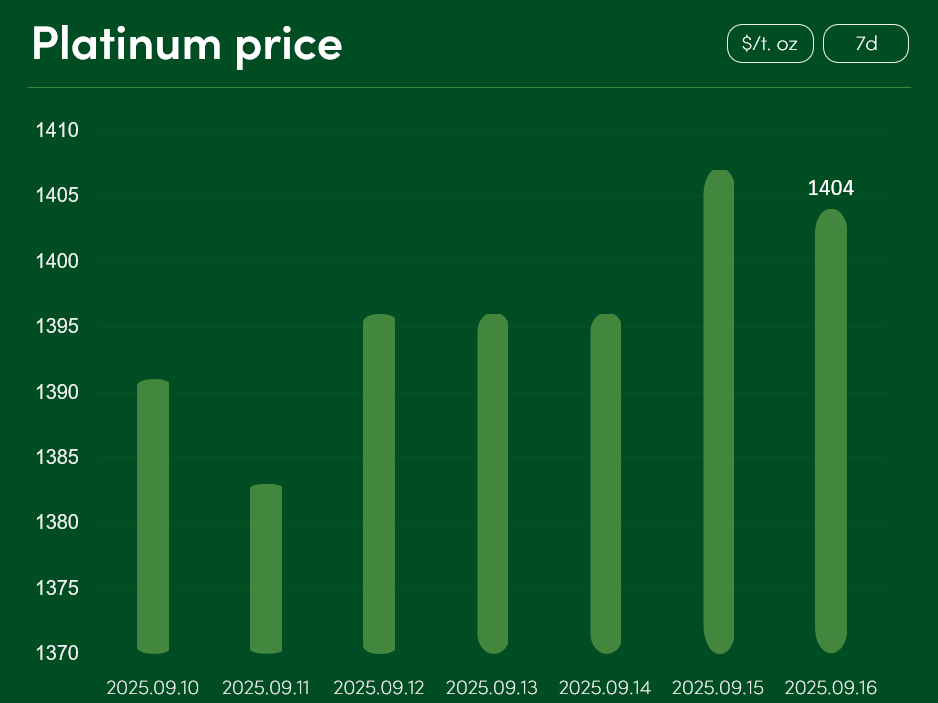

Platinum price during the same period increased from $1,391 to $1,404 per troy ounce.

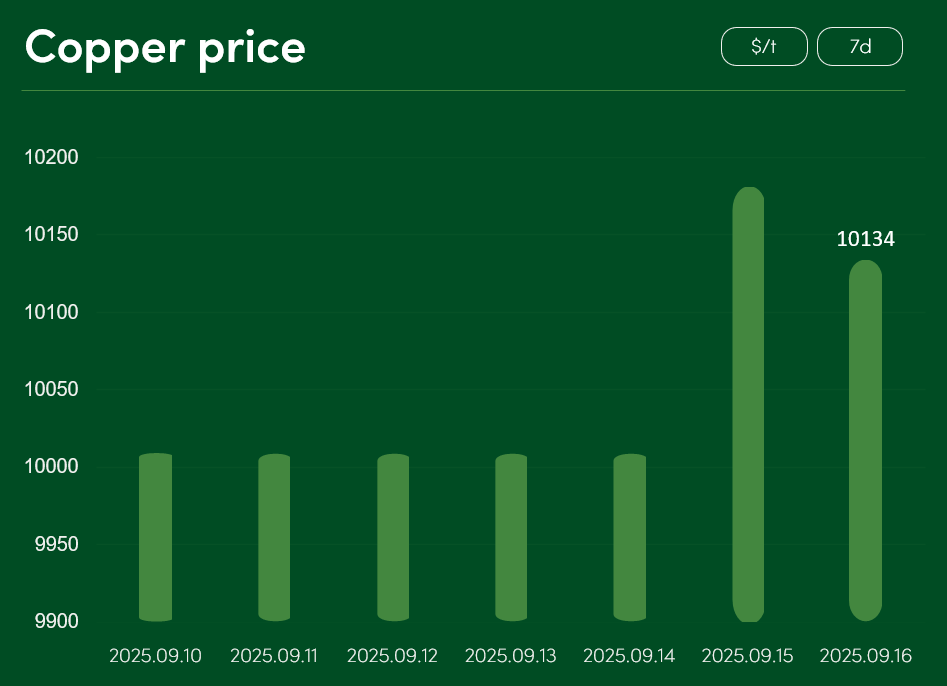

Global copper price grew by about 1.25% from September 10 to September 16, reaching $10,134 per tonne.

The rise in copper prices is driven both by slower production and challenges in the mining sector. China announced about a 5% decrease in refined copper output in September. Meanwhile, the mining company Freeport-McMoRan confirmed that its Grasberg copper-gold mine in Indonesia remains closed; searches continue for seven employees who went missing during the incident at the mine.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.