October 15, 2024

Market Overview 09-10-24 to 15-10-2024

Investors, who had watched most precious metals prices move to higher points last week, were quick to attribute this result to escalations and growing geopolitical threats in the Southeast Asia and Middle East regions. On the other hand, although the situation in these areas remains difficult, the prices of the main precious metals are in no hurry to register strong rises. The upward movement of prices is somewhat slowed by conflicting financial signals from the world’s most powerful economies.

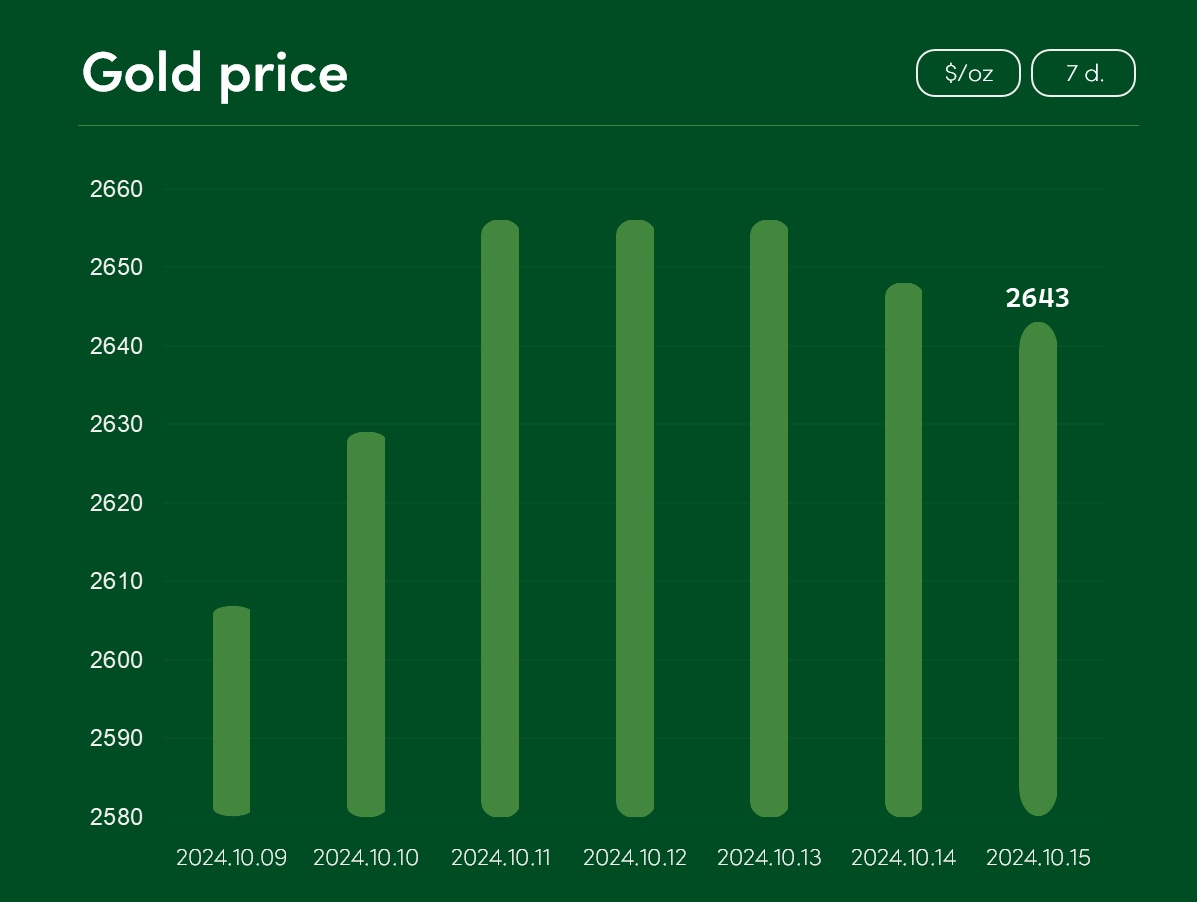

Gold prices successfully overcame the corrections of early October, rising by ~1.4% between 9 October and 15 October to reach $2643/oz.

Analysts are rushing to find the reasons for last week’s successful performance of gold in geopolitical global threats. The ongoing Israeli-Hamas war, invasion in the Gaza Strip and the Israeli ground invasion accompanied by rocket strikes in Lebanon increase the likelihood of further conflict escalation in the Middle East. Investors are also worried by such news, as the latest Reuters report, which states that the US is softening its political tone and abandoning earlier calls for an immediate ceasefire in Lebanon.

The Chinese military aggressive exercises in the Taiwan Strait on 14 October also added great concerns about future of world’s geopolitical stability; such operations will certainly encourage investors not to turn away from gold as an investment hedge in the near future.

Silver prices rose by around 1.5% between 9 October and 15 October to $31.02/oz. The overall mood of investors and analysts regarding this precious metal is currently characterised by strong uncertainty. Timid forecasts are strongly influenced by the conflicting economic signals from the world’s major economic powers.

The government of China, the main user of silver, announced a commitment to issue new government bonds to buy up underperforming real estate last Saturday. Beijing also plans to offer special subsidies to low-income citizens and to increase the capital of its Central bank.

Although these decisions are viewed positively in the financial world, the markets are not in a hurry to react too optimistically. Investors were expecting an aggressive fiscal stimulus from China and predicted a value of between 2 and 10 trillion yuan for this “injection” according to TradingEconomics.

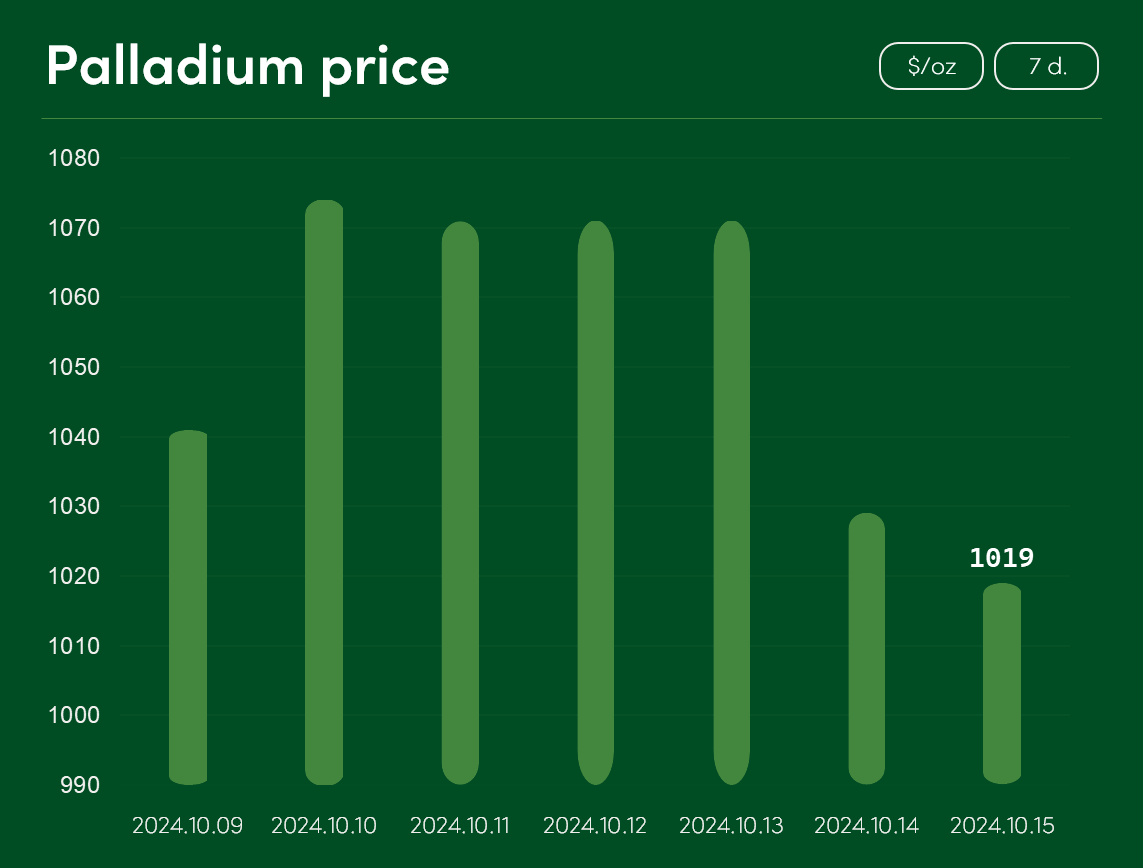

Palladium, which had a much more modest performance on the exchanges between 9 October and 15 October, recorded a ~2% price drop during the period and reached a price of $1019/oz.

Meanwhile, platinum prices rose by more than 3% last week to $983/oz.

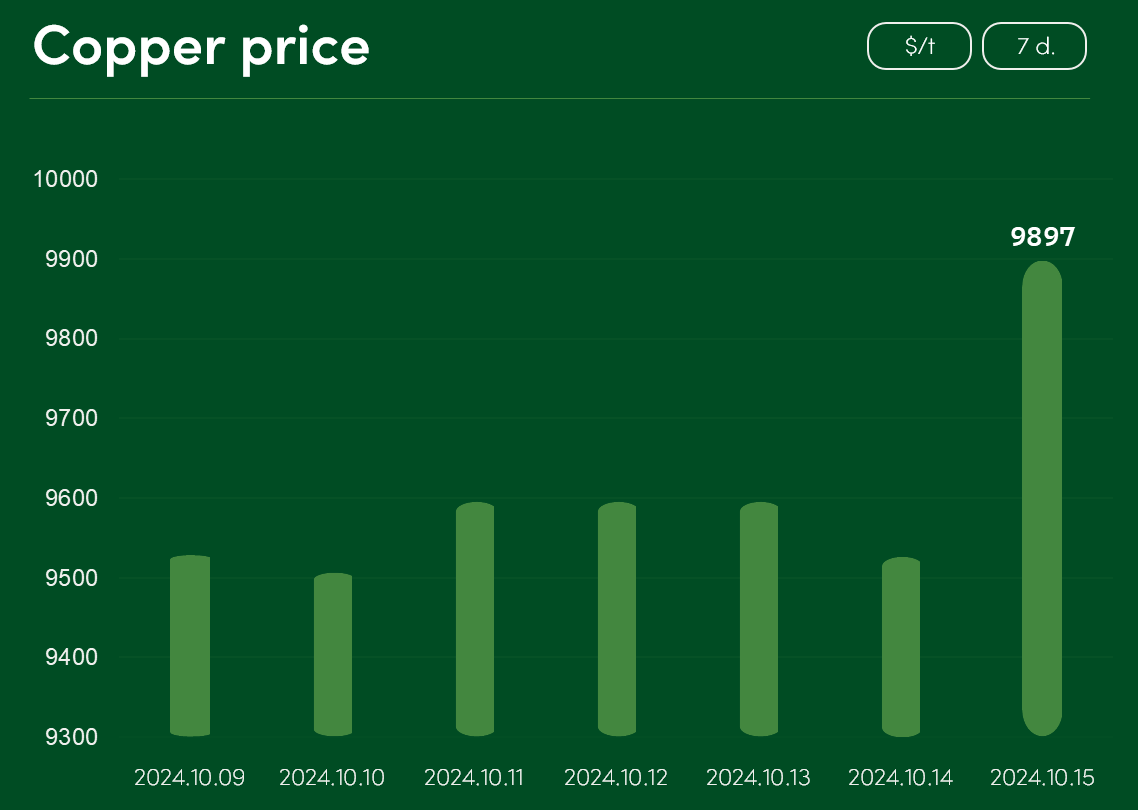

Although copper faced price corrections at the beginning of October, successful last week’s growth allowed the precious metal to compensate for a large part of the previous downturn. Between 9 and 15 October, copper market price rose by more than 3.5% to reach a point of $ 9897/t.

Although copper prices have seen a solid recovery over the last week, investors are concerned about the economic problems of China, a major consumer of copper and one of the largest producers of the metal.

The financial world is watching China’s attempts to overcome its domestic property crisis through a loosening of the domestic financial market and stimulation of local property buying. At the same time, however, according to TradingEconomics, China’s economically stagnating market is experiencing a decline in demand for copper, reflected in statistics such as the near-zero refining charges for Chinese copper smelters. This suggests that the fall in demand for purified copper in the Chinese market has temporarily created an oversupply in this country. Such news made investors to be more cautious when it comes to predictions of the short-term prospects for copper price growth.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.