July 15, 2025

Market Overview 09-07-2025 to 15-07-2025

Last week, developments and alarming statements in the field of international trade contributed to the formation of precious metals market prices. The administration of U.S. President Donald Trump continues to escalate global trade fragmentation and is planning to introduce tariffs targeting specific metal industry sectors. Investors are responding to such news by more actively choosing precious metals, which serve as protection of investment capital from unexpected crises.

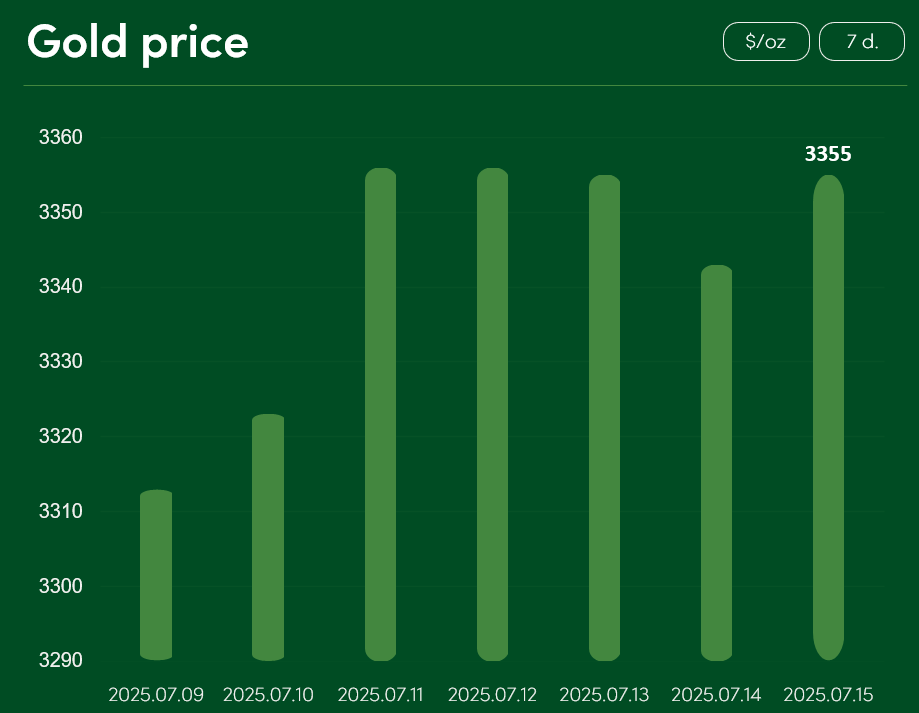

From July 9 to July 15, the global gold price increased by more than 1.25%, reaching $3,355/oz

The optimistic gold price trend was driven by the aggressive tone of U.S. trade policy. As Trump continues to expand the list of countries that might face stricter import tariffs from August 1, unfavourable measures were announced for the European Union and Mexico. Without a separate trade agreement, both of these strategic U.S. economic partners risk facing tariffs of 30%.

Optimism in the precious metals market is also fuelled by Donald Trump’s clear stance against relatively high U.S. interest rates. On Monday, the U.S. President renewed his “attacks” on FED Chair Jerome Powell, stating that interest rates should be at 1% or even lower.

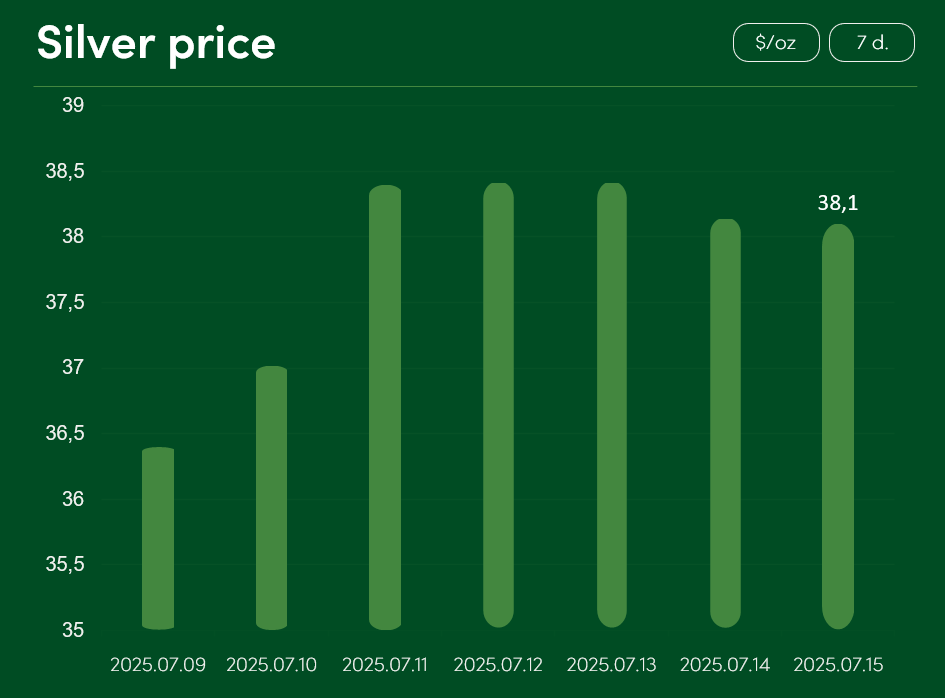

From July 9 to July 15, the global silver price rose by over 4.6%, reaching $38.1/oz.

This sharp increase in silver prices was also driven by the uncertain future of global trade and optimism regarding potential changes in U.S. interest rate policy. Markets were rattled by a statement from U.S. National Economic Council Director Kevin Hassett, in which he hinted that President Trump could remove FED Chair Jerome Powell “if there’s cause.”

Traders are now pricing in just over 0.5% (50 basis points) of U.S. interest rate cuts by the end of the year. It is likely that if this forecast materializes, it will contribute to increased demand for U.S. dollar–denominated precious metals (such as gold, silver, etc.) in foreign markets.

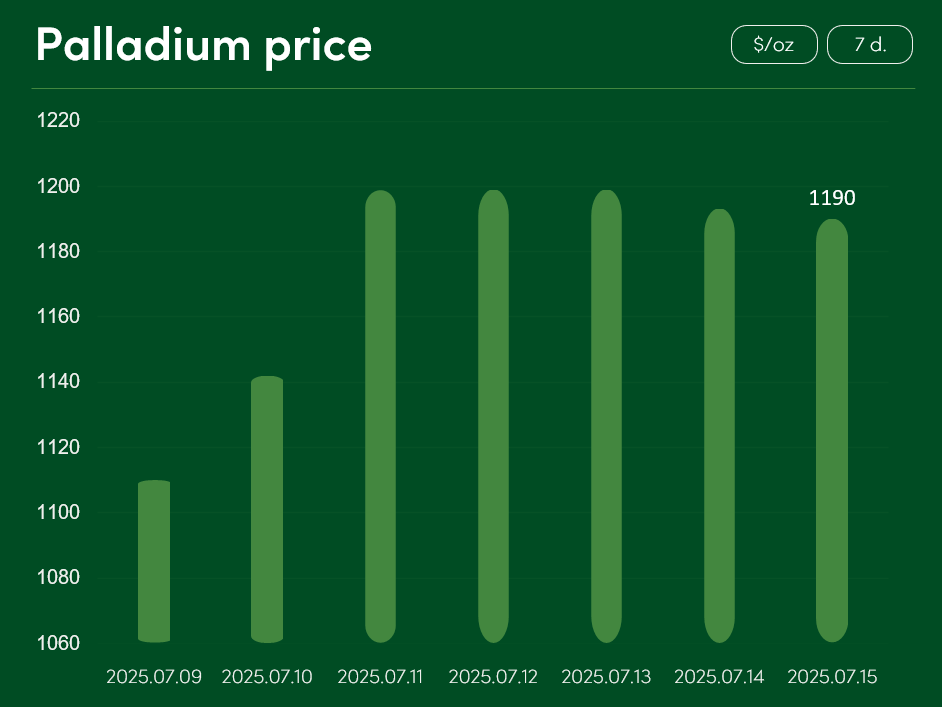

From July 9 to July 15, the global price of palladium increased by approximately 7.2%, reaching $1,190/oz.

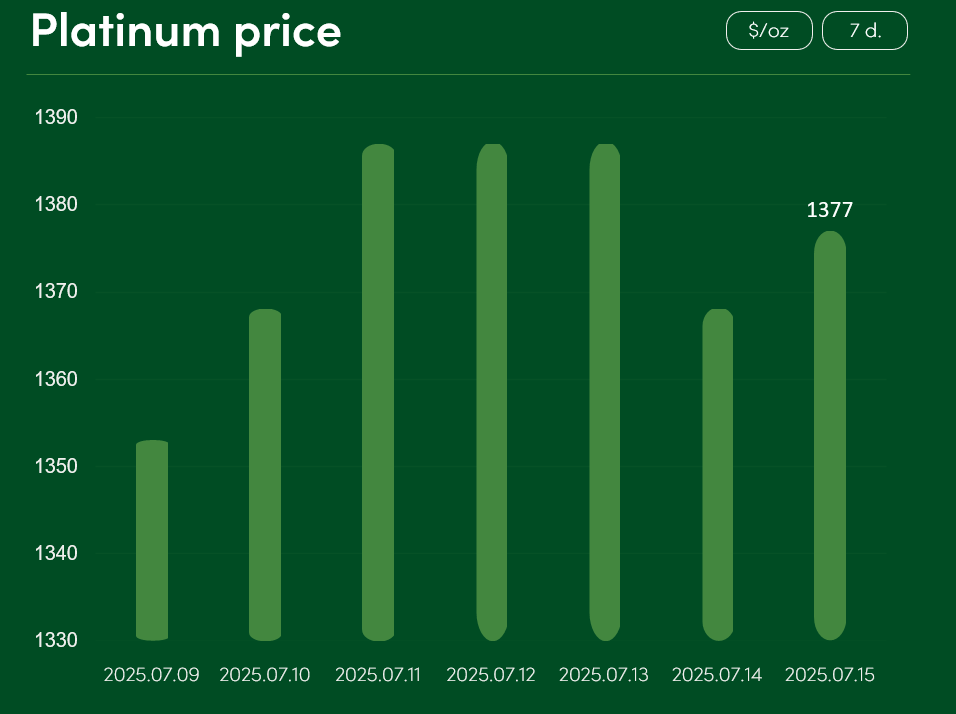

The global platinum price rose by more than 1.7% over the same period, reaching $1,377/oz.

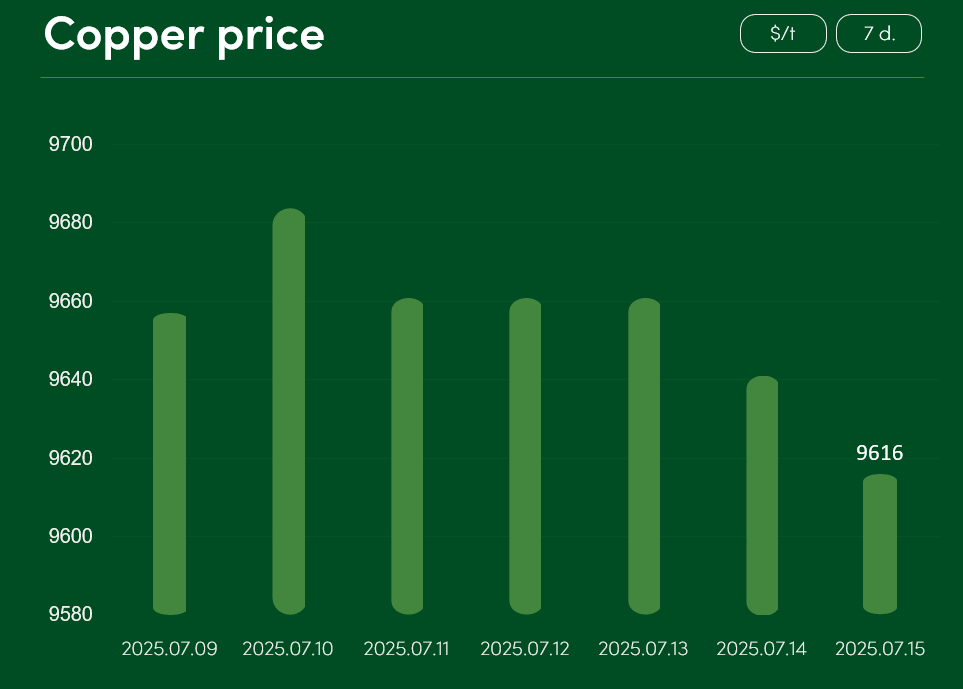

The global copper price over the past 7 days decreased by more than 0.4%, reaching $9,616/t as of July 15.

Analysts find it particularly difficult to forecast short-term copper price movements. If efforts to reach trade agreements between the U.S. and its strategic partners fail, global copper demand may decline, reducing the likelihood of consistent copper price growth.

It is precisely in the area of trade agreements that more alarming trends can currently be observed. Reports indicate that the European Union is intensifying negotiations with various countries affected by U.S. import tariffs (including Japan and Canada) regarding possible coordinated retaliatory actions.

On the other hand, the sharp copper price increases seen in recent months may also be supported by the latest specific U.S. trade policy decisions.

In a somewhat unexpected move, Trump announced that, starting August 1, a global 50% import tariff will be applied to all copper imported into the United States, regardless of the country of origin. Analysts report that the implementation of such a measure could cause serious disruptions to the U.S. copper supply chain: nearly half of all copper consumed in the U.S. market is imported from other countries.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.