April 15, 2025

Market Overview 09-04-2025 to 15-04-2025

During the last week, precious metals prices experienced a period of strong growth. It was driven by the chaos caused by the trade wars, the weakening of the dollar and the increasing talk of interest rate cuts in the US. Precious metals are increasingly being bought to hedge against rising economic-geopolitical risks and to increase the value of investment portfolios in a context of a weakening dollar and possible interest rate cuts.

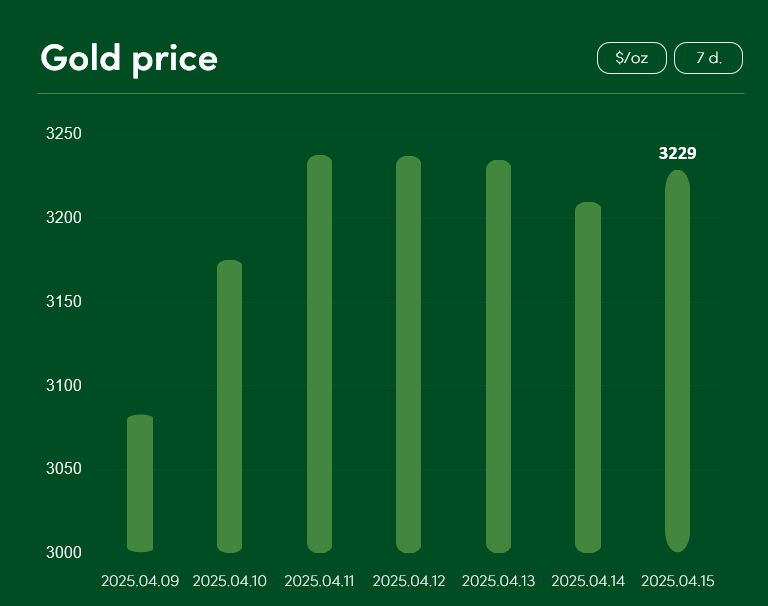

The global gold price rose by ~4.75% between 9 April and 15 April. On 15 April, it reached $3229/oz.

Although gold has already broken previous all-time price records several times this year, the most popular precious metal continues to delight investors with its upbeat growth. One of the more important reasons for this rise is the turmoil caused by international tariff wars. Although US President Trump has decided to postpone the application of the latest global import tariffs on all trading partners (except China) for 90 days, fearing further escalations and trade-economic crises, investors are opting for the time-tested hedge of gold, silver and other precious metals.

US import tariffs are also fuelling price increases in the domestic market; they have a negative impact on the strength of US dollar. Compared against the euro, the US dollar currently struggles near its three-year lows. The depreciating dollar is encouraging greater investment in precious metals (gold, silver, etc.) denominated in this currency in other markets than US (Europe, Asia, etc.). Comparing the results of the first quarter, gold exchange-traded funds saw the largest capital inflows (~$21.1 billion) in the past three years.

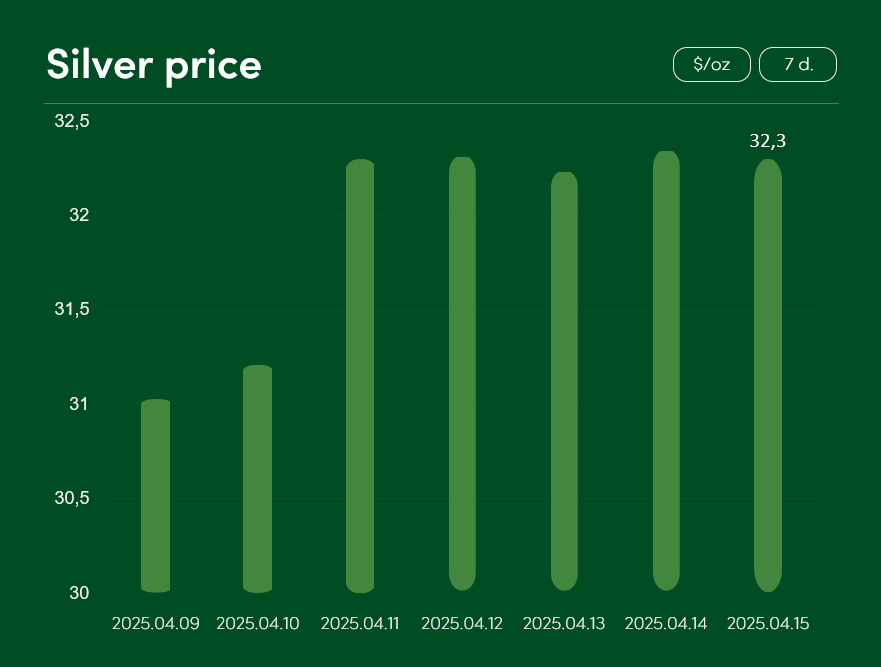

The global silver price rose by approximately 4% between April 9 and April 15, reaching $32.3/oz. Therefore, the silver price per gram on the exchanges on April 15 was approximately $1.03.

The rise in silver prices is also strongly driven by the discussed weakening of the dollar and the global trade war between the US and the rest of the world. Although the United States postponed the latest application of global tariffs for a period of 90 days, investors’ concerns have recently been fuelled by Trump’s order to explore the possibility of new tariffs on key mineral resources. As most of these minerals reach the US from China, investors fear a further escalation of the trade war between the world’s two major economies.

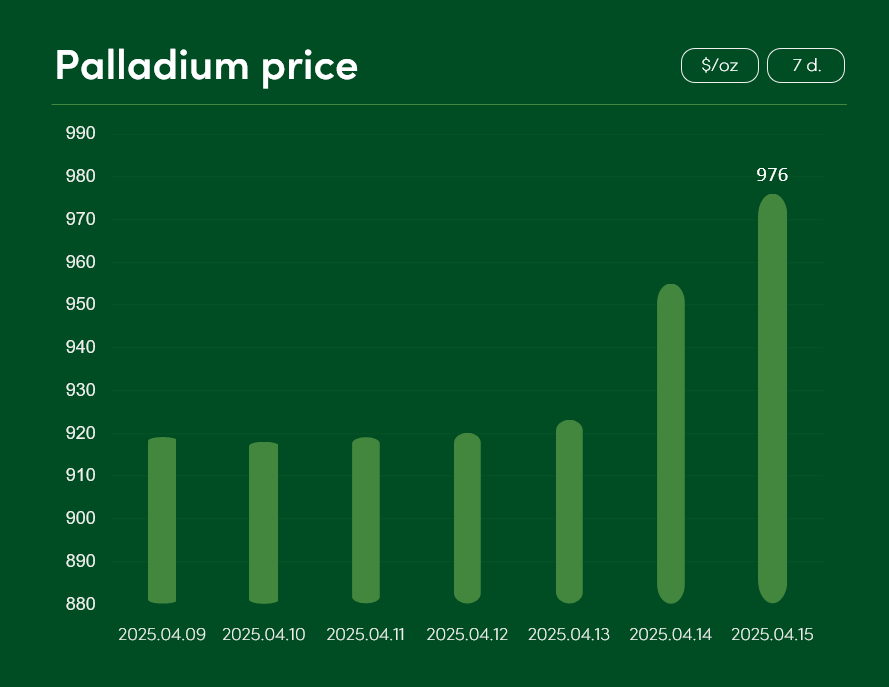

The price of palladium increased by ~6.2% between 9 April and 15 April, reaching $976/oz on 15 April.

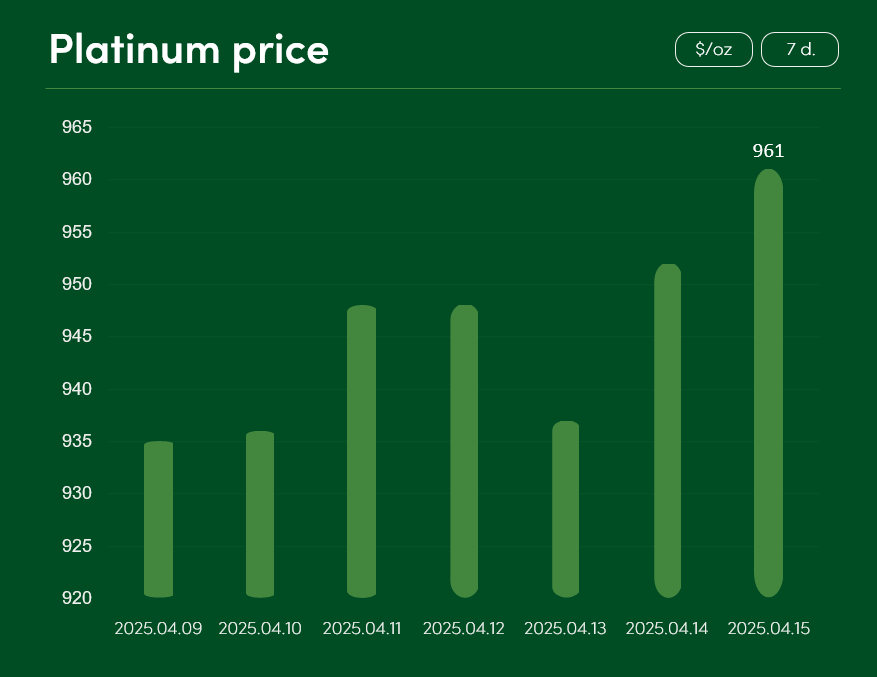

The global platinum price has increased by 2.8% over the last 7 days to $961/oz.

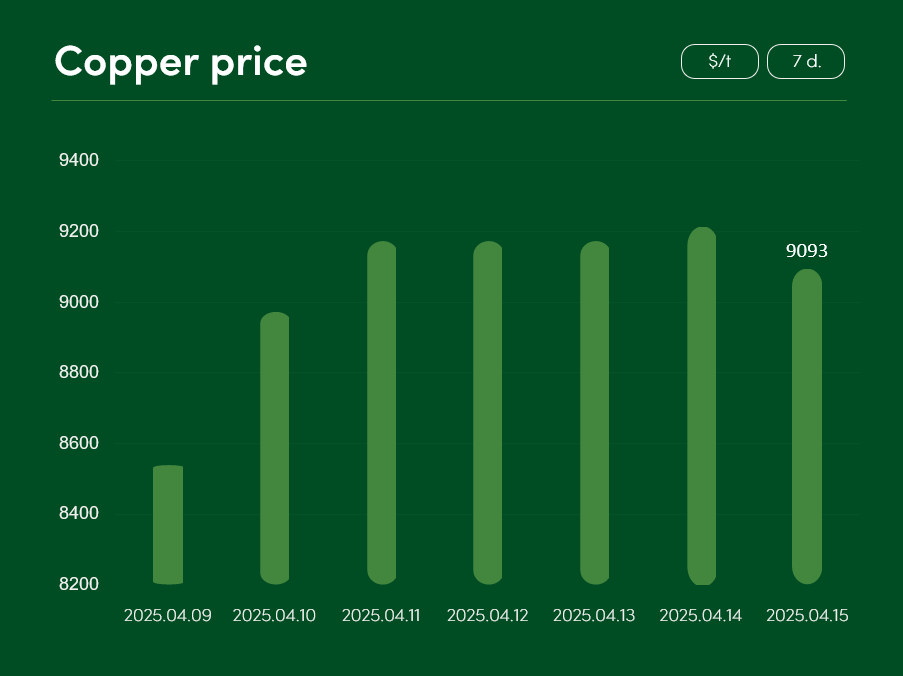

The global copper price increased by ~6.5% between 9 April and 15 April, reaching $9093/t on 15 April.

Fears of possible tariffs on US copper imports have contributed to the recent increase in prices of this industrial metal. If specific import tariffs are imposed on refined copper entering the United States, the world’s major economy could face supply problems for this industrial metal.

Given that there are currently only two copper smelters operating in the US, it would not be possible to solve the problem of the increased cost of refined copper by increasing the volumes of copper ore imported into the US in the event of new copper tariffs. The problematic and uncertain future of copper imports and exports contributes to the investments in this metal of strategic importance.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.