October 14, 2025

Market Overview 08-10-2025 to 14-10-2025

As autumn reaches its midpoint, the precious metals market continues its record-breaking price rally. Sudden shifts in international economic relations, the prolonged U.S. political crisis, and the growing likelihood of long-term Federal Reserve rate cuts are driving investors to increasingly expand their portfolios with precious metals.

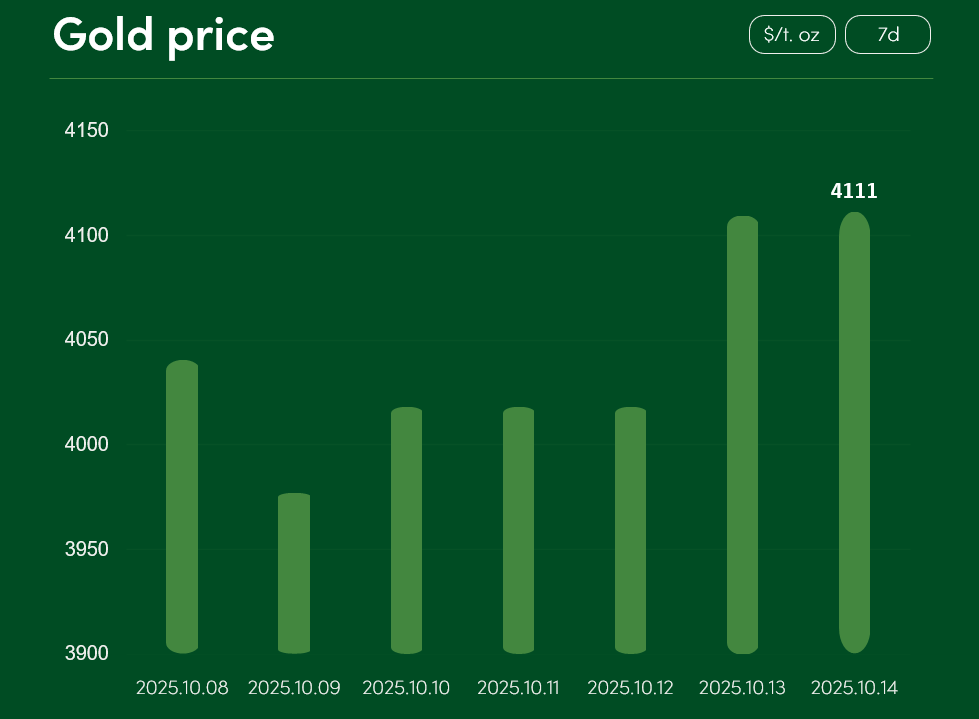

The global gold price rose by more than 1.7% between October 8 and October 14, reaching $4,111 per troy ounce.

The surge to new all-time highs was fuelled by escalating U.S.–China geopolitical tensions. After China unexpectedly tightened its rare earth export regulations, U.S. President Donald Trump announced that starting in November, the United States would impose an additional 100% tariff on imports from China. As the world awaits the anticipated meeting between the U.S. and Chinese leaders in South Korea, the heightened political and trade uncertainty continues to push precious metals prices higher.

The flourishing of the precious metals market is also supported by the persistently high probability of U.S. interest rate cuts. According to current futures data, markets assign a 96% probability that the Federal Reserve will cut rates by 25 basis points (0.25%) in October. Another 25-basis point cut is projected for the December meeting (with a 95% probability).

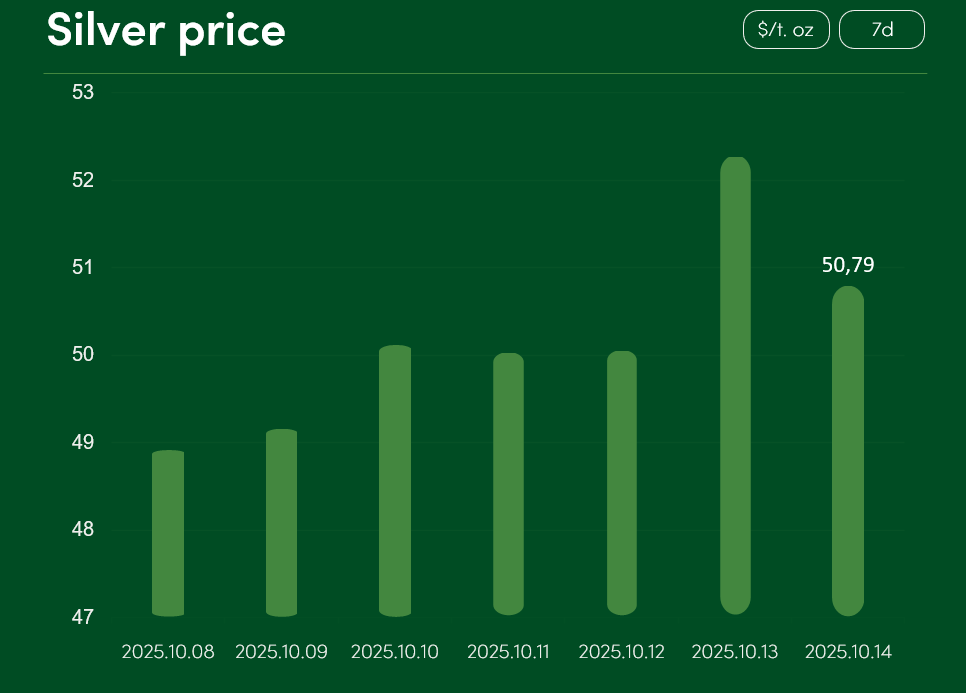

The global silver price rose by more than 3.8% between October 8 and October 14, reaching $50.79 per troy ounce.

Silver prices are driven higher by both the ongoing global trade crisis and political turmoil within the U.S. government. Due to disagreements between Democrats and Republicans over the national budget, the U.S. government has been temporarily shut down for the second consecutive week.

Western Asian economies are also facing political turbulence. In Japan, the sudden collapse of the ruling government coalition has caused turmoil in the country’s stock market, with the main Japanese stock index — Nikkei 225 — experiencing corrections.

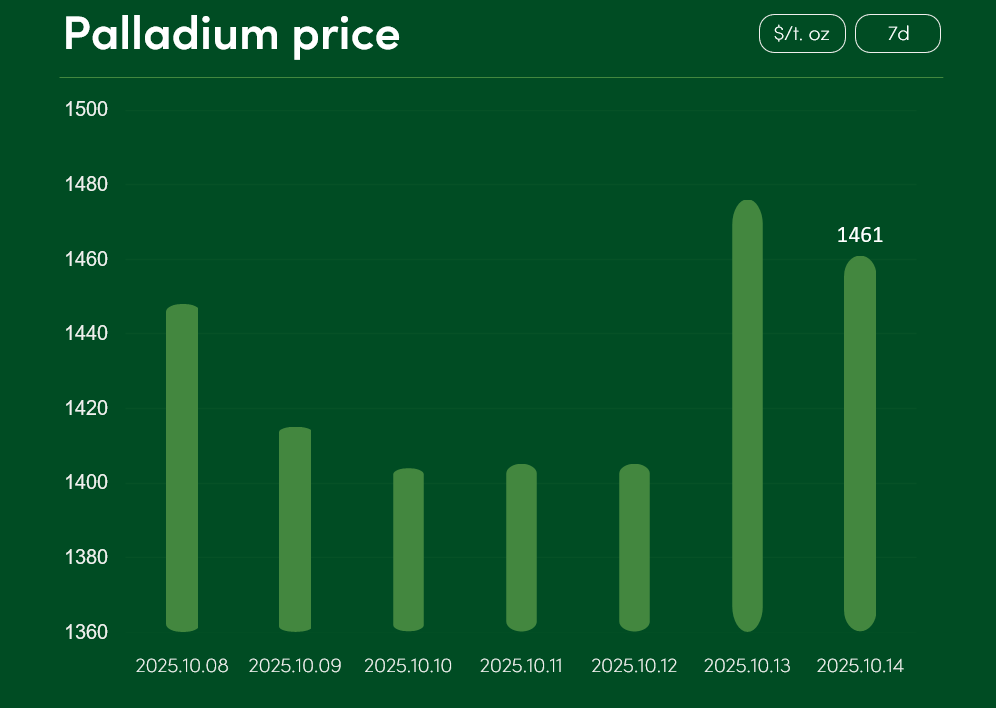

The global palladium price posted a modest gain of around 0.9%, reaching $1,461 per troy ounce between October 8 and October 14.

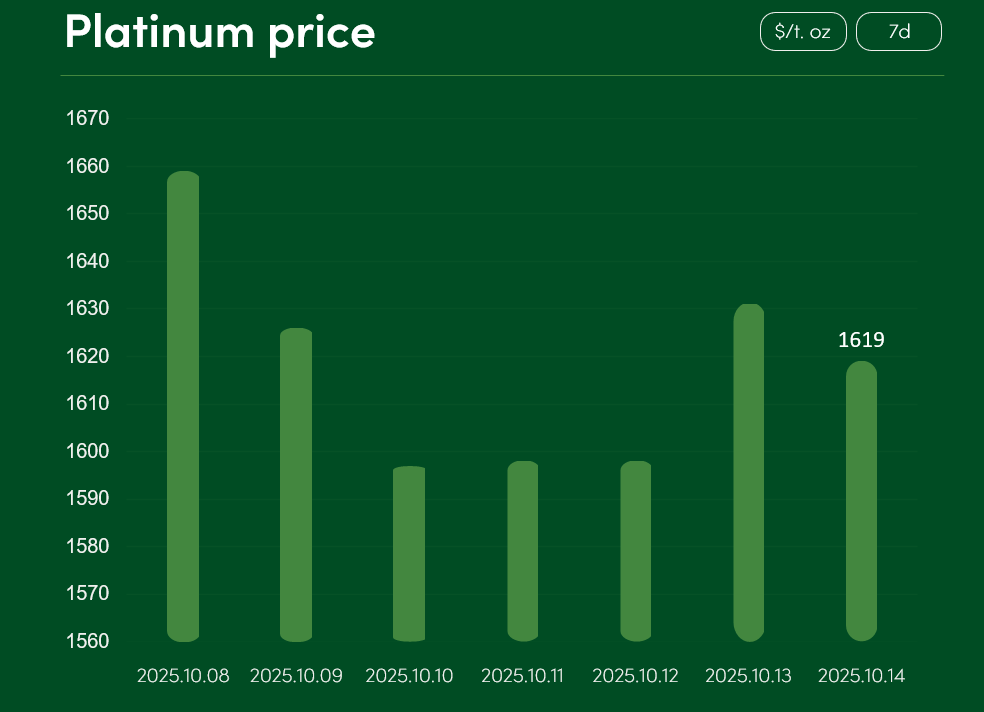

During the same period, platinum prices declined by approximately 2.4%, settling at $1,619 per troy ounce.

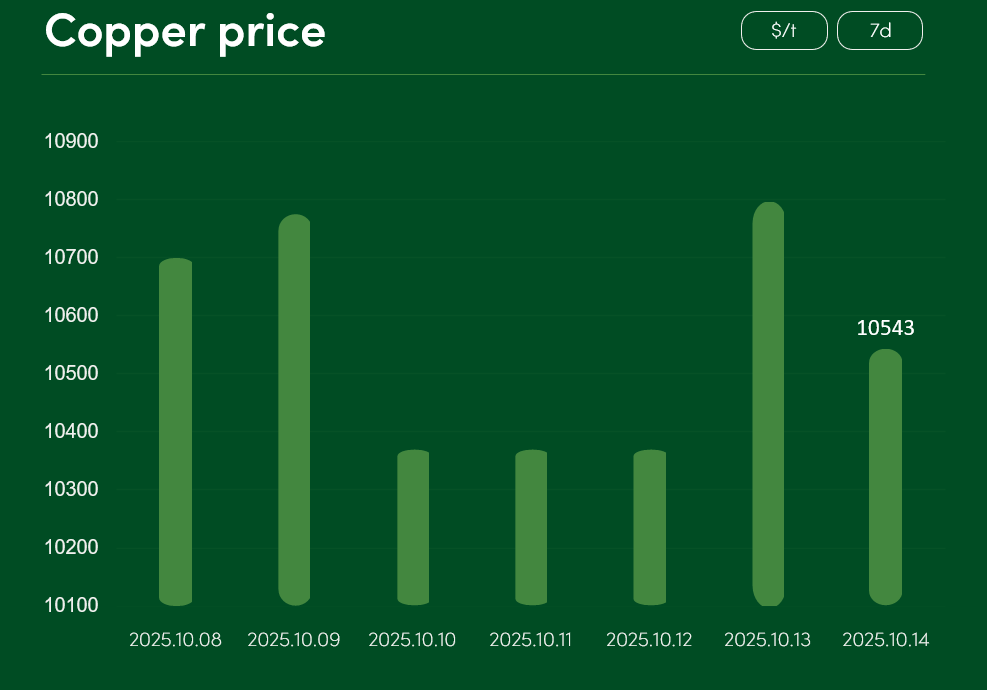

Copper prices remained largely stable over the same week, with a closing price of $10,543 per tonne on October 14.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.