January 13, 2026

Market Overview 07-01-2026 to 13-01-2026

Market Chaos and New Precious Metals Records

Last week, the precious metals market saw a significant increase in gold and silver prices. Analysts link this new upward wave in precious metals to heightened tensions within the Federal Reserve’s leadership, rising geopolitical threats in the Middle East, and aggressive political rhetoric from the United States.

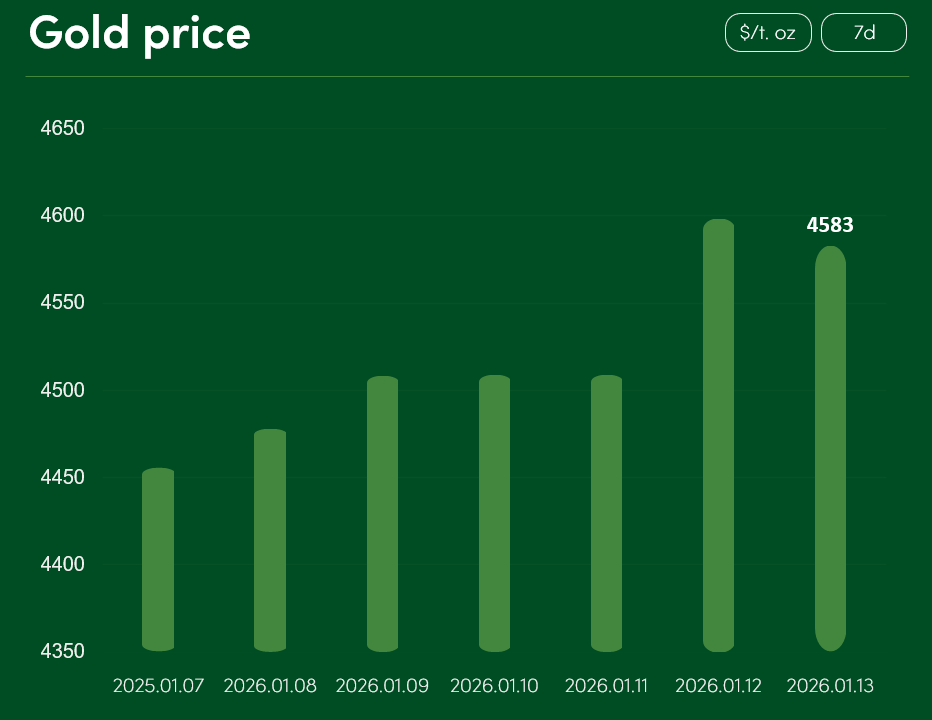

The global gold price rose by more than 2.8% last week, setting new all-time highs and reaching USD 4,583 per troy ounce on January 13.

The formation of new geopolitical conflicts has recently contributed significantly to the rise in gold prices. As the U.S.–Venezuela crisis continues, U.S. President Donald Trump once again spoke about taking over Greenland. Trump’s threat to seize the island “one way or another” drew critical reactions from European leaders and raised new doubts about the future of NATO as a defensive alliance.

Media attention was also drawn to the U.S. position toward Iran. As violent protests by Iranian citizens against the country’s regime continue to intensify, Trump stated that the U.S. would impose a 25% trade tariff on all countries maintaining business relations with Iran. As the likelihood of U.S. military intervention in Iran increases, investment demand for precious metals is also rising.

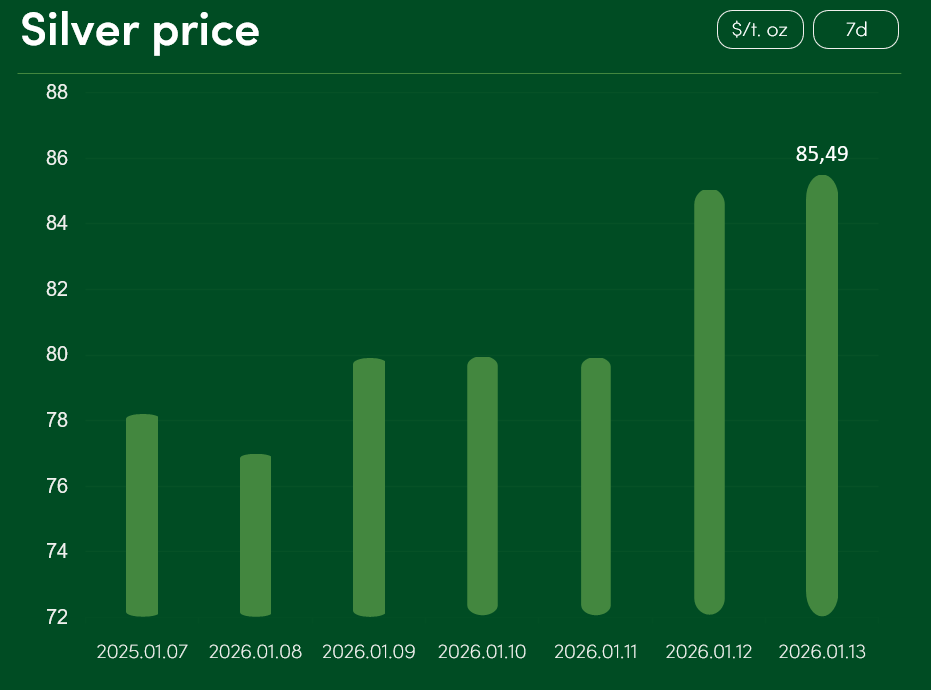

The global silver price also set a new all-time high last week, rising by more than 9.3% between January 7 and January 13 and reaching USD 85.49 per troy ounce.

Silver prices are being supported not only by deepening geopolitical crises but also by a chaotic situation in the U.S. domestic market. As the federal prosecutors opened a criminal investigation into Fed Chair Jerome Powell, his comments about the Trump administration’s attempts to strengthen its influence over the central bank through intimidation have increased uncertainty about the future of U.S. policy. This, in turn, is contributing to rising investor anxiety and growing global demand for precious metals.

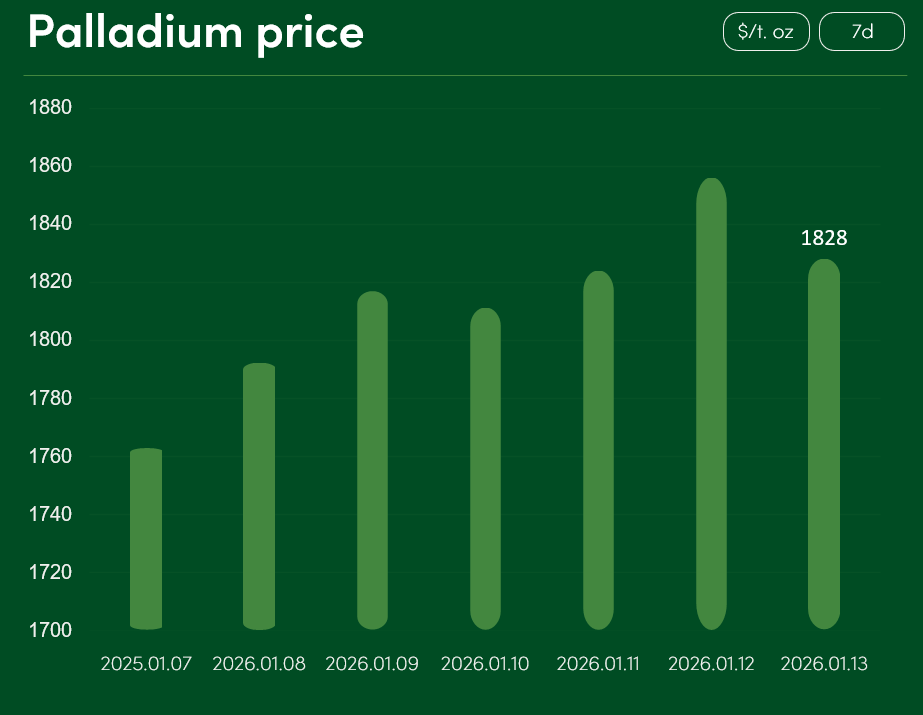

Between January 7 and January 13, the global palladium price rose by approximately 3.7%, reaching USD 1,828 per troy ounce.

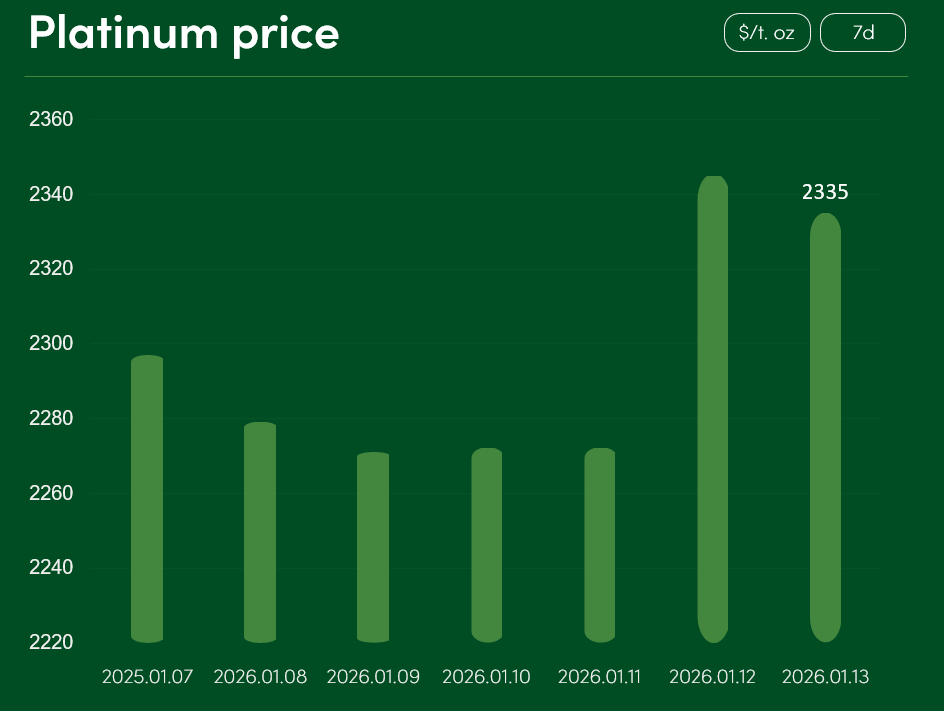

Over the same period, the global platinum price increased by more than 1.5%, reaching USD 2,335 per troy ounce on January 13.

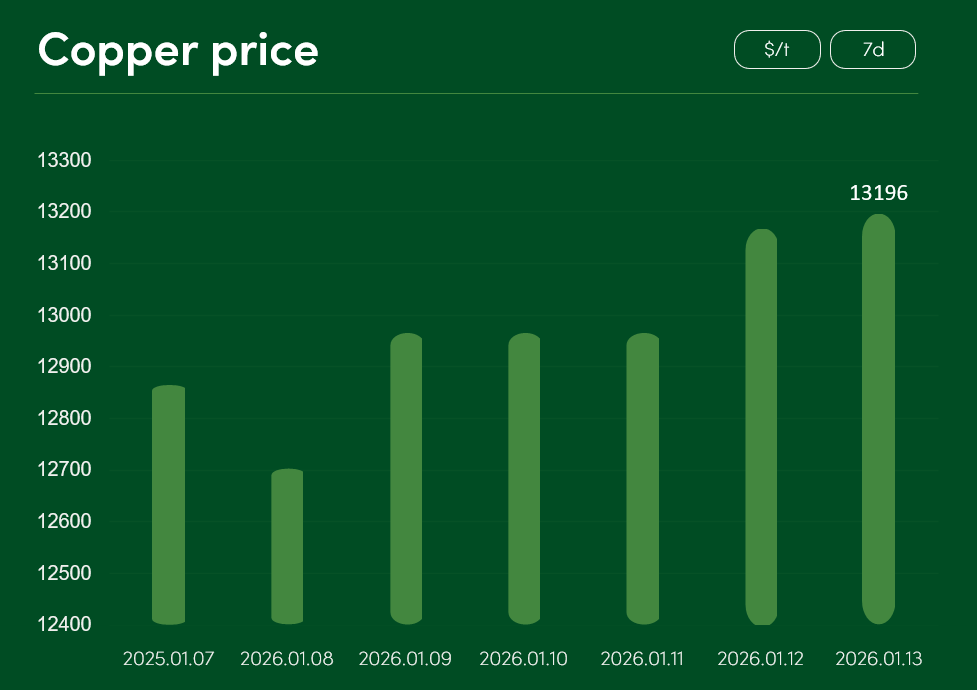

The global copper price rose by more than 2.5% between January 7 and January 13, reaching USD 13,196 per tonne.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.