November 12, 2024

Market Overview 06-11-24 to 12-11-2024

Precious metals went through a consensual correction in market prices over the past week. The US election results undoubtedly contributed to these changes. With the markets finally seeing a partial geopolitical stabilisation and an optimistic appreciation of the dollar, some investors are turning away from precious metals. Investors are returning to riskier assets in anticipation of global inflation and price increases.

Global gold prices fell by ~2% between 6 November and 12 November and reached a price point of $2596/oz.

The correction in gold prices is partially influenced by reduction in global geopolitical tensions. The emergence of D. Trump as US President on 6 November ended the temporary political division in the US and encouraged investors to return to riskier investment instruments.

With the investment community expecting an extension of protectionist tariff and duty policies from the Trump-led United States, gold’s decline has been accompanied by a record rise in the US dollar and in US equities. The American S&P500 stock index has risen by ~5% over the past week to reach new all-time highs. The US dollar, according to CNBC, appreciated by 1% against the Chinese yuan and by almost 2% against the Japanese yen in the immediate aftermath of Trump’s victory.

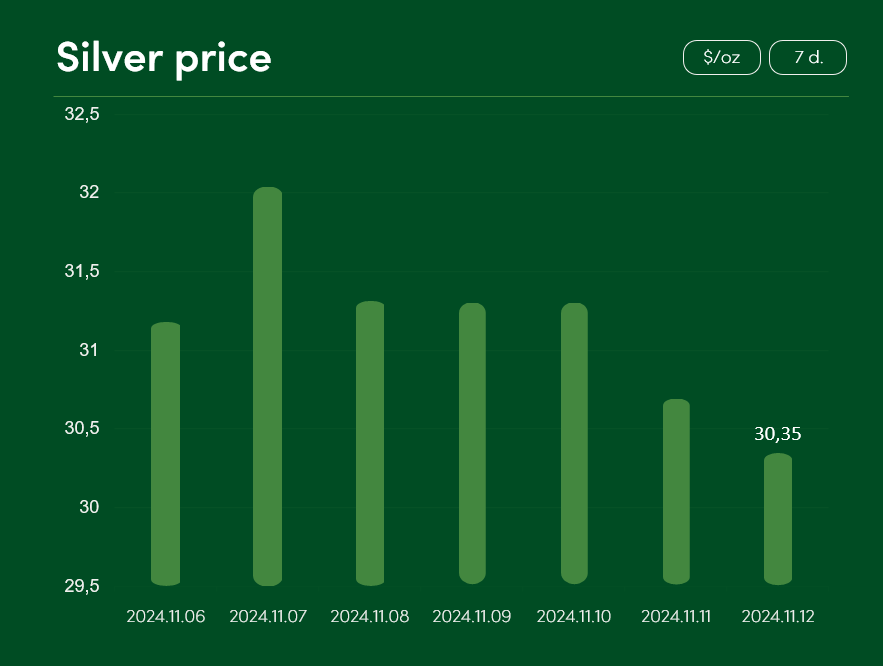

The price of silver fell by ~2.5% between 6 November and 12 November to $30.35/oz.

Part of the contraction in silver prices can also be attributed to the US election results. However, the less-than-effective economic recovery policy of China, a major silver consumer, also contributed to this correction.

Although, according to Reuters, during last Friday the Chinese government announced a 10 trillion yuan ($1.4 trillion) debt package aimed at boosting growth in the stagnant economy, experts at TradingEconomics and many other financial analysts state that the measure did not inspire the expected economical outcomes.

The outlook for silver prices is also weighed down by uncertainty of demand for the metal in China’s solar panel sector. Domestic solar panel companies have already started to reduce their production volumes due to Trump’s victory in the US elections. The Chinese fear that further increases in US tariffs on imports of solar modules will lead to increased production of these goods in America and negatively affect Chinese export flows.

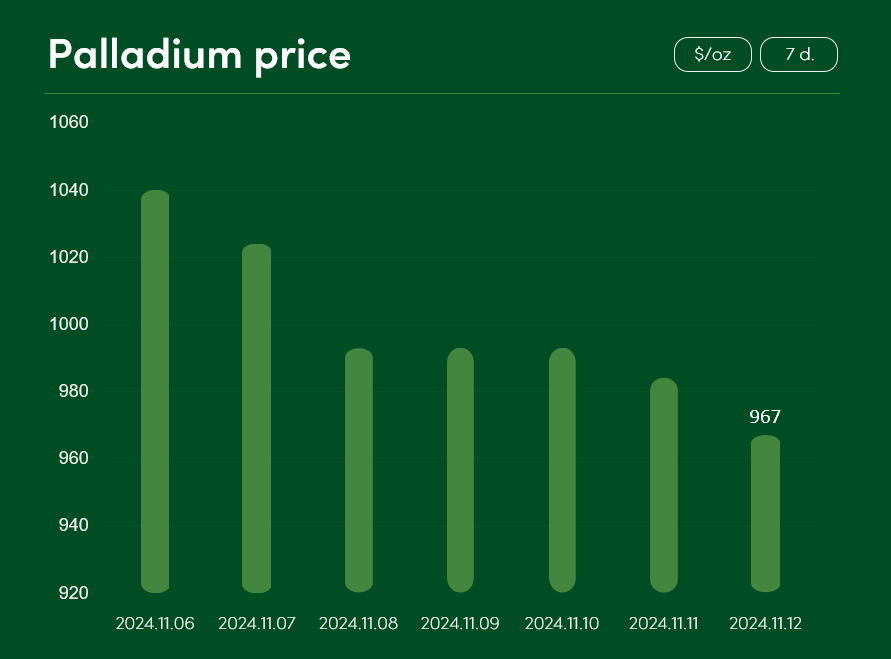

The price of palladium fell by 7% between 6 and 12 November to $967/oz.

Platinum also experienced a more pronounced price correction, with the exchange price of this precious metal decreasing by ~3.5% between 6 and 12 November to $953/oz.

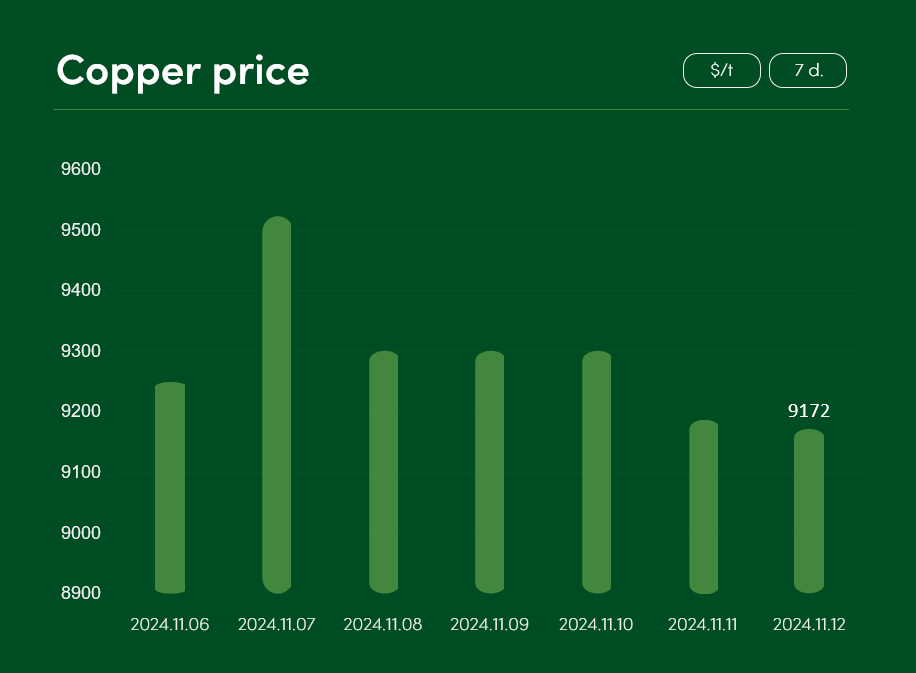

Semi-precious copper metal experienced a relatively small price decline of 0.8% between 6 and 12 November, reaching a price of $9172/t.

According toTradingEconomics experts, copper struggled last week not only because of stagnant demand for the metal in the Chinese market and the less than fully effective recovery of the Chinese economy. The strengthening of the US dollar and investors’ defection into riskier investing instruments also posed a challenge to global metal prices.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.