August 12, 2025

Market Overview 06-08-2025 to 12-08-2025

Over the past week, price growth in various precious metals markets was replaced by equivalent corrections. Investor caution was partly driven by a more noticeable reduction in risk in the spheres of geopolitics and international trade. Official announcements were made regarding both new import tariff decisions and actions aimed at reducing geopolitical tensions.

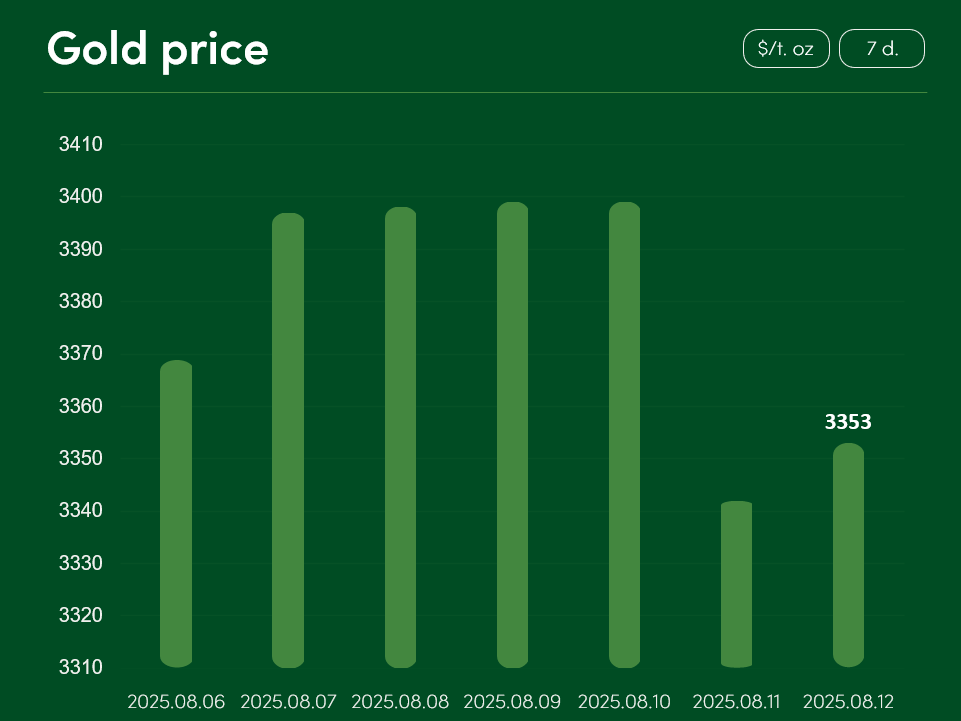

The global gold price, assessing the overall period of the past seven days, slipped by ~0.45% and on August 12 reached $3,353/t. oz.

Gold price growth and the sharper correction during the last seven days were partly influenced by rumours in the import tariffs sphere. Last Friday, media reported that the United States had introduced a 39% import duty on 100-ounce and 1-kilogram gold bars imported from Switzerland. The news, which investors took as a premise for a possible further rise in gold prices, was quickly denied by U.S. President D. Trump.

Gold price growth has also recently been restrained by favourable news in the sphere of trade agreements. The U.S. extended the deadline for applying the planned import tariffs on China by another 90 days. Following China’s adoption of an identical 90-day postponement of import tariffs, markets have been increasingly optimistic about the prospects for long-term trade agreements.

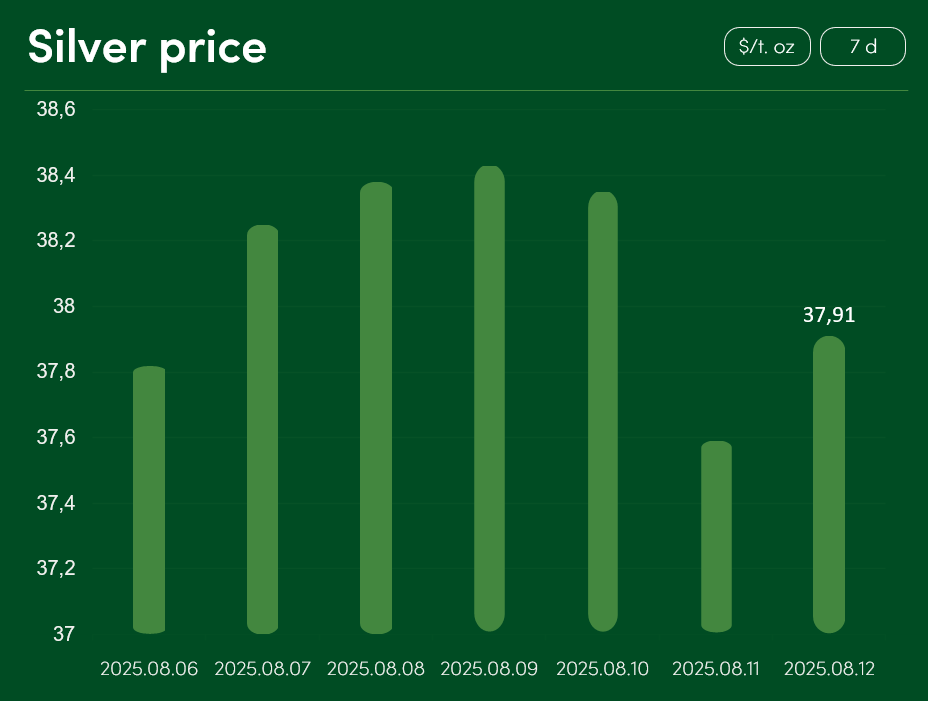

The global silver price, assessing the overall period of August 6–August 12, experienced relatively minor changes. On August 12, the silver price reached $37.91/t. oz.

Optimistic silver price growth is also constrained by the discussed import tariff changes and the de-escalation of global geopolitical tensions. After D. Trump confirmed news about a planned meeting this Friday in Alaska with Russian President V. Putin, the public reacted to this as a more significant sign of de-escalation of the war in Ukraine. Media reports also emerged about possible Ukrainian territorial concessions in pursuit of a peace agreement.

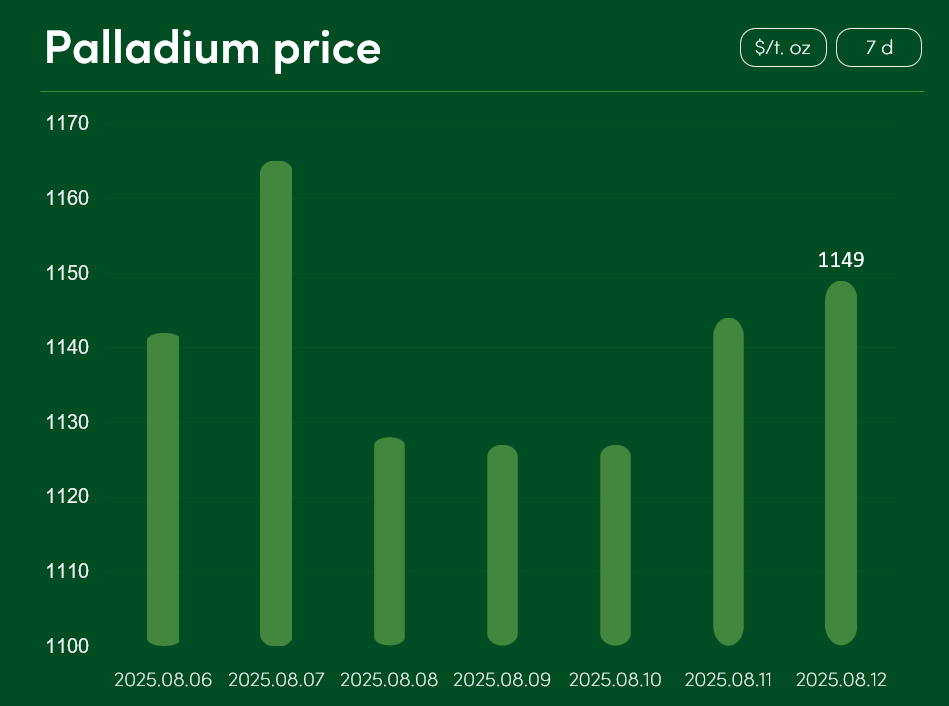

On the other hand, the market possibly avoided more pronounced silver price corrections due to news such as the rising probability of U.S. interest rate cuts, favourable for the growth of U.S. dollar-denominated precious metals prices. In response to the poor latest U.S. labour market figures, Federal Reserve Board member Michelle Bowman stated that they confirm labour market instability and her view that it is appropriate to implement three Fed interest rate cuts this year. The global palladium market price from August 6 to August 12 rose by ~0.8%. On August 12, the palladium price reached $1,149/t. oz.

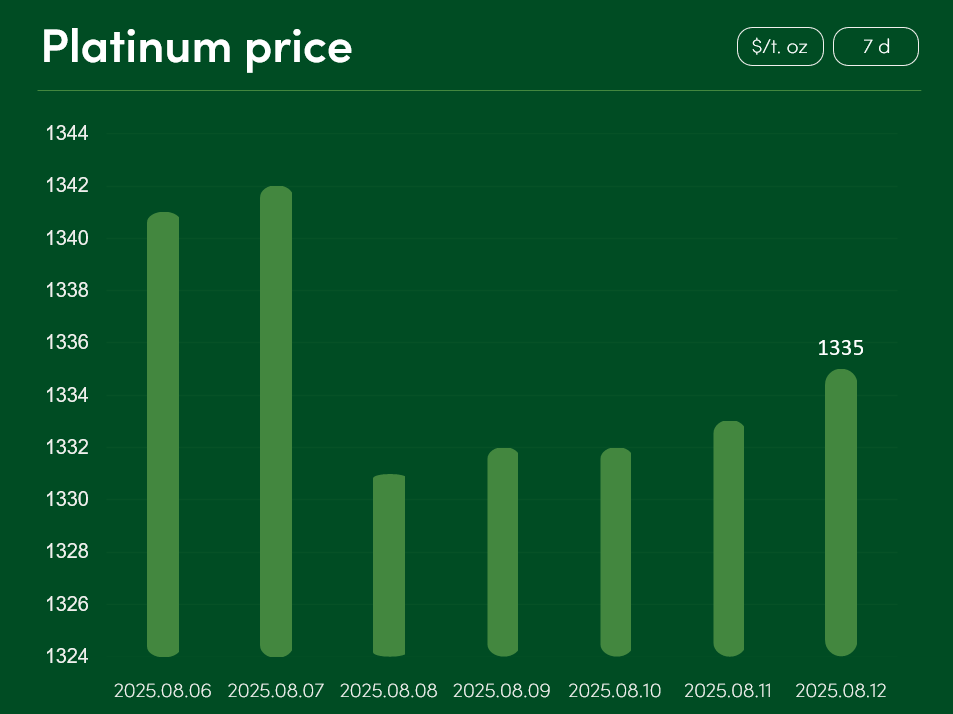

The global platinum price from August 6 to August 12 faced a slight correction; on August 12, the price stood at $1,335/t. oz.

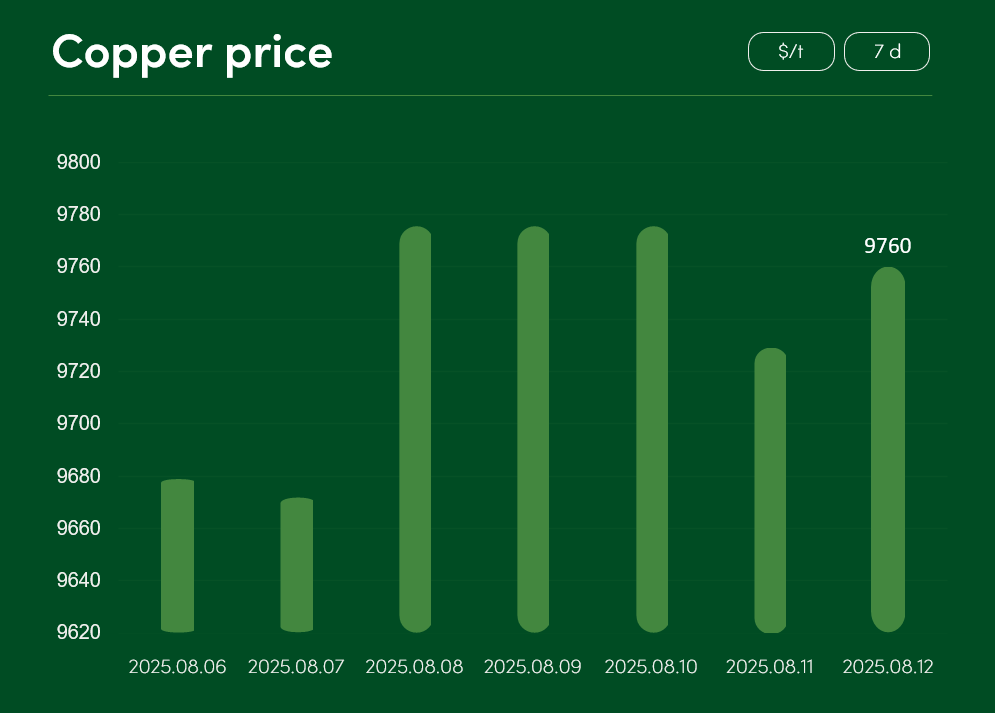

The global copper price from August 6 to August 12 rose by >0.8%; on August 12, the price reached $9,760/t.

Positive developments in the U.S.–China trade war sphere have recently contributed significantly to optimistic copper price dynamics. On the other hand, copper price growth in the longer term may be hindered by specific U.S. import tariff decisions. On August 1, the United States officially introduced a 50% copper import duty for all trading partners, with tariff exemptions applied to such products as refined copper. This decision has become a major problem for copper traders: in the U.S. domestic market, due to the applied tariff exemptions, it is becoming more difficult to sell copper stocks accumulated before the tariffs came into force.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.