November 11, 2025

Market Overview 05-11-2025 to 11-11-2025

Chaos in the U.S. market is driving precious metals prices higher!

Last week, several major precious metals experienced significant price growth. It appears that the favourable performance for precious metals investors has been influenced both by the record-long temporary U.S. government shutdown, the expected Federal Reserve interest rate cuts, and the latest U.S. economic data.

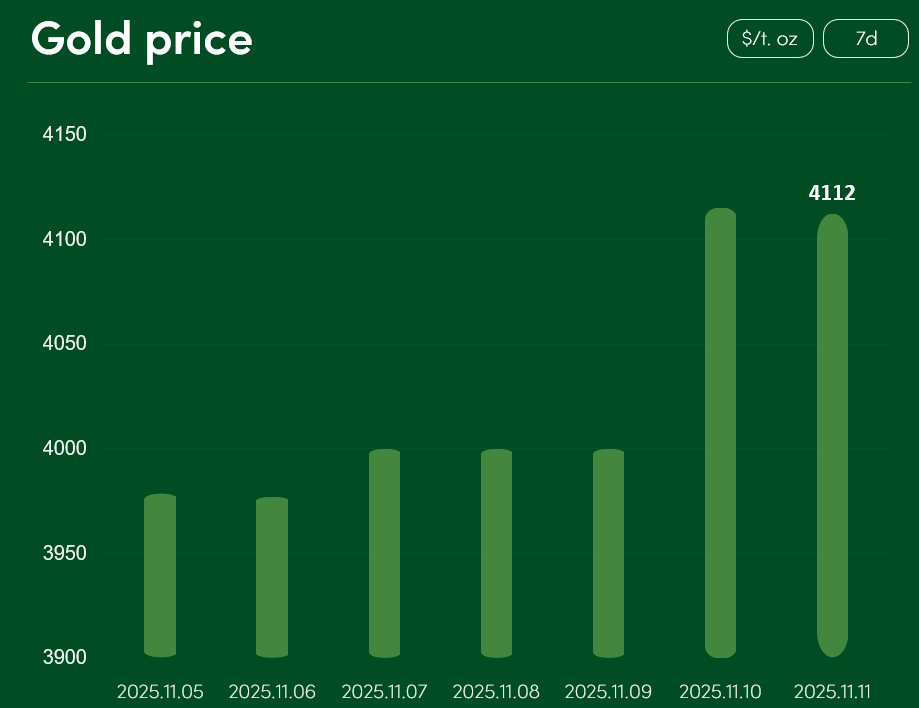

The global gold price rose by more than 3.2% from November 5 to November 11 and reached $4,112/t. oz.

The surge in gold prices was supported by the record-long temporary U.S. government shutdown. Although the Senate approved the legislation required to reopen the government on Monday, and the House of Representatives vote is scheduled for this Wednesday, the shutdown, now in its 42nd day, has already become a major challenge to the U.S. political and economic system.

Gold price growth is also supported by expectations of U.S. interest rate cuts. Current market pricing indicates a 67% probability that the Federal Reserve will cut rates by 0.25% at the beginning of December. Lower interest rates would increase the investment appeal of precious metals denominated in U.S. dollars (gold, silver, etc.) for foreign currency holders.

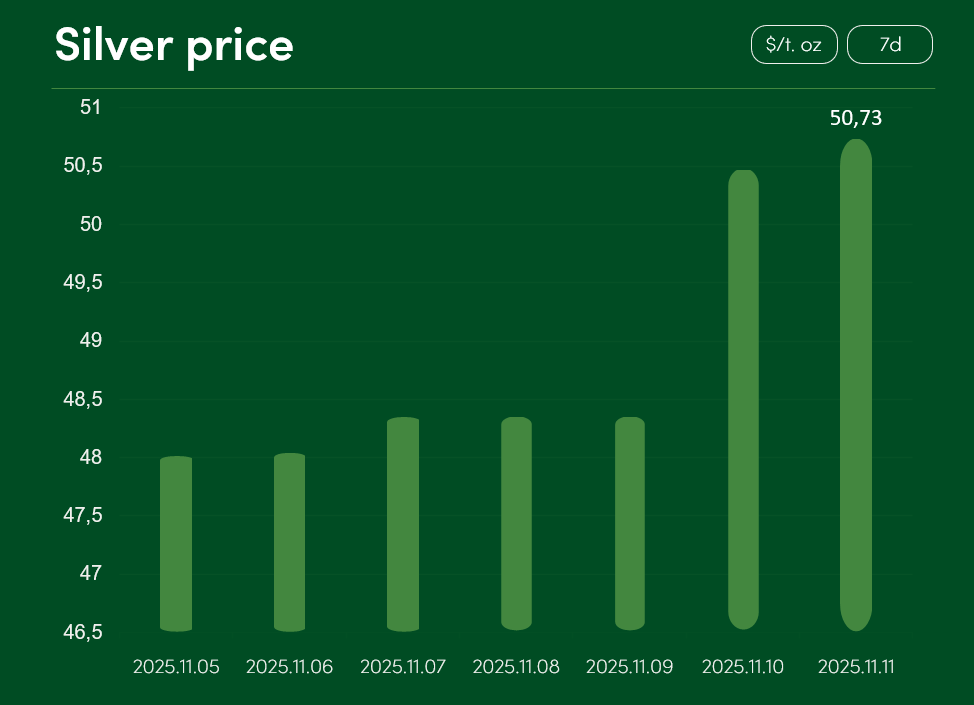

The global silver price increased by approximately 5.7% from November 5 to November 11 and reached $50.73/t. oz.

Silver price growth is driven not only by U.S. political tensions and interest rate cut expectations. Investors are also increasingly cautious about problematic U.S. economic indicators.

The updated October Michigan Consumer Sentiment Index (MCSI) showed relatively low confidence among U.S. consumers regarding the country’s economic future and their personal financial situation. In October, the index fell to 50.3 points, reaching its lowest level in three years.

U.S. labour market indicators also appear concerning. Recent surveys show that in October this year, private U.S. companies eliminated 153,000 jobs. For comparison, during the same period in 2024, the number of eliminated jobs was 55,500. This data, published at a time when official October job creation figures are missing due to the government shutdown, is unsettling for many investors.

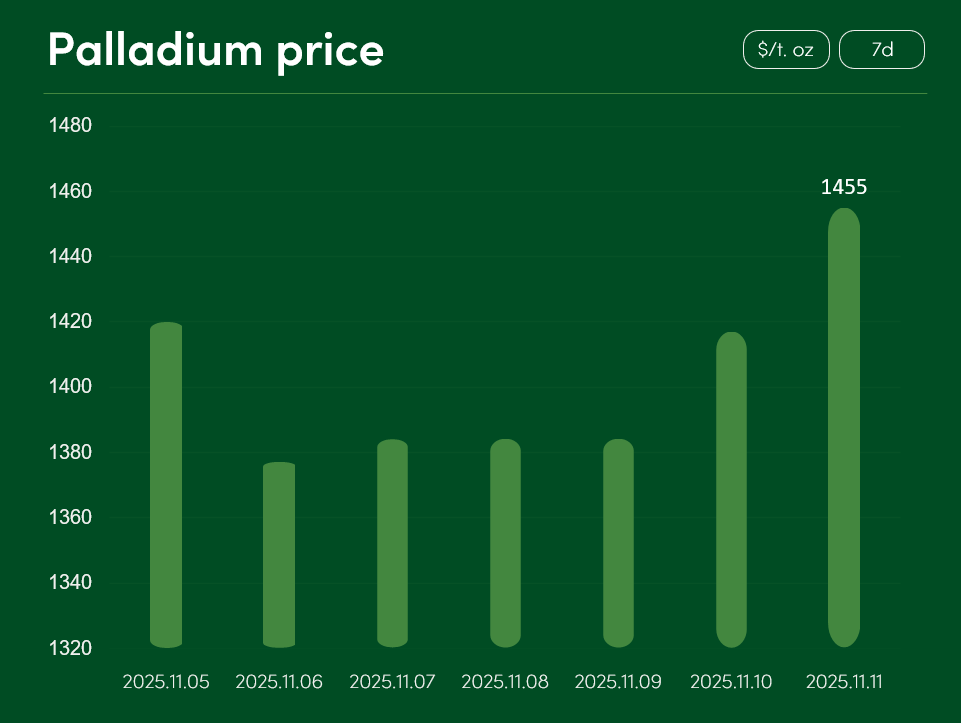

The global palladium price experienced minimal changes from November 5 to November 11, reaching $1,455/t. oz. on November 11.

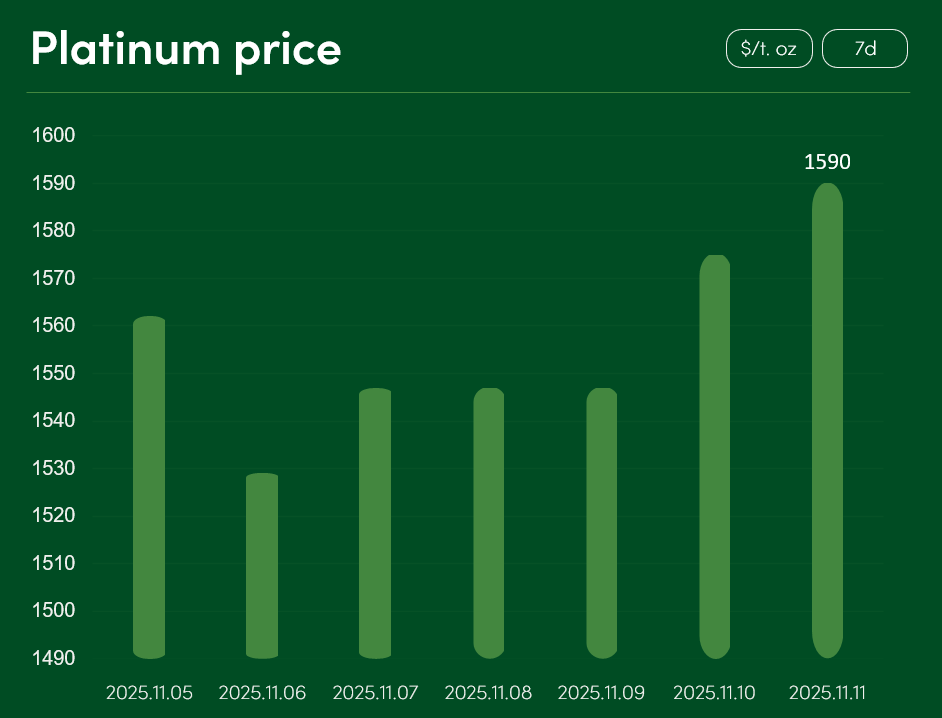

The global platinum price also showed minimal fluctuations, reaching $1,590/t. oz. on November 11.

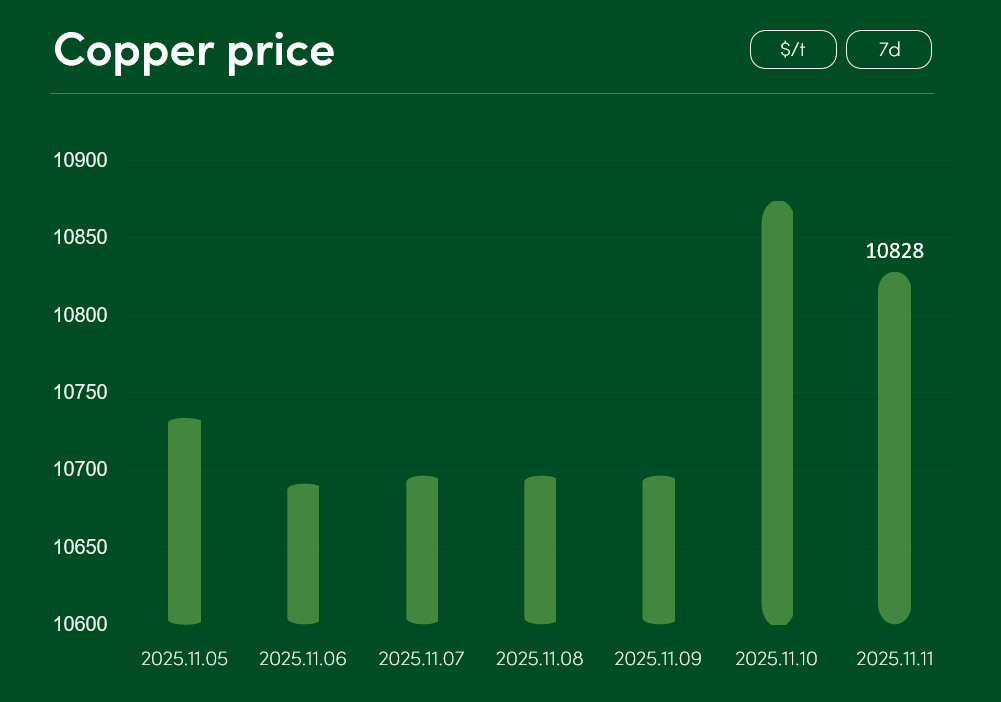

The global copper price rose by approximately 0.9% from November 5 to November 11 and reached $10,828 per tonne.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.