March 11, 2025

Market Overview 05-03-2025 to 11-03-2025

The past week has been full of politico-economic events that could lead to further gains in precious metals prices. The weakening of the US dollar and the aggressive trade policy of the United States are encouraging increased investment in precious metals. Meanwhile, fiscal stimulus measures in China, changes in the global supply chain and the German infrastructure fund deal are contributing to the optimistic view on the industrial metal prices.

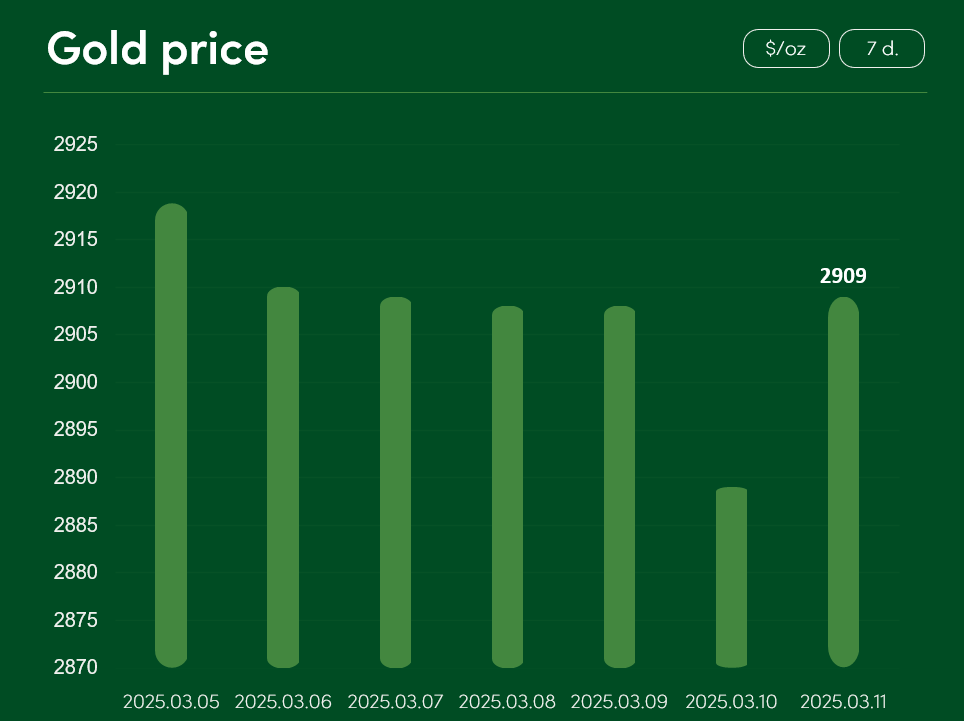

The record high gold price remained almost unchanged between 5 and 11 March. On 11 March it reached $2909/oz.

The recent high gold prices are partly supported by market uncertainty about the future of US economy. The world’s most powerful economy has recently imposed import tariffs of 25% on some Mexican and Canadian goods and raised tariffs on imports from China by 10%. In the face of retaliatory measures from the latter countries, investors are greeting the new trade policy with fear.

The tariffs are likely to have a negative impact on product and raw material prices, primarily in the market that applied them first. For this reason, some investors are leaving assets directly linked to the dollar currency in favour of other popular currency alternatives, such as the euro and the yen. The weakening of the dollar is also leading to more active gold buying. The precious metal is settled globally in dollars, which has now made gold a relatively cheaper investment option for holders of other currencies.

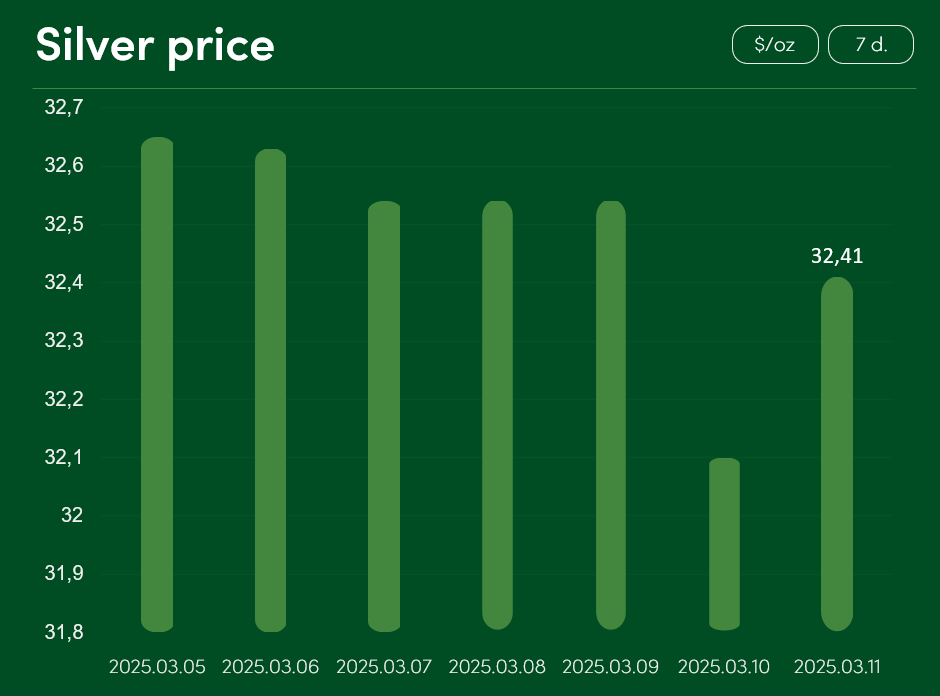

The global silver market price also experienced relatively little change between 5 March and 11 March. After a marginal (~0.75%) correction, the silver price reached $32.41/oz.

The record high silver prices are supported by both strong industrial demand for the metal and uncertainty about the future of the global economy. Investors’ concerns over the past week have also been fuelled by Trump’s current stance on economic future of the US. In an interview with Fox News on Sunday, the US President avoided answering directly whether the state’s economy is heading towards a period of high inflation or a recession, but he did not rule out the latter possibility.

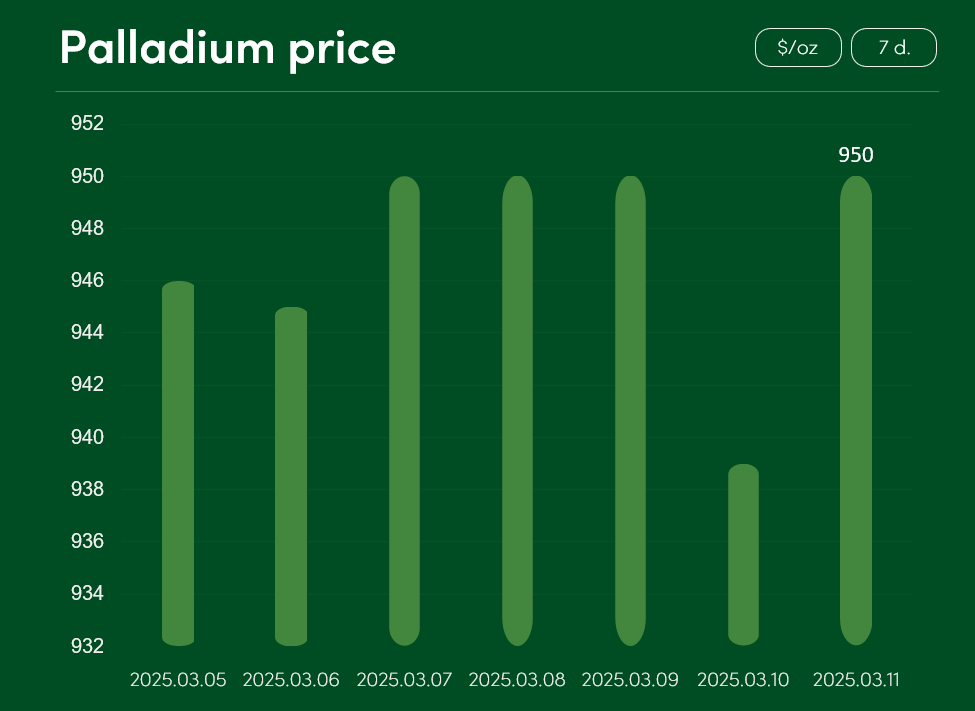

The global palladium price recorded minimal changes between 5 March and 11 March, reaching a point of 950 $/oz on 11 March.

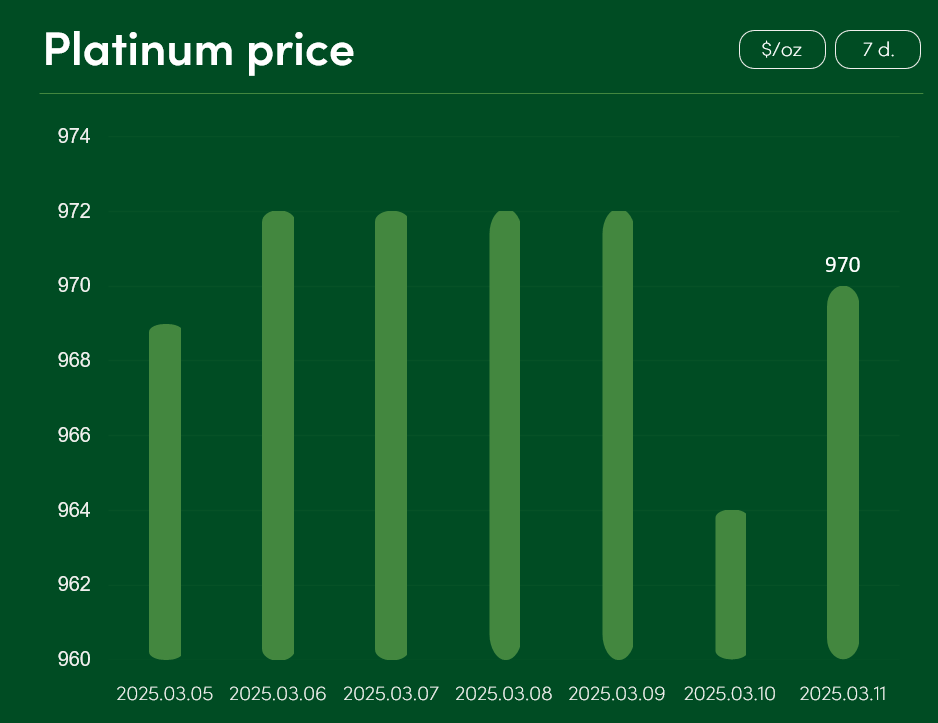

The global platinum price has also shown relatively low volatility over the last 7 days. On 11 March, the precious metal reached a price of $970/oz.

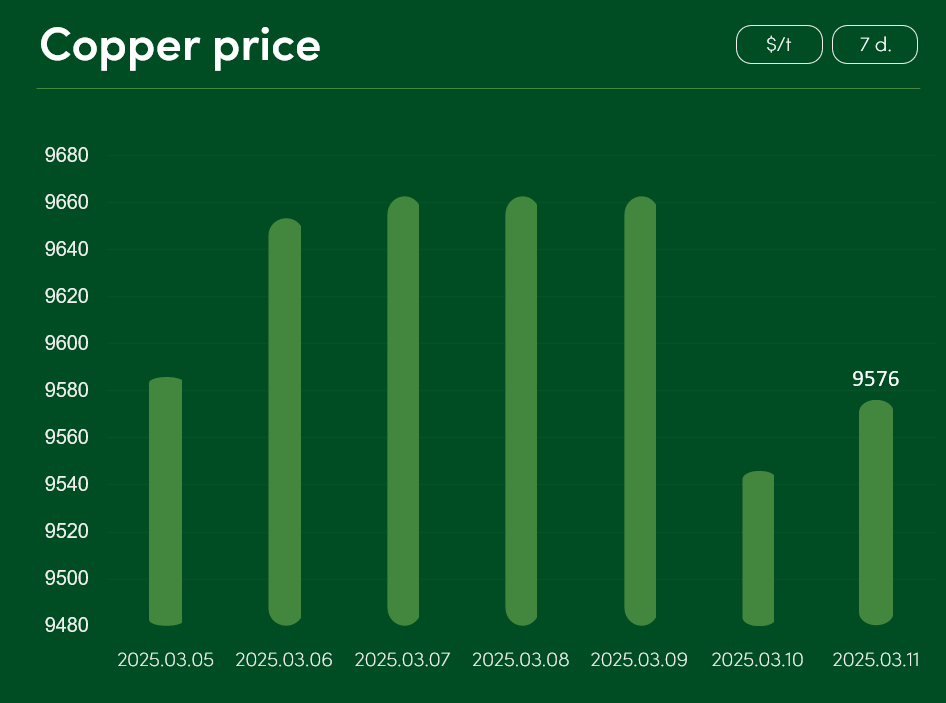

The global price of copper has also experienced relatively calm 7-day period. The global copper price reached a price point of $9576/t on 11 March.

In the short term, decisions of the German and Chinese governments in favour of industrial production should contribute to the growth of copper demand.

China, the largest copper user, announced on 5 March a target to increase its GDP by 5% this year. Beijing will issue USD 179 billion of long-term treasury bonds this year to meet this target. It is also envisaged that the country’s local authorities will be able to issue debt securities worth around USD 610 billion. Experts say that, in this way, China is trying to mitigate the effects of the import tariffs imposed on it by the USA.

The German Infrastructure Fund agreement also seems to be in favour of global copper prices and demand for various industrial metals. The Christian Democratic Union (CDU) and the German Social Democratic Party (SPD), which are seeking to form a majority in the country’s ruling government, have agreed on the creation of a €500 billion fund for infrastructure spending. The fund would be used to upgrade the country’s armed forces as well as Germany’s infrastructure and to boost country’s economic growth.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.