February 11, 2025

Market Overview 05-02-2025 to 11-02-2025

Record-breaking price developments and contradictory dynamic of main rates are the factors that have confronted the precious metals markets over the past week. Market mobilisation has been driven by the approval of new trade tariffs in the US, the resumption of geopolitical threats in Gaza, and global challenges in metals sectors of mining and supply.

Last week, the global gold price continued its assured rise and repeatedly set new all-time price records. From 5 February to 11 February, a price increase of ~1.3% was recorded, with the price reaching $2905/oz on 11 February.

The rise in the gold price was driven primarily by investors’ concerns about the escalation of the global trade conflict. Following the approval of new import tariffs on China, US President Trump unexpectedly announced a decision to impose a 25% tariff on steel and aluminium imported into the United States from all countries.

Gold prices were also pushed up by renewed geopolitical threats in the Middle East. Hamas has accused Israel of numerous violations of the ceasefire agreement and postponed a planned hostage release.

The growth of the main precious metal is also supported by accommodative monetary market policy. Central banks of England, Europe, India, Sweden and Canada have already cut interest rates at the end of January/beginning of February.

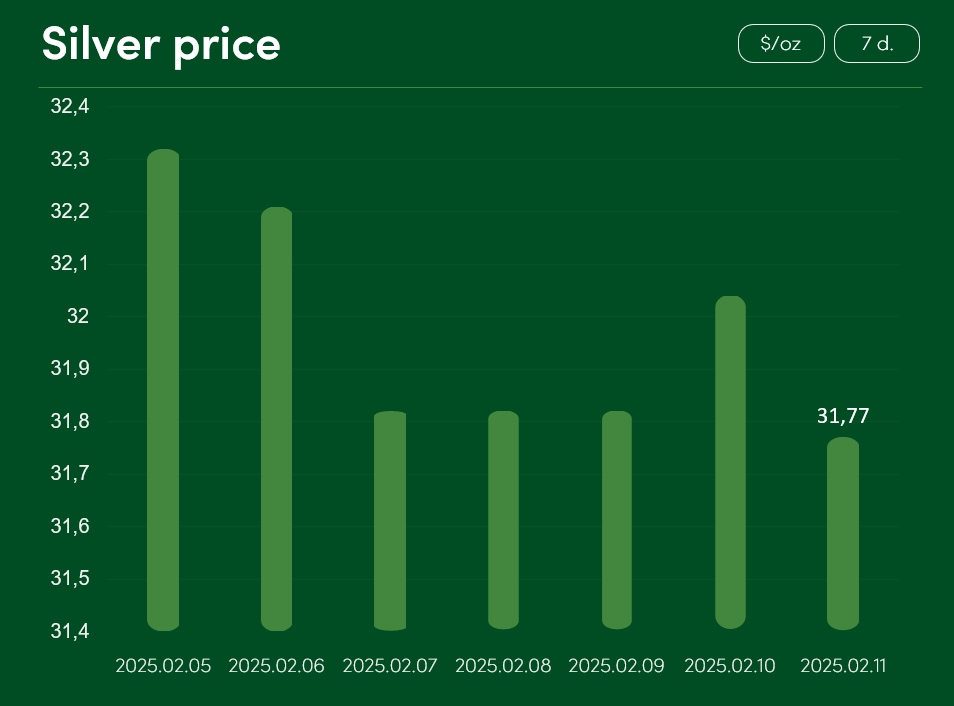

Silver faced a somewhat unexpected price correction. Its price, which recorded a correction of ~1.75% between 5 February and 11 February, reached $31.77/oz on 11 February.

Although the economic and political environment is favourable for the rise in precious metals prices, a short-term correction in silver was to be expected from an analysis of the overall trend on the silver exchange over the medium term.

Between the beginning of January 2024 and the end of January 2025, the global silver price recorded an extraordinary price increase of ~42%. Huge price gains of silver have also provided an excellent selling opportunity for earlier buyers of the metal.

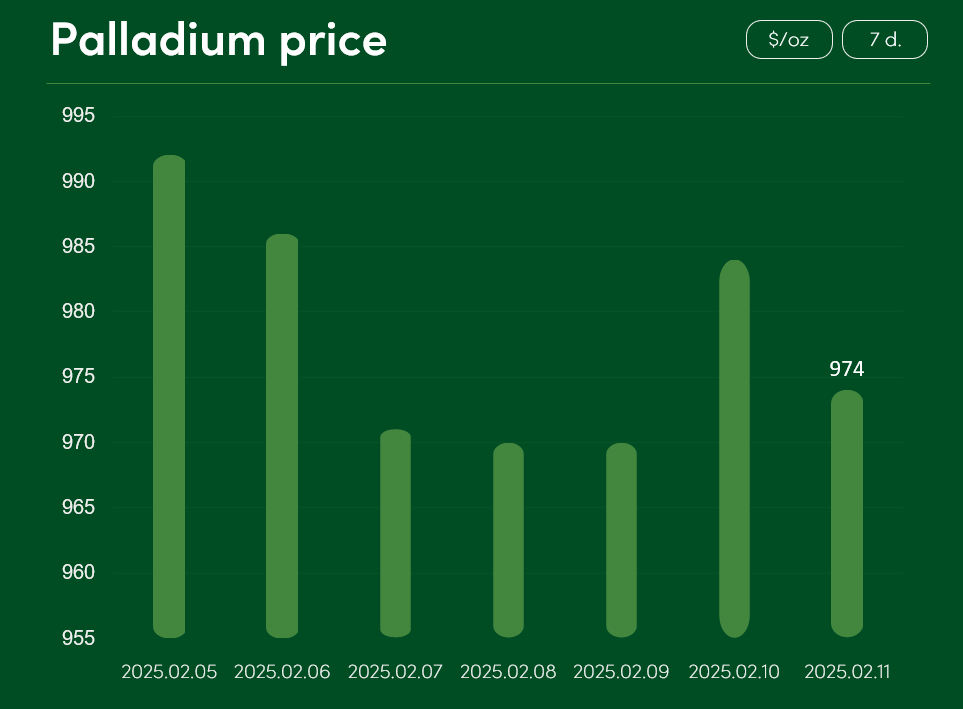

The market price of palladium fell by 1.8% between 5 February and 11 February to $974/oz.

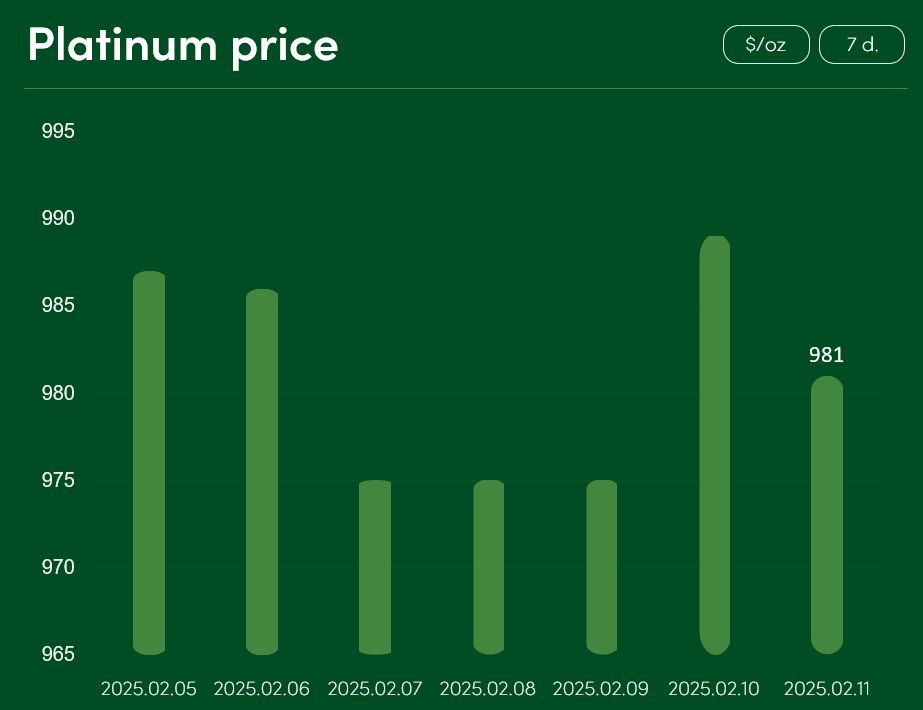

Platinum managed to partially counteract the short-term price decline over the last 7 days and ended the week at $981/oz.

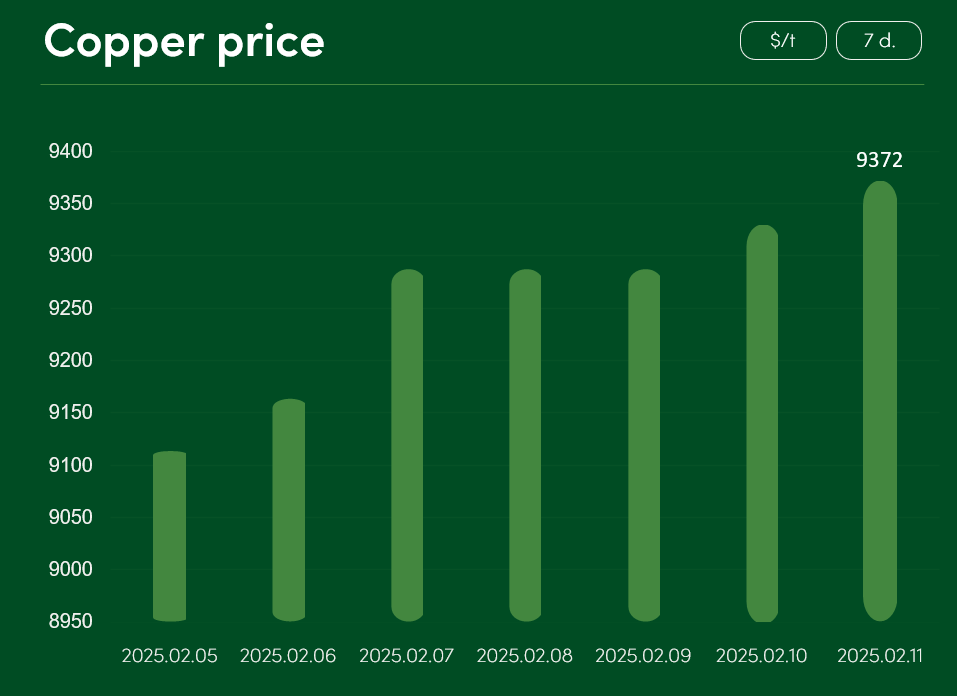

Copper, which has been enjoying an upward trend for some time now, rose by ~2.85% between 5 and 11 February to reach 9372 $/t.

Copper prices are not only boosted by the recovery of the Chinese and US industries, but also by rising German industrial production. The German Federal Statistical Office reported a 6.9% increase in new industrial production orders in December last year. This indicates a recovery in the German production industry and enhances the attractiveness of copper metal as an investment choice.

The consolidation of copper prices at a higher level is also likely to be aided by supply bottlenecks. In anticipation of global copper supply challenges in 2025, Glencore and Anglo American, large global mining companies, have reported lower production rates for the metal in 2024.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.