December 10, 2024

Market Overview 04-12-2024 to 10-12-2024

Precious metals prices reacted differently to global financial and geopolitical news over the past week. The rise in gold and silver prices is mainly attributed to the escalation of the conflict in the Middle East and to favourable monetary decisions by the Chinese government. Copper, a semi-precious industrial metal whose price is heavily influenced by the political decisions and economic situation of the Chinese market, also recorded positive gains. Meanwhile, palladium and platinum, less popular investment choices, did not experience any significant price changes this week.

Between 4 and 10 December, gold price overcame a slight correction and reached $2663/oz on 10 December.

Gold has been holding its high price position for some time due to the deepening geopolitical crises in the Middle East. Initially, the price of the metal was pushed up by the Israeli invasions of the Gaza Strip and South Lebanon. In the last week, the political threats have been compounded by the coup d’état by Syrian rebels and the subsequent incursion of the Israeli army into Syria.

While geopolitical threats are driving the popularity of gold as an investment hedge, favourable monetary policy decisions are making the outlook for the metal’s future price growth more optimistic at the same time. Reuters reports that the Chinese government decided on Monday to adopt “moderately loose” monetary policy decisions for the first time in 14 years, combining fiscal expansion with significant interest rate cuts. The Chinese central bank also added to its gold reserve for the first time in seven months, according to TradingEconomics analysts, further strengthening demand for the precious metal.

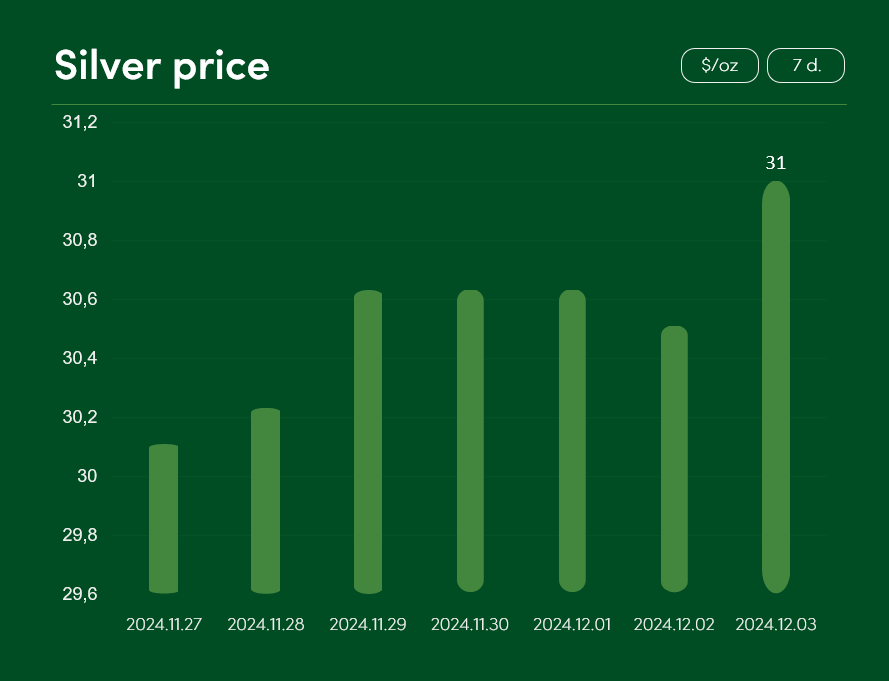

The silver spot price rose by >1.5% between 4 December and 10 December to $31.81/oz.

The rise in the silver price was driven by the geopolitical crisis discussed, by the news on Chinese monetary policy and by the increasingly likely decision to cut US interest rates. Currently, the markets estimate a ~86% probability that the Fed will cheer investors with a 0.25% (25 bps) cut in US interest rates on 18 December, thus further boosting various consumption and investment indicators.

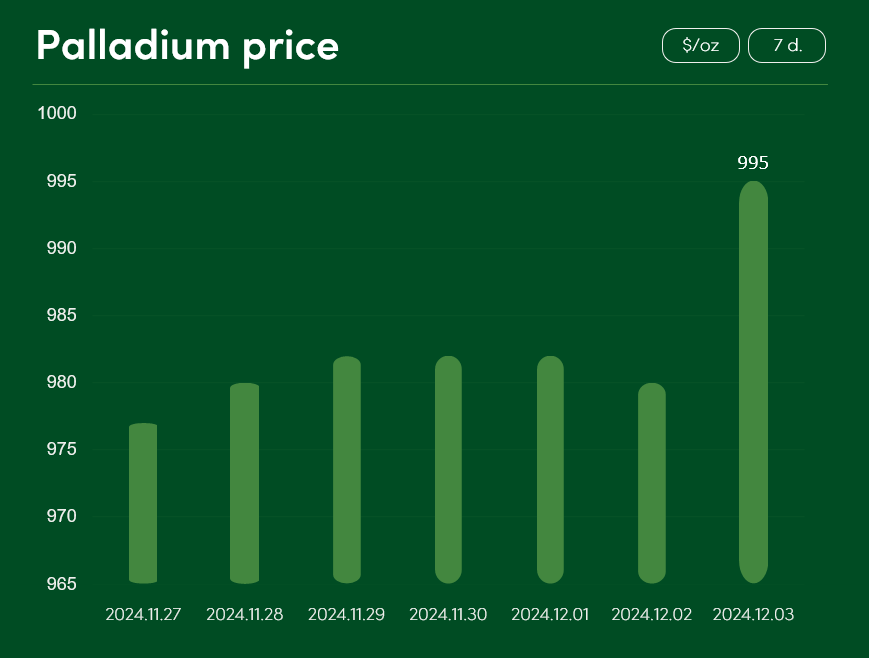

The market price of palladium has remained almost unchanged over the past week, recording a ~0.5% decline between 4 and 10 December to reach a price of $974/oz.

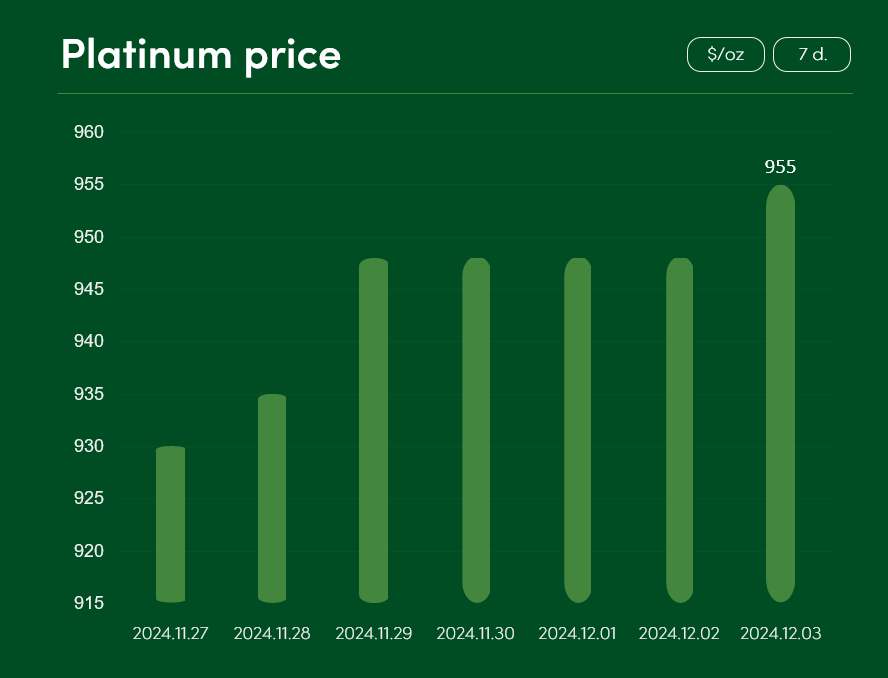

Platinum metal also recorded minimal changes: from 4 to 10 December the platinum market price fell from $940 to $939/oz.

Between 4 December and 10 December, copper price rose by >2% to $9167/t.

The main contributor to the increase in copper prices was the Chinese government’s monetary policy decisions. They were a kind of counterbalance and a positive signal for the markets in the face of US President Trump’s promises to raise tariffs on China, Mexico and Canada.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.