September 10, 2024

Market Overview 04-09-24 to 10-09-2024

Precious metals prices ended the period of last seven days (From September 4th to September 10th) with a small but clear increase. Analysts are unanimous in attributing the optimistic market sentiment to the interest rate cuts expected by investors in the US and the euro area. Even though the unemployment rate at the labour market of world’s strongest economy is still relatively high, such trend seems to be slowly starting to fade away. However, such situation is definitely fuelling talks and heightening probability of a softer interest rate cut scenario in the US.

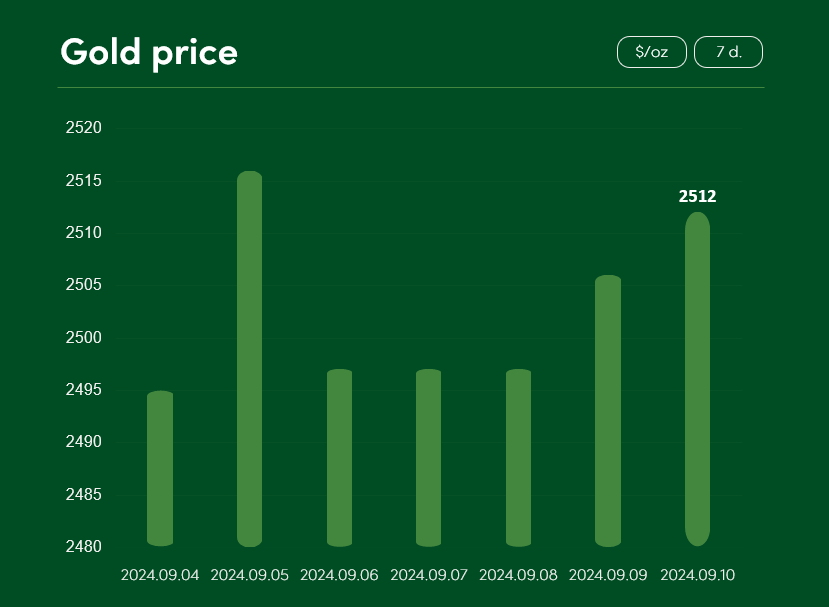

The gold price rose by ~0.75% between 4 September and 10 September to reach $2512/oz. According to Bullionvault’s expert commentary, the $2500 price threshold may be just a “good start” before a new rise: markets are optimistic about a future interest rate cut, and analysts expect to see capital injections of Western countries into the gold market after such event finally takes place.

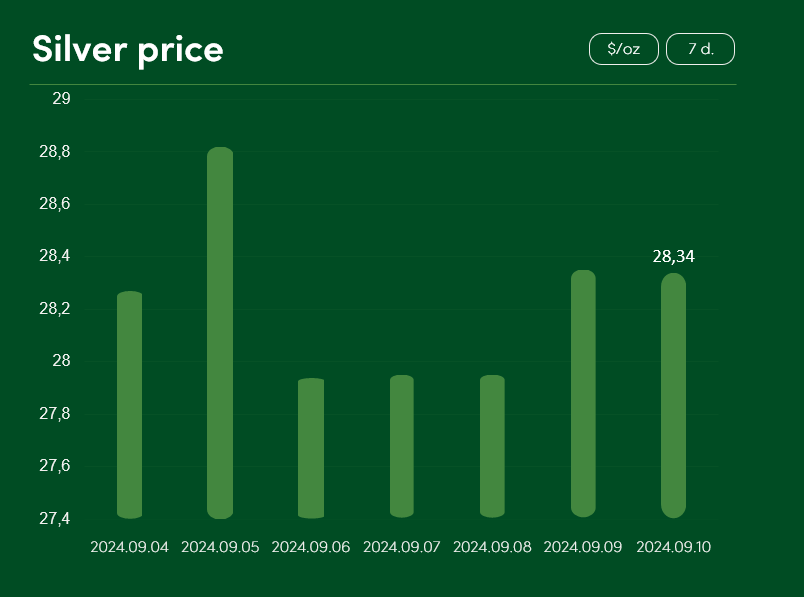

Silver prices have experienced a certain kind of stagnation over the period of last 7 days: on 10 September, the silver price was ~$28.34/oz.

The changes in investor sentiment and market’s indecision about the further movement of the silver price is clearly reflected in the price chart of this metal. Even though the whole world is optimistic about interest rate cuts in the US and Europe, the latest US unemployment figures are met with unease.

According to the US unemployment rate statistics provided by Tradingeconomics, the unemployment rate in the United States stood at 4.2% in this year’s August. This is one of the highest monthly unemployment rates recorded in the last two years. On the other hand, it is also slightly lower than the 4.3% unemployment rate, recorded in July. Some experts predict that the not-too-substantial weakening of the US labour market will also lead to a more modest rate cut. If this forecast comes true, the autumn rise in precious metals prices may be somewhat more modest than some of the biggest market enthusiasts expected it to be.

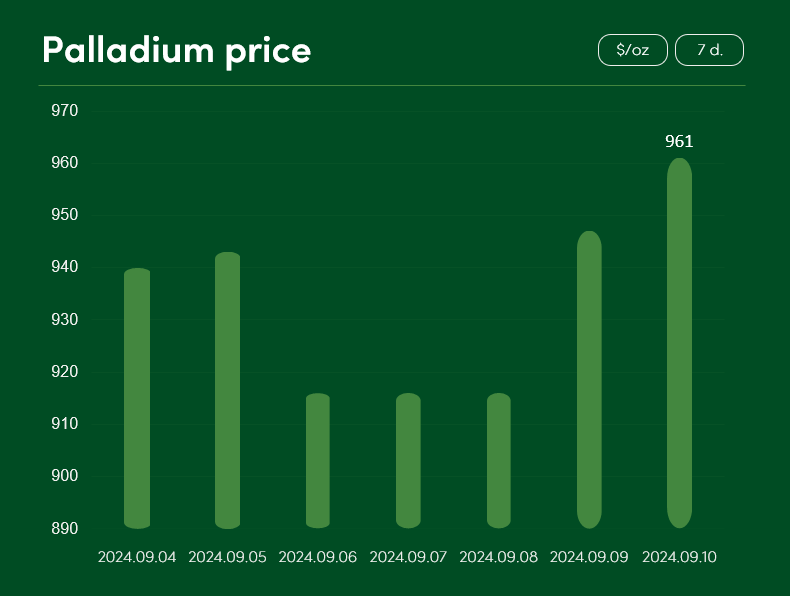

Palladium recorded a ~2% rise on the market during last week, reaching a price of $961/oz on 10 September.

Even more impressive was the rise in platinum prices: between 4 September and 10 September, this precious metal rose by >3% to reach a point of $941/oz.

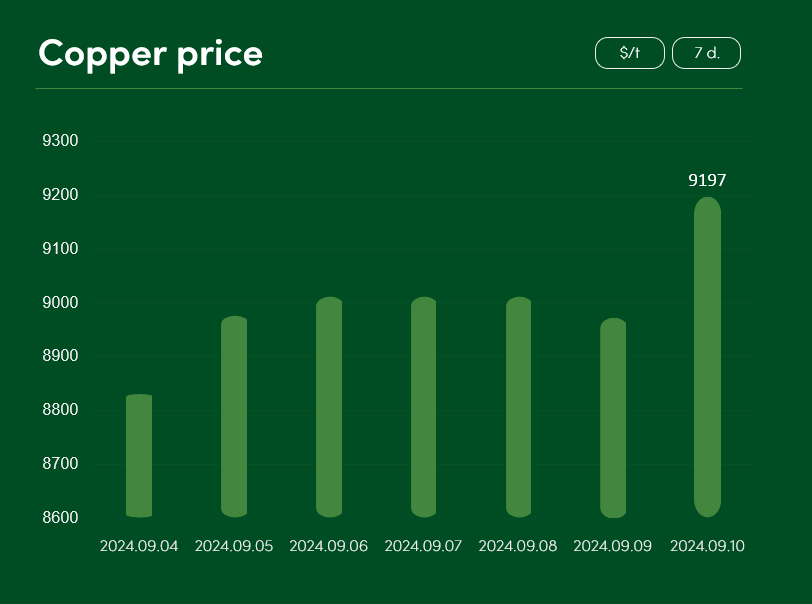

Semi-precious copper metal broke the price slump recorded at the end of August and enjoyed a successful upward stretch of >4% over the last 7 days, reaching $9197/t on 10 September.

According to the expert insights provided by TradingEconomics, the observed consolidation in copper prices can be partly explained by the stabilisation of copper demand recorded in China, the largest import market for this metal. Optimism is also undoubtedly fuelled by the expected cut in US interest rates, which will make it cheaper for many companies of all sizes in the country to borrow money for business development purposes, and easier for local residents to access a large variety of credits, fit for everyday consumption purposes.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.