February 10, 2026

Market Overview 04-02-2026 to 10-02-2026

Precious Metals Market: Calm Before the Storm?

Although price movements in the major precious metals markets were relatively modest last week, investors continue to view the sector with heightened caution. This sentiment has been shaped both by the sharp market correction at the end of January and the sudden partial price recovery observed in early February.

When providing further price forecasts for precious metals, analysts are focusing on both central bank investment decisions and rising geopolitical risks.

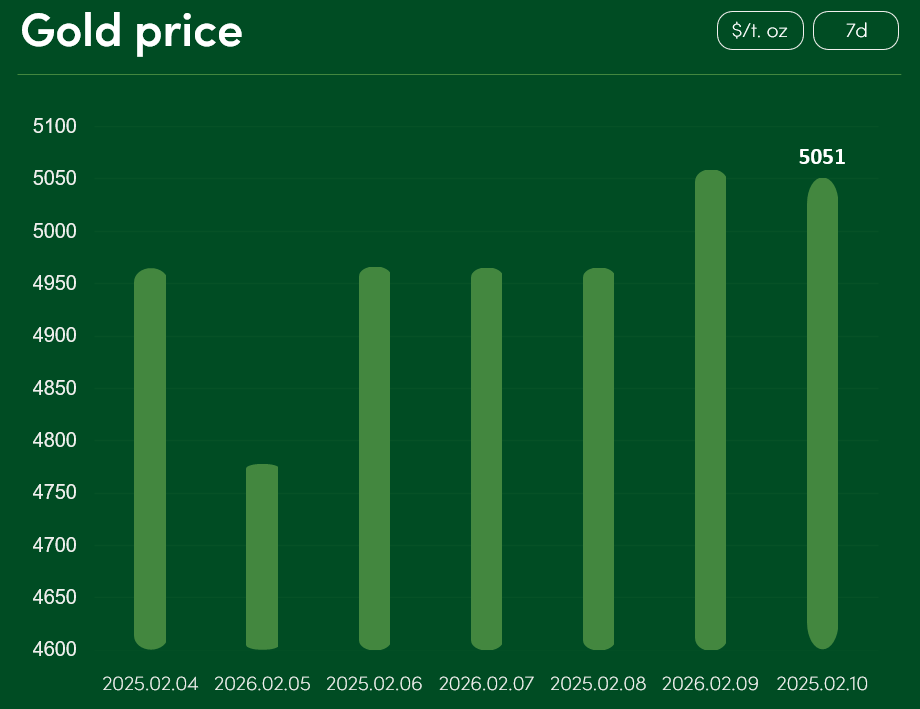

The global gold price increased by more than 1.7% between February 4 and February 10, reaching USD 5,051 per troy ounce. The average gold price in February stands at USD 4,909 per troy ounce.

Despite the sharp price decline that shook the gold market at the end of January, linked to pricing adjustments on commodity exchanges, early February has seen a partial recovery and a degree of market stabilisation.

As investors cautiously assess further upside potential for gold prices, analysts point to several factors that could support the strengthening of the market.

Despite widespread uncertainty and recent corrections, China’s central bank has played a significant role in stabilising the gold market. Reports indicate that China’s main financial institution increased its gold reserves for the fifteenth consecutive month in January.

Gold prices may also be supported in the near term by growing geopolitical tensions. Following the conclusion of the first round of indirect talks between the United States and Iran, the US Maritime Administration issued recommendations for all US-flagged vessels. These advise ships to remain as far as possible from Iran’s territorial waters and not to grant Iranian military forces permission to board US vessels.

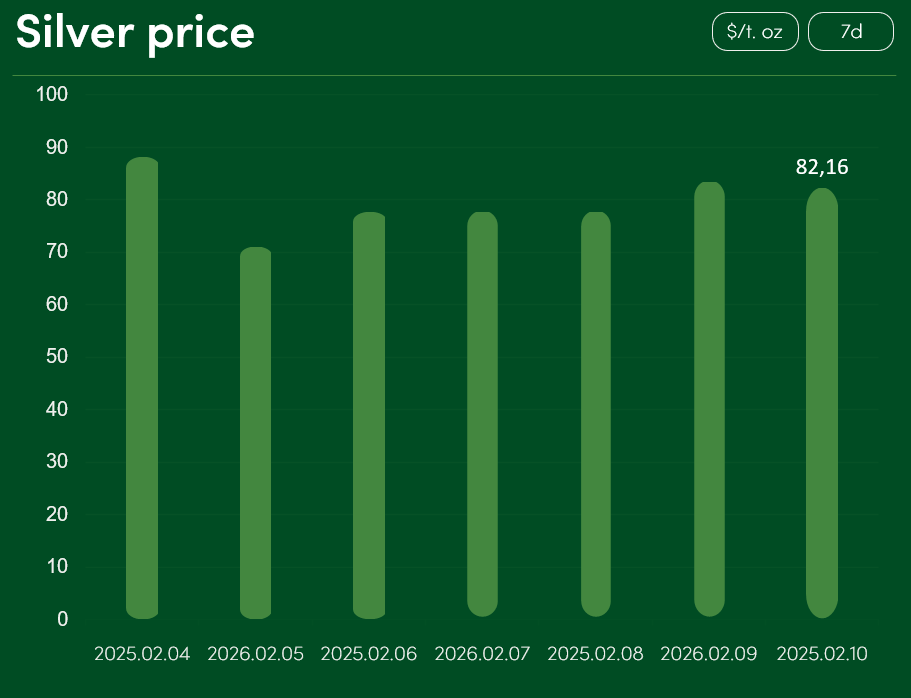

The global silver price declined by more than 6.8% between February 4 and February 10, reaching USD 82.16 per troy ounce. The average silver price in February stands at USD 82.34 per troy ounce.

With silver prices experiencing yet another notable correction since the end of January, investors are searching for clarity regarding the market’s future outlook.

Analysts at precious metals refining and trading company Heraeus emphasise that both gold and silver markets have now entered a high-volatility regime. As gold temporarily transforms into a speculative asset, silver is also experiencing heightened fluctuations and a more challenging price forecasting environment.

Nevertheless, several factors could support a recovery in silver prices in the near term. Analysts are primarily focusing on developments in the US market. Expectations are growing that the Federal Reserve could begin cutting interest rates as early as its April meeting. Experts such as State Street analyst Lee Ferridge suggest that an aggressive rate-cutting cycle by the Fed could lead to a correction of up to 10% in the US dollar.

Should this scenario materialise, US dollar–denominated precious metals such as gold and silver would become significantly more attractive investment options for holders of foreign currencies.

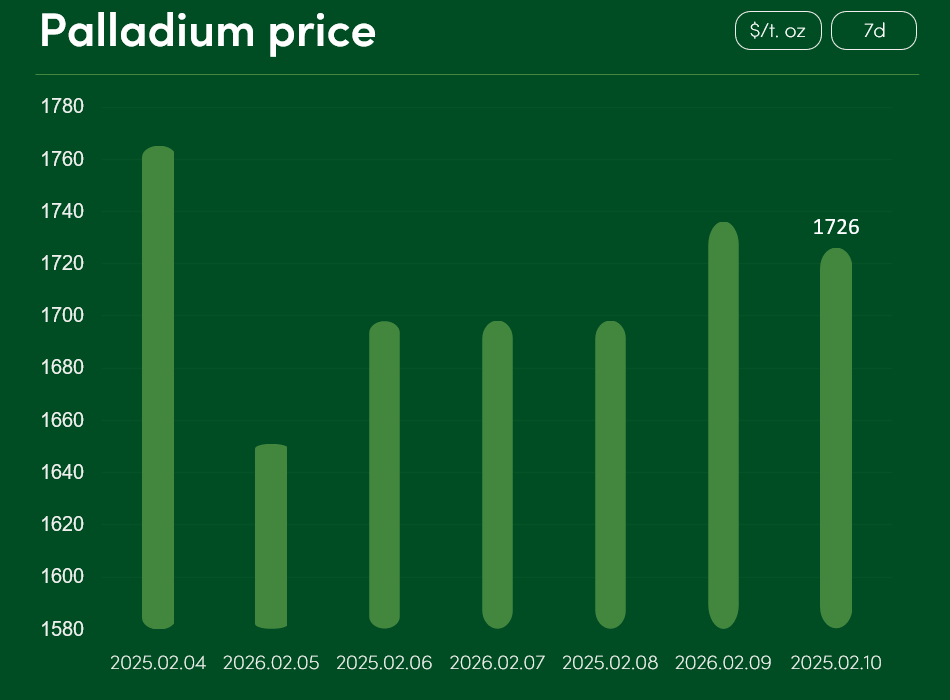

The global palladium price recorded only minor movements over the past week. On February 10, palladium reached USD 1,726 per troy ounce, while the average price for February stands at USD 1,746 per troy ounce.

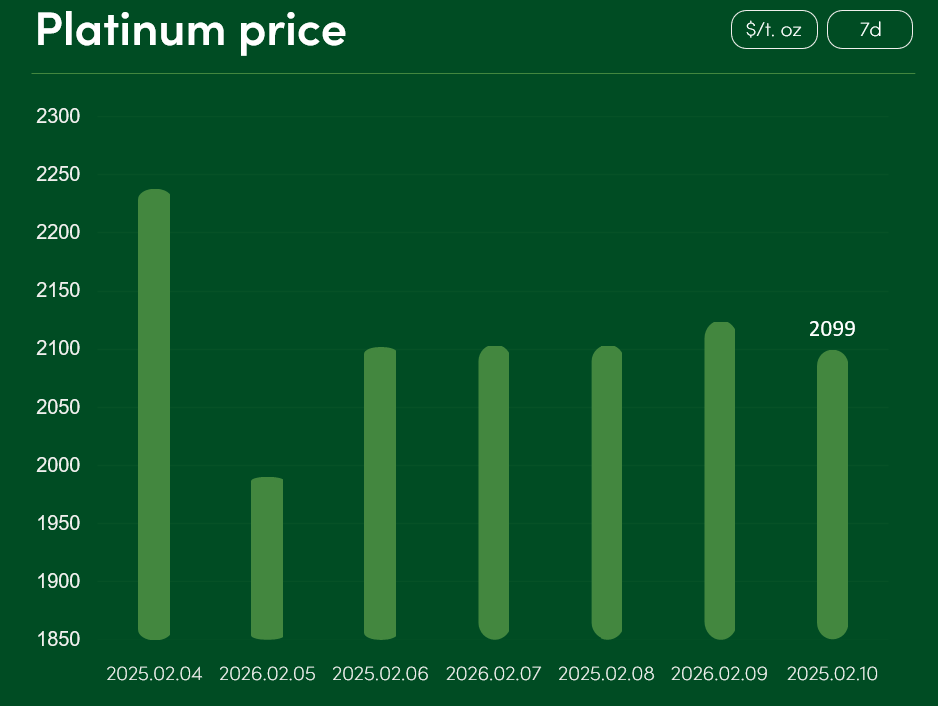

The global platinum price declined by more than 6% between February 4 and February 10, reaching USD 2,099 per troy ounce on February 10. The average platinum price in February stands at USD 2,144 per troy ounce.

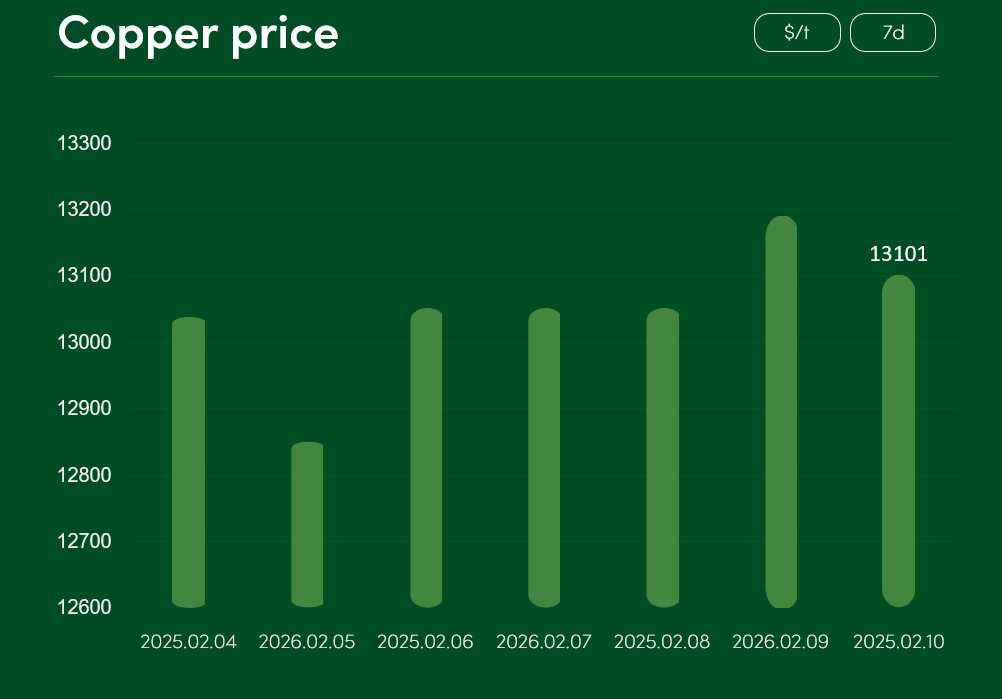

Meanwhile, global copper prices showed relatively minimal changes over the past week. On February 10, copper was trading at USD 13,101 per tonne.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.