December 9, 2025

Market Overview 03-12-2025 to 09-12-2025

A Period of Optimistic Expectations in Precious Metals Markets

Last week brought no shortage of optimistic news to the precious metals markets. The developments were related to new price records, anticipated favourable monetary policy decisions, and central banks’ investment strategies that support precious metals.

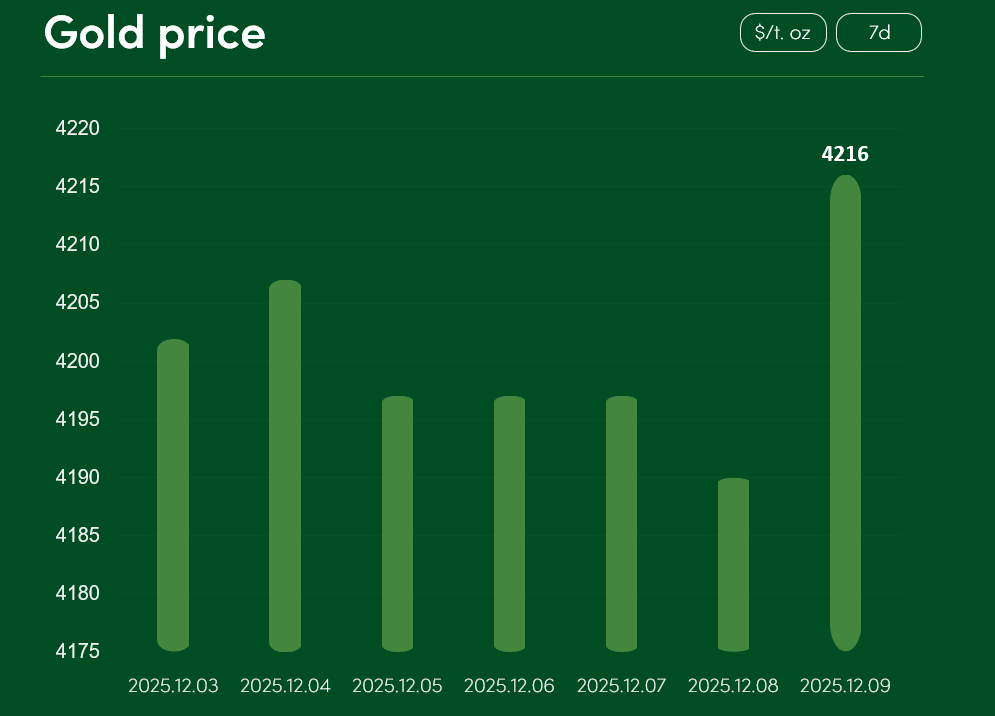

From December 3 to December 9, the global gold price experienced only minor fluctuations. On December 9, the price reached $4,216 per troy ounce.

Although gold prices have recently encountered corrections and periods of stagnation, optimistic sentiment in the gold market is significantly driven by central banks’ investment decisions.

Reports indicate that the People’s Bank of China, despite relatively high prices, added to its gold reserves for the 13th consecutive month this November. According to official data, the total amount of China’s central bank gold reserves reached 74.12 million troy ounces in November.

Other central banks worldwide are also optimistic about gold. It is reported that collectively in October alone, central banks added 65 tonnes to their gold reserves.

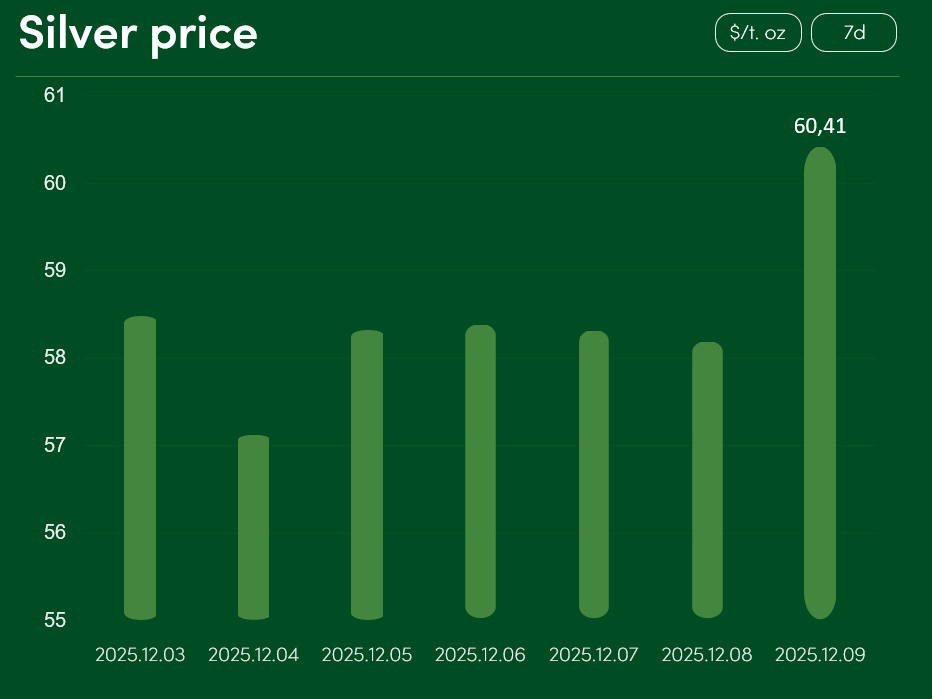

The global silver price recorded several new all-time highs over the past week. On December 9, silver reached $60.41 per troy ounce.

Recent silver price growth is supported by U.S. monetary policy and strong investment-industrial demand.

With markets pricing in an 89% probability of a Federal Reserve rate cut in December, such a decision would increase demand for precious metals denominated in U.S. dollars — including gold and silver — among foreign currency holders.

Record silver prices are also boosted by strong investment-industrial demand worldwide. As silver continues to hit new highs, the short-term demand level in exchange-traded funds has reached its highest point since July.

Rising demand in major global markets also contributes significantly to this trend. India imported about 60 million troy ounces of silver in October alone (four times more than in October last year). With demand increasing, the long-standing global silver supply deficit is expected to reach up to 200 million troy ounces this year alone.

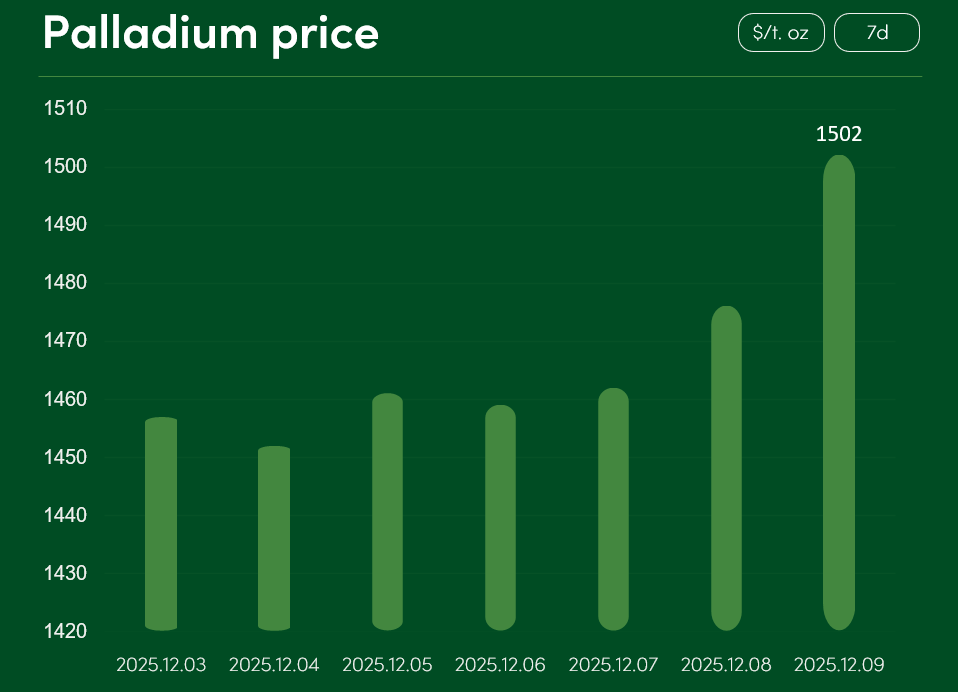

The global palladium price rose by approximately 3.1% from December 3 to December 9, reaching $1,502 per troy ounce.

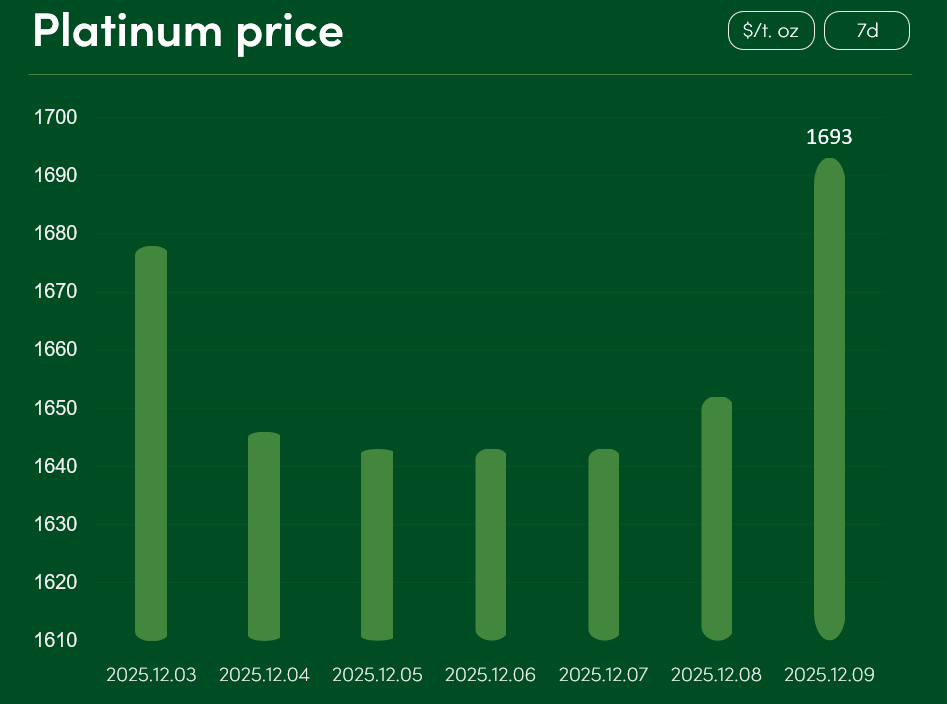

During the same period, the global platinum price experienced only minimal changes, reaching $1,693 per troy ounce on December 9.

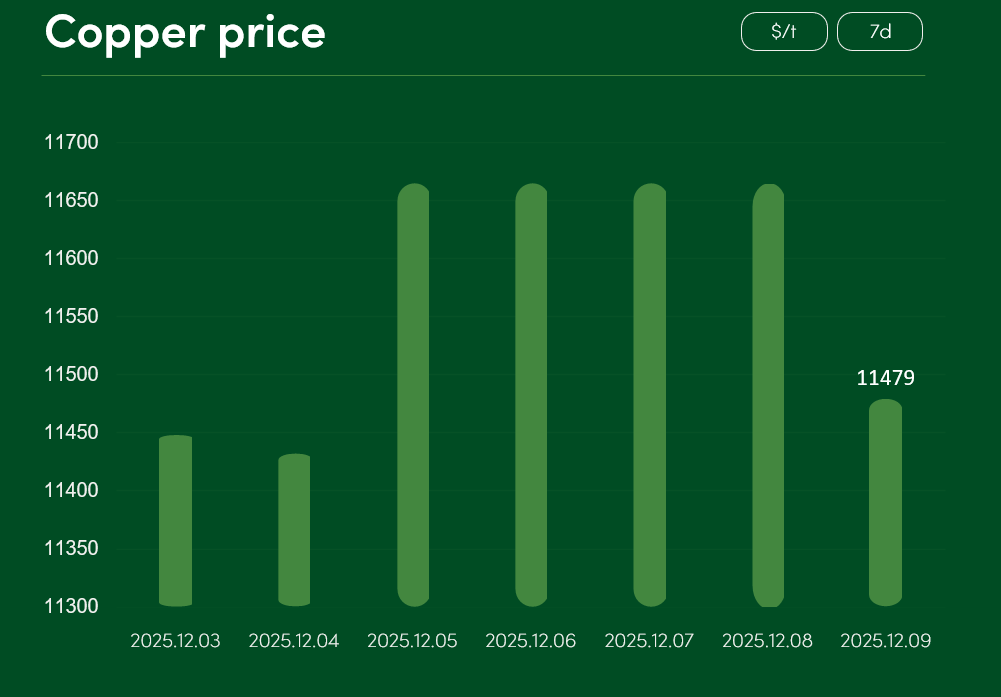

The global copper price also showed no significant movements from December 3 to December 9. On December 9, the price reached $11,479 per tonne.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.