September 9, 2025

Market Overview 03-09-2025 to 09-09-2025

Over the past week, most of the leading precious metals markets either extended their optimistic growth phase or consolidated at relatively high price levels. The recent surge in demand for precious metals has been driven both by growing expectations of an imminent US interest rate cut and a weakening dollar, as well as by political unrest in Europe and investment-friendly central bank decisions favouring precious metals.

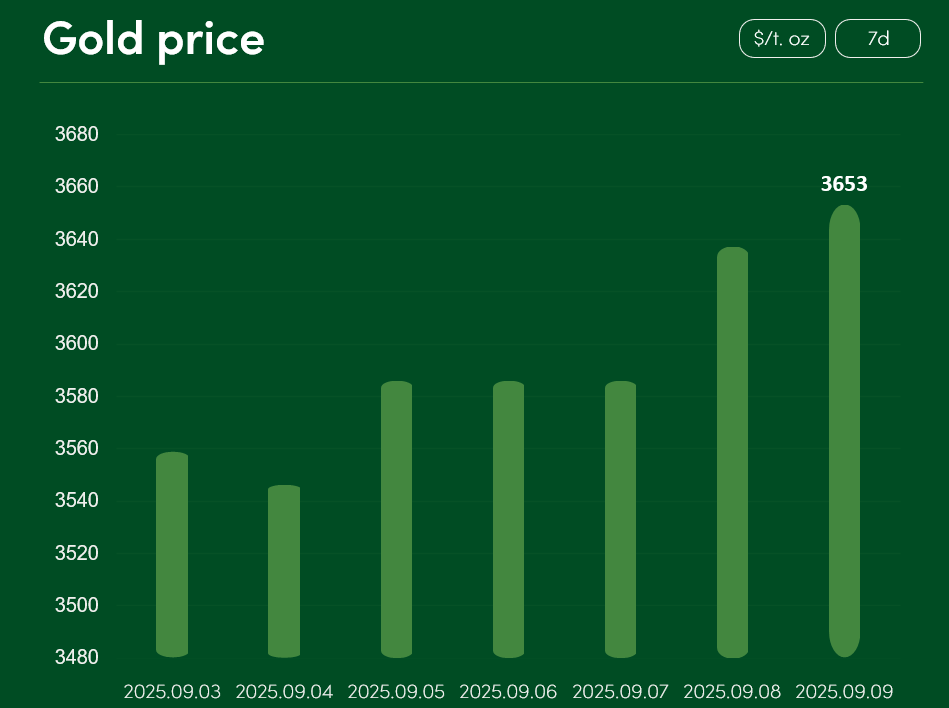

The global gold price rose by more than 2.6% between 3 and 9 September, reaching $3,653 per troy ounce.

Gold’s recent rally has been fuelled by favourable forecasts regarding US monetary policy. Markets currently imply an 88% probability that the Federal Reserve will cut rates by 25 basis points (0.25%) at its upcoming September meeting. There is also an almost 12% probability of a deeper 50-basis-point (0.5%) cut.

Strong confidence in a forthcoming rate cut stems both from supportive statements by members of the Fed Board and from US economic signals that encourage monetary easing. With the US labour market weakening further — only 22,000 new jobs were created in August (well below expectations of 76,500) — a rate cut is becoming an almost guaranteed market scenario. This has triggered a decline in the US dollar, which in turn supports foreign demand for dollar-denominated precious metals (gold, silver, etc.).

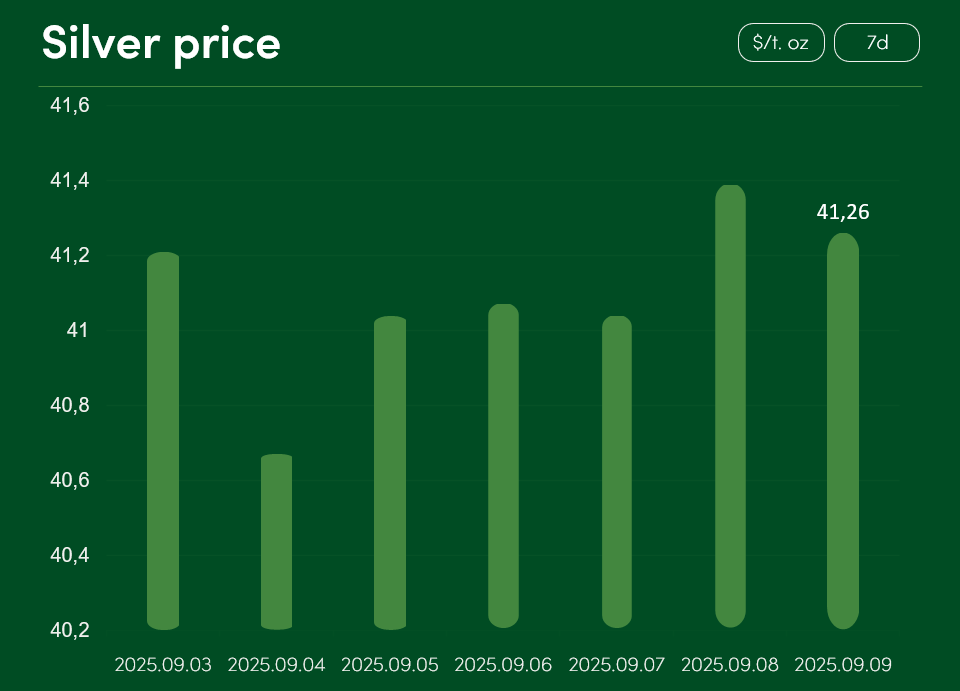

This year’s record-breaking silver price faced only minor fluctuations between 3 and 9 September. On 9 September, it stood at $41.26 per troy ounce.

Silver’s elevated price levels are currently supported both by anticipated shifts in US monetary policy and by investor caution in response to political turmoil in Europe. In France, the government collapsed after the Prime Minister lost a vote of confidence in parliament. Meanwhile in Germany, in the run-up to the 14 September local elections in North Rhine-Westphalia, as many as seven candidates from the AfD party died within a short period of time. This unprecedented scenario has sparked political debate and a wave of tension in the EU’s largest economy.

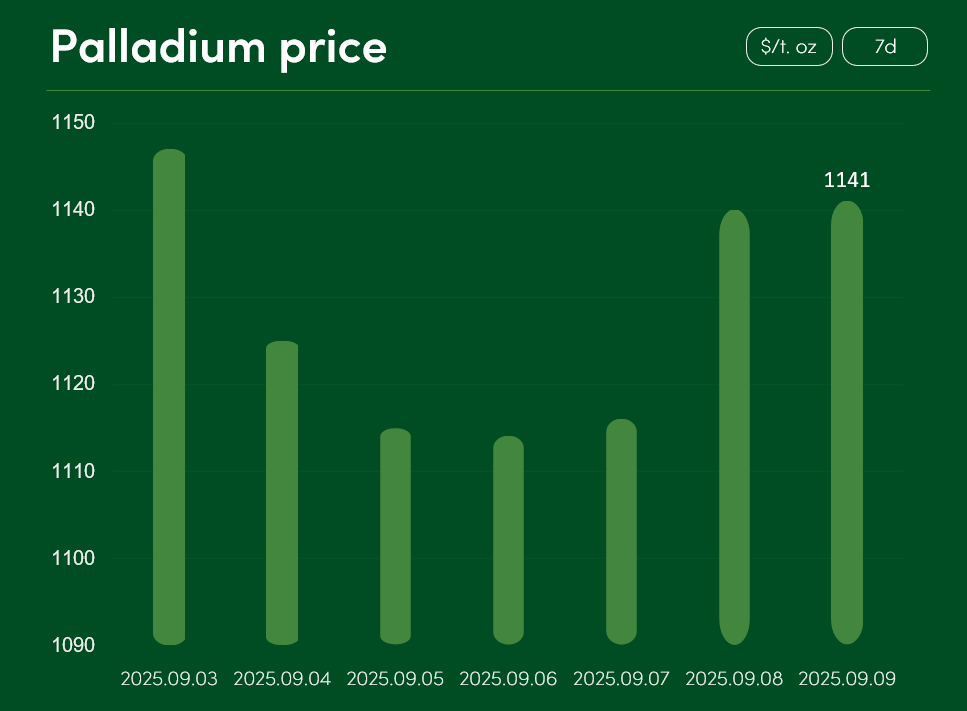

The global palladium price also experienced only minor movements between 3 and 9 September. On 9 September, it stood at $1,141 per troy ounce.

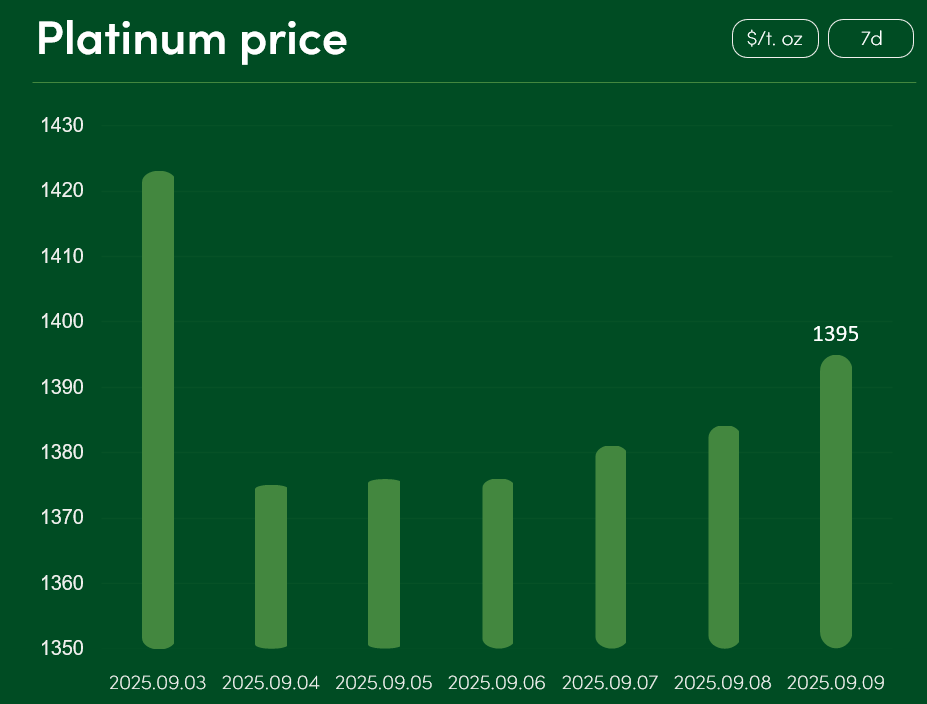

The platinum price, however, underwent a sharper correction over the same period. A partial rebound enabled this precious metal to reach a market price of $1,395 per troy ounce on 9 September.

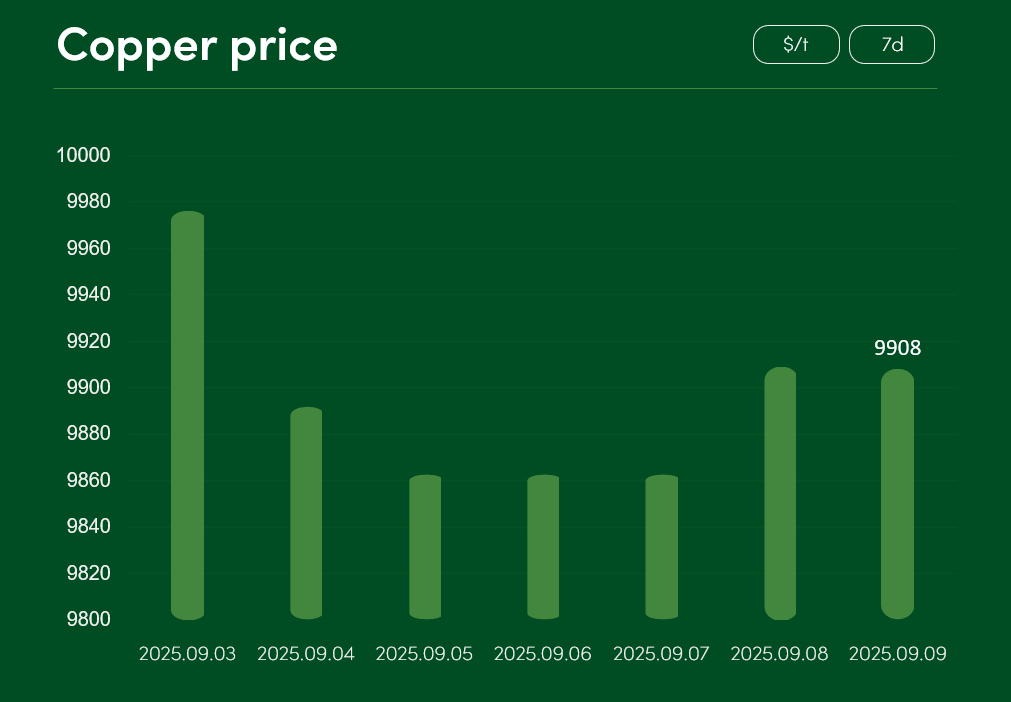

The global copper price fell by more than 0.6% between 3 and 9 September, reaching $9,908 per tonne on 9 September.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.