October 8, 2024

Market Overview 02-10-24 to 08-10-2024

Precious metals prices experienced a slight correction last week, prompting some investors to question their future growth prospects. On the one hand, the likelihood of further interest rate cuts in various markets and rising tensions in the Middle East are encouraging some analysts to continue to forecast promising periods of price increases in the near future. On the other hand, some central banks categorically refuse to buy certain precious metals at current market prices. Such news is leading some investors to think more carefully about whether the metals markets, which are setting new price records almost daily, really still have the potential to record profitable growth in the longer term.

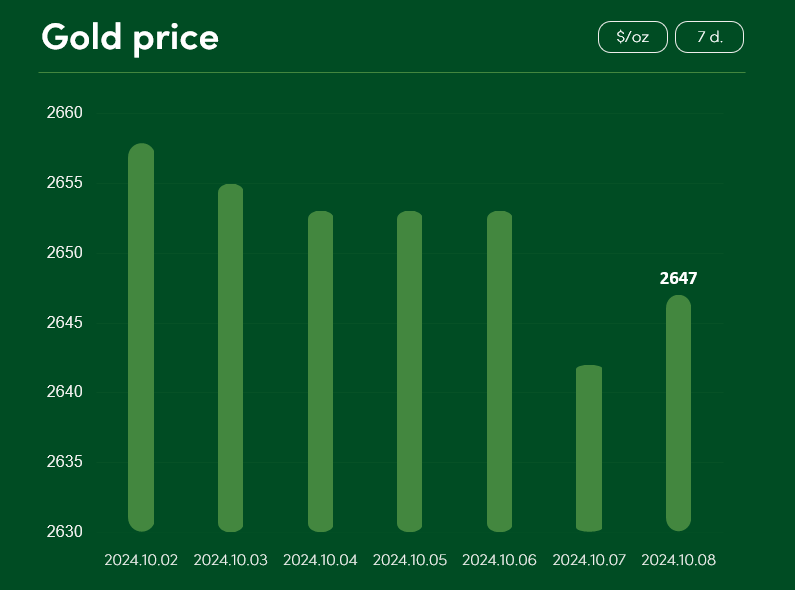

Gold prices have experienced a slight correction in recent days, with the precious metal falling by ~0.4% between 2 October and 8 October to $2,647/oz.

Although gold has been experiencing record periods of growth for some time, the growing tensions in the Middle East are likely to continue to fuel further injections of investment funds into this metal. According to the latest information from the BBC, the Israeli military is expanding its ground invasion in southern Lebanon, all while Hezbollah launched rocket attacks on the northern Israeli port city of Haifa on 7 October.

However, while the small investors are becoming more and more optimistic about the rise in gold prices in the face of geopolitical crises, the central banks of some of the most influential countries are hesitant to buy gold at current price range. China is one of those sceptical pessimists. According to TradingEconomics, China’s central bank has refrained from making any additions to its gold reserves for the fifth consecutive month.

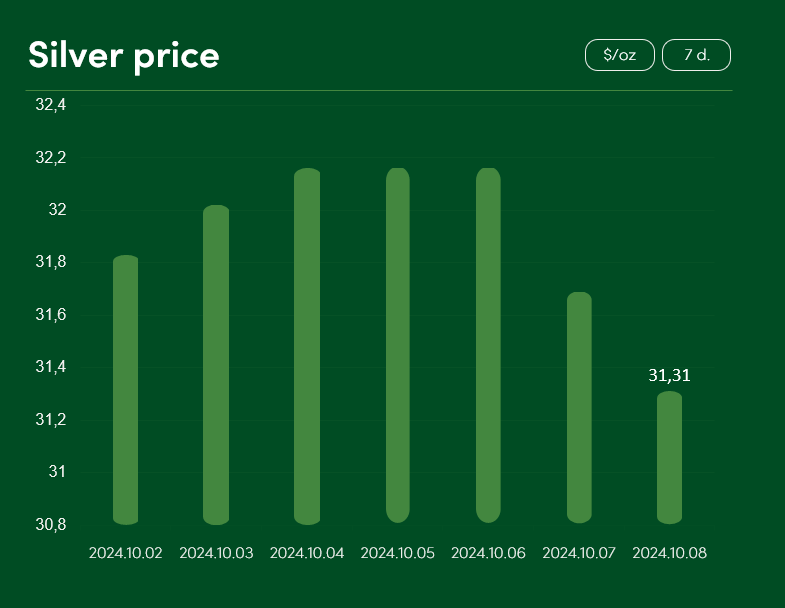

Silver prices also recorded a slight decline last week. From 2 October to 8 October, silver prices on the international market fell by ~1.5% to $31.31/oz.

Despite the short-term price decline, the long-term outlook for silver prices does not appear to be facing serious challenges. Rising gold prices are helping to boost silver market capitalisation, while the easing monetary policy of China (one of the major silver users) is also contributing to the growth of industrial demand for the metal.

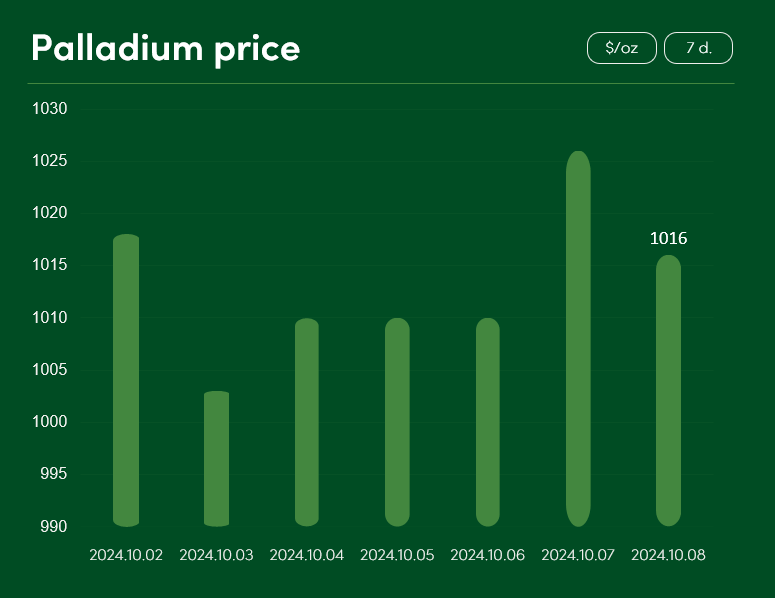

Palladium prices remained almost unchanged last week, with a correction of ~$2/oz between 2 October and 8 October, which can be interpreted as a temporary consolidation at the $1016/oz price point.

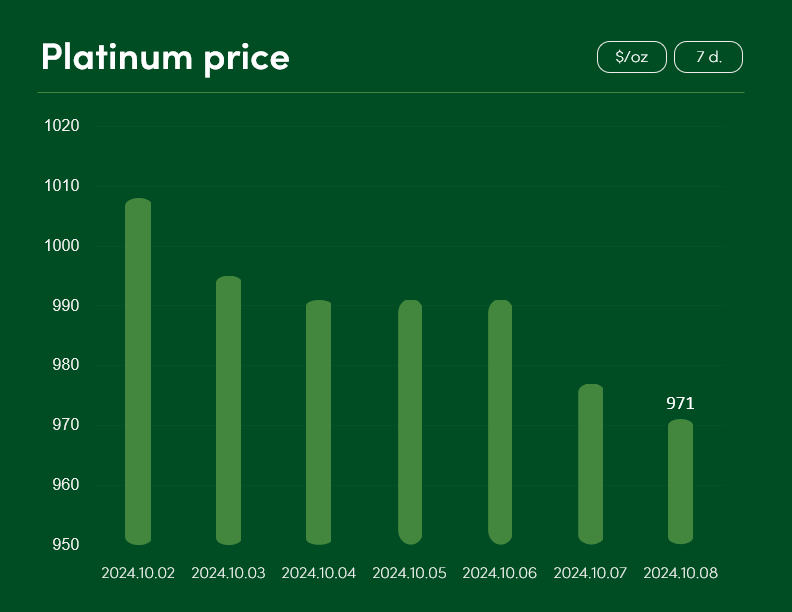

Platinum prices experienced a more significant correction between 2 and 8 October, with the precious metal recording a fall from 1008 $/oz price point to 971 $/oz over the last 7 days.

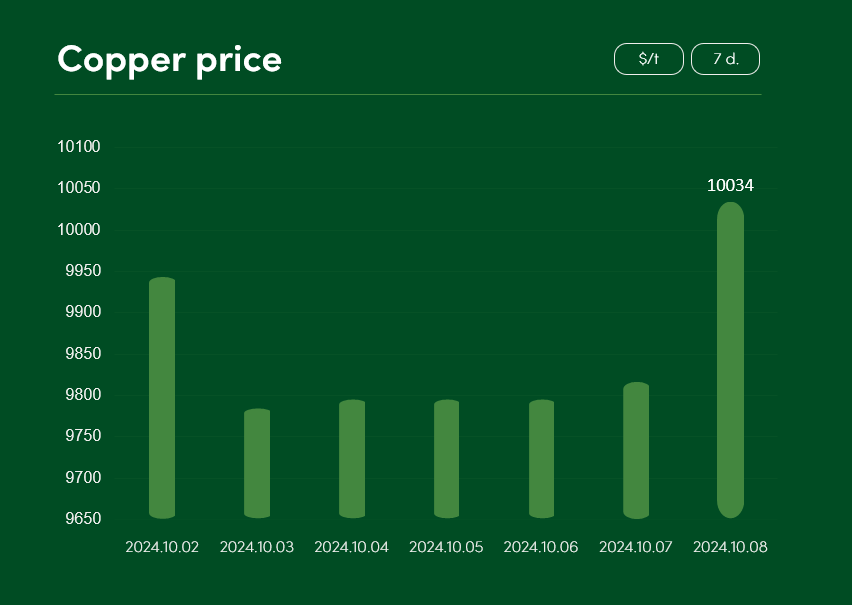

Semi-precious copper metal market prices overcame a slight correction in the first half of the week to end the period of 2 October – 8 October with a gain of ~0.9% and a market price of 10034 $/t.

The correction in early October copper prices may have been driven by factors such as weaker expectations of future interest rate cuts in the US. After a 50-basis point (0.5%) rate cut at the end of September, most analysts on the US market expect a more moderate 0.25% (25-basis point) FED’s rate cut in November.

On the other hand, China’s decisions to cut bank interest rates and to ease the banks’ reserve fund requirements are working in favour of copper demand and price growth. According to TradingEconomics experts, copper market enthusiasts are now even more hopeful about China, the main consumer of the metal: further decisions in favour of the copper metal and the Chinese industry are now expected from the fiscal policies of the Chinese government.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.