July 8, 2025

Market Overview 02-07-2025 to 08-07-2025

Last week, price movements in precious metals markets were driven both by the news of the U.S. domestic economy and by new, relatively strict decisions in the international trade sector. The declining probability of U.S. interest rate cuts presents additional challenges to the continued rise in precious metals prices. Ongoing instability in global trade continues to contribute to supply–demand tensions in the industrial metals market.

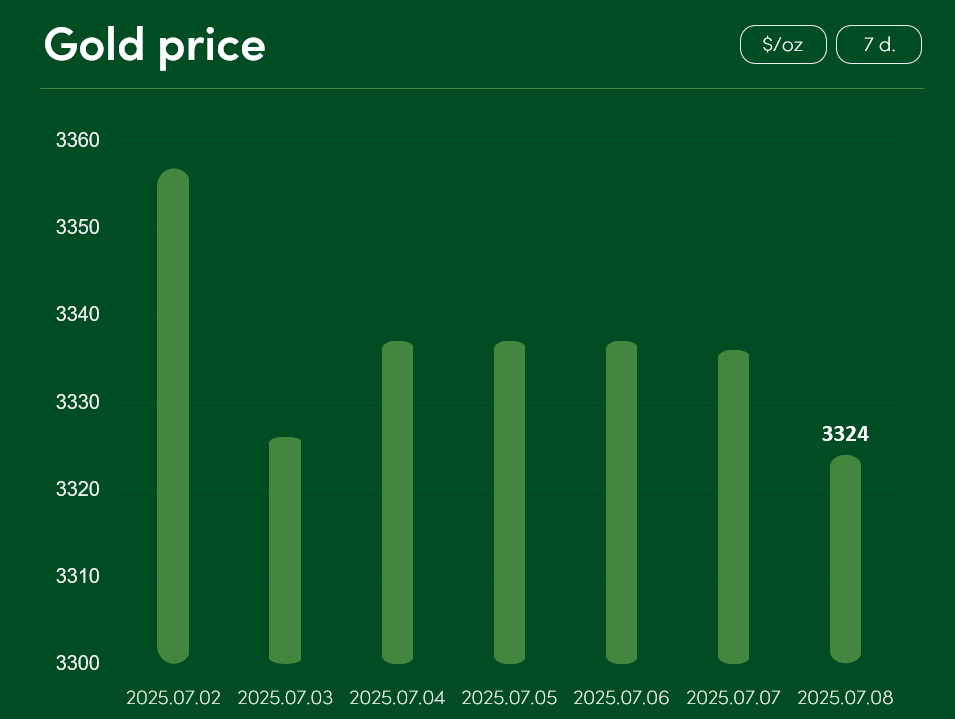

Between July 2 and July 8, the global gold price experienced a ~1% correction, reaching $3,324/oz on July 8.

Gold price growth in recent weeks has been hindered not only by already high current valuations but also by the uncertain state of international trade. On Monday, U.S. President Donald Trump decided to extend the delay in implementing aggressive international trade tariffs until August 1. However, this decision was accompanied by another announcement: if trade agreements won’t be reached, 14 U.S. trade partners will face the imposition of new (or postponed) tariffs starting in August.

Investors interpret this news ambivalently: while the risk of further economic conflicts partly supports demand for precious metals, the delay in tariffs and the real possibility of peaceful trade agreements reduce confidence in the sustained growth of gold, silver, and other precious metal prices.

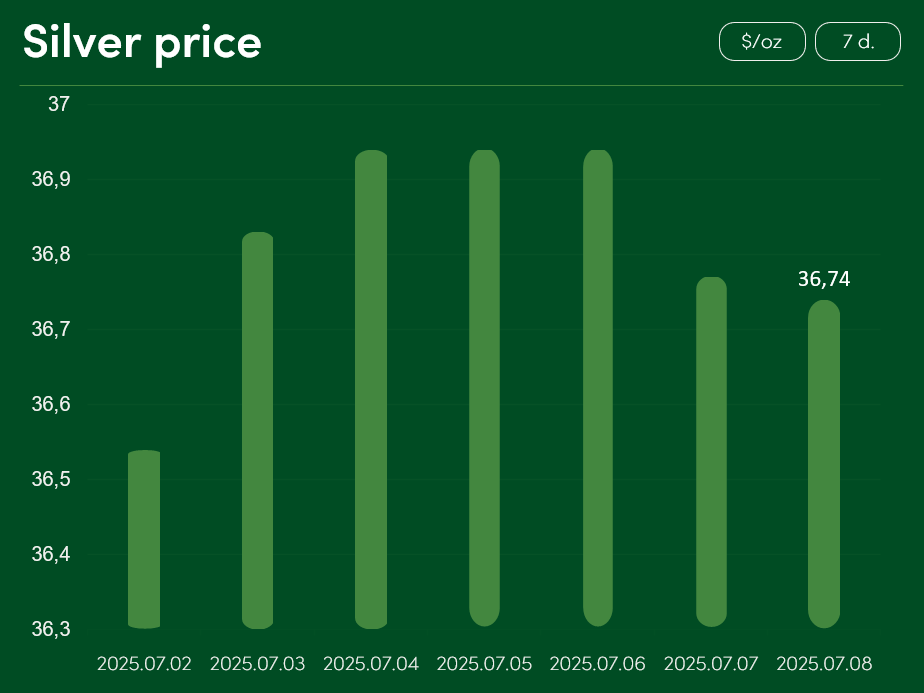

The global silver price remained relatively stable between July 2 and July 8, reaching $36.74/oz on July 8.

June (versus a forecast of 117,500), while the national unemployment rate fell to 4.1%. This result significantly reduced the probability of a Federal Reserve interest rate cut and weakened the growth outlook for precious metals denominated in U.S. dollars, including gold and silver.

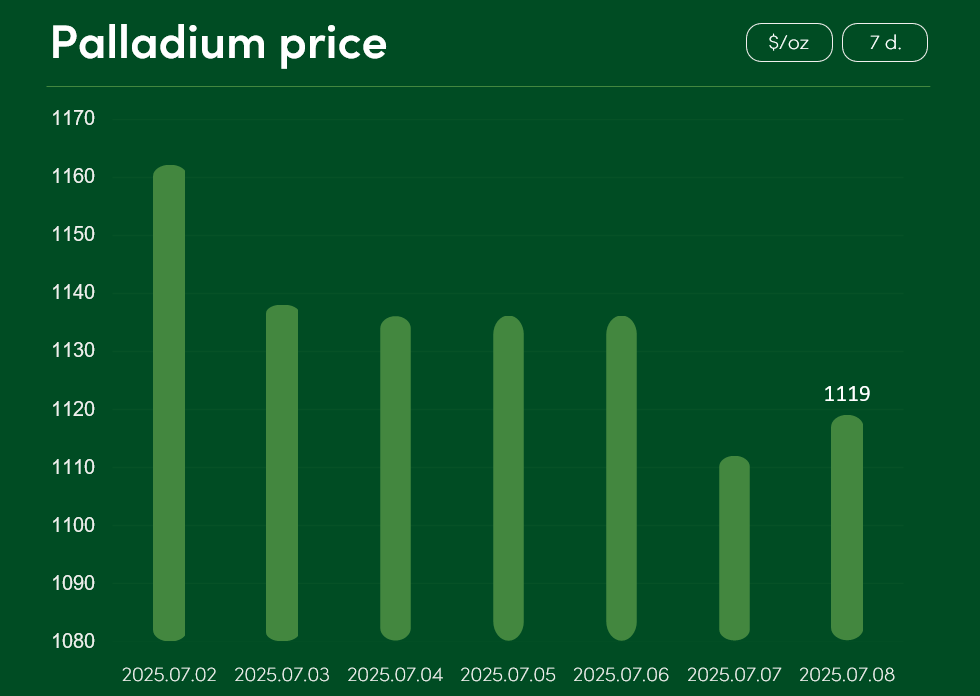

The global palladium price fell by ~3.7% between July 2 and July 8, reaching $1,119/oz on July 8.

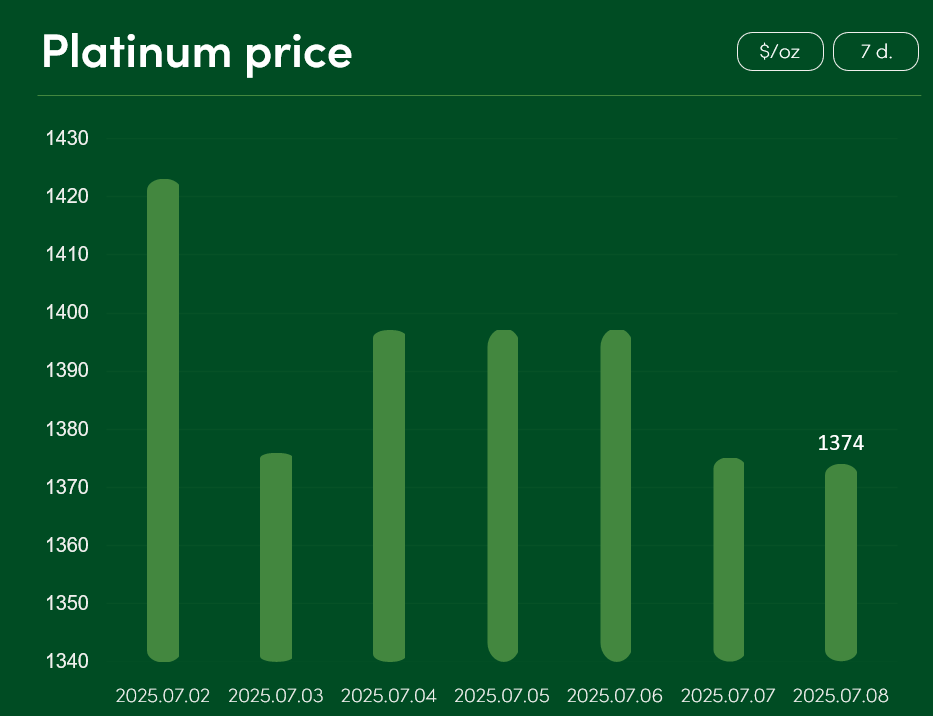

The global platinum price declined by ~3.4% during the same period, reaching $1,374/oz on July 8.

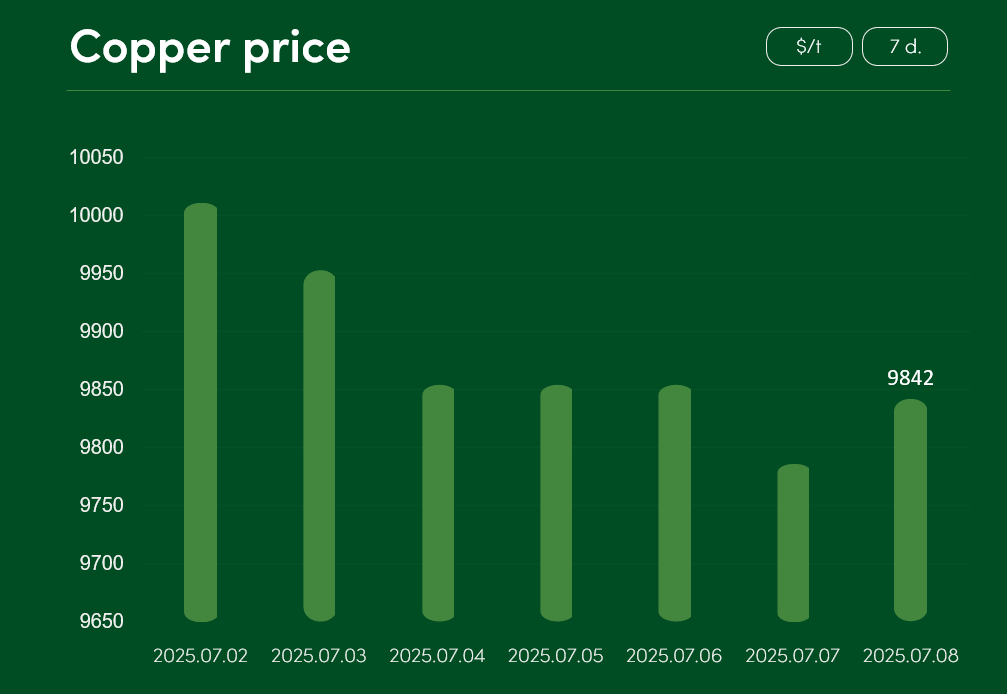

The global copper price dropped by ~1.68% between July 2 and July 8, reaching $9,842/t on July 8.

The latest correction in copper prices is partly attributable to rising tensions in international trade rhetoric. Although the U.S. extended the tariff implementation deadline until August 1, President Trump also threatened to impose an additional 10% import tariff on all countries that support the “anti-American BRICS policy.” Analysts are concerned that the expansion of aggressive trade policies may hinder global economic growth and reduce demand for industrial metals, including copper.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.