April 8, 2025

Market Overview 02-04-2025 to 08-04-2025

The price movements that rocked the precious metals markets last week were mainly due to aggressive US trade policy decisions and the resulting turmoil on stock and currency exchanges. With investors anxiously assessing the rapidly changing global trading landscape, even the safest precious metals – gold and silver – no longer look like a particularly safe and promising investment.

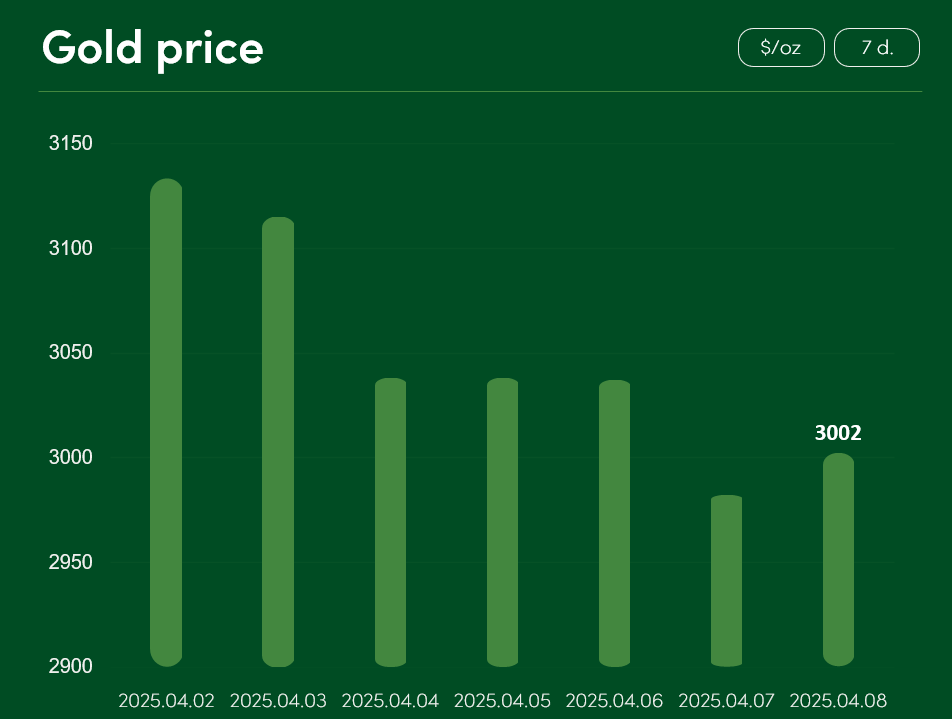

The global gold price experienced a ~4.2% correction between 2 April and 8 April, reaching $3002/oz on 8 April.

The strongest contributor to the sharp correction in gold prices was the escalation of the global trade conflict initiated by the USA. Last week, US President Trump announced global import tariffs of varying levels on all US trading partners. A 20% tariff was imposed on goods imported into the US from the European Union, while the tariffs already imposed on China were complemented by a new import tax of 34% on goods entering the US.

US trading partners such as China have been quick to impose retaliatory trade tariffs. However, although the United States stock market recorded its biggest correction since the Covid pandemic crisis, so far, the precious metals are not performing well as a safe haven asset for investors. Part of the reason for the record high decline in precious metals was fear and uncertainty about changes in the consumption of goods and services in the global market.

Rising import tariffs of the US are also likely to boost country’s domestic growth. Such an outcome would contribute to the appreciation of the dollar and, in turn, increase the investment costs of precious metals and reduce their investment attractiveness to those buyers who purchase gold, silver and other dollar-denominated commodities using their own, local currencies.

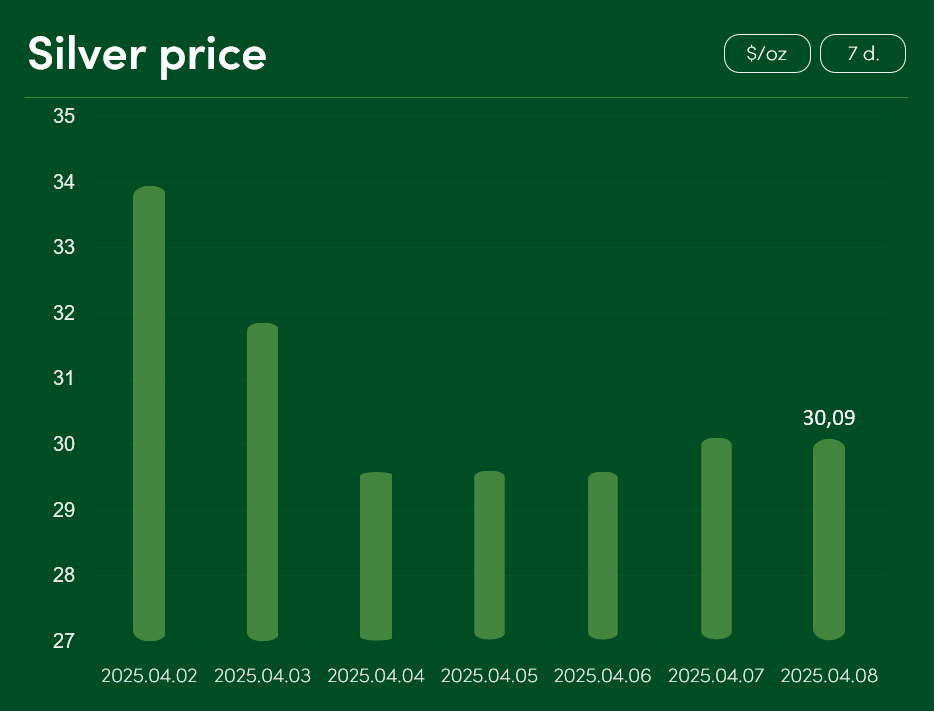

The silver market price experienced an even more challenging period from 2 to 8 April. A correction of ~11.35% was recorded, bringing the metal back into the $30/oz. price range.

The fall in silver prices was also due to the aforementioned extraordinary import policy decisions in the US. Even after the adoption of exceptionally high import tariffs, Trump continues to threaten China, which has adopted retaliatory tariffs, with additional import taxes of 50%. Meanwhile, US Treasury Secretary Scott Bessent has reported that almost 70 US trading partners have already contacted the White House for import tariff relief. However, with uncertain market sentiment on the future of global import-export decisions, the global trade crisis is also taking its toll on the precious metals sector.

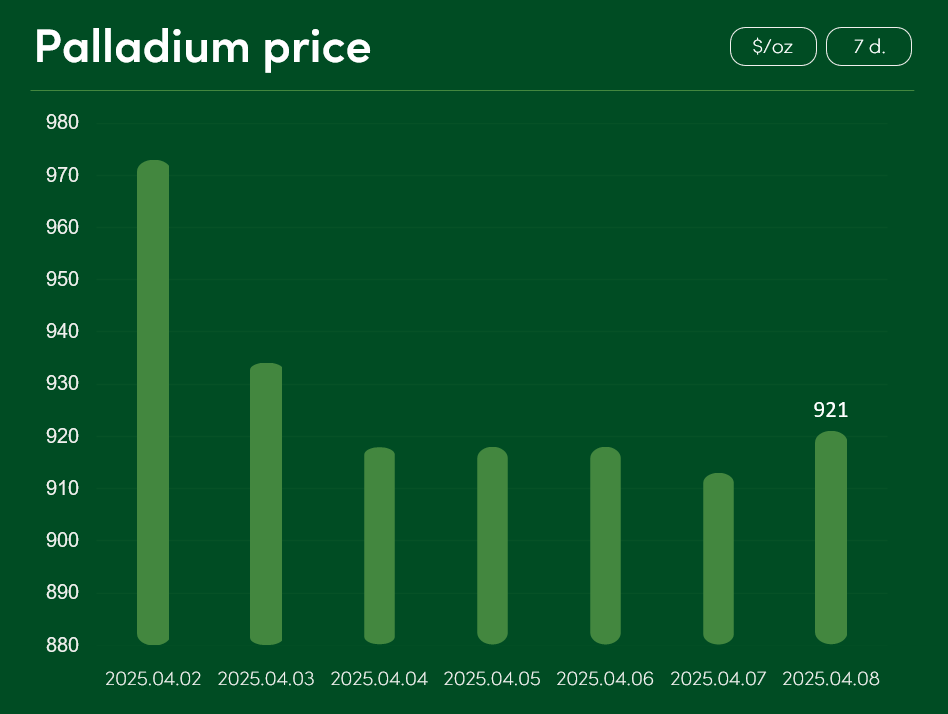

The market price of palladium dropped by ~5.3% between 2 and 8 April to reach $921/oz.

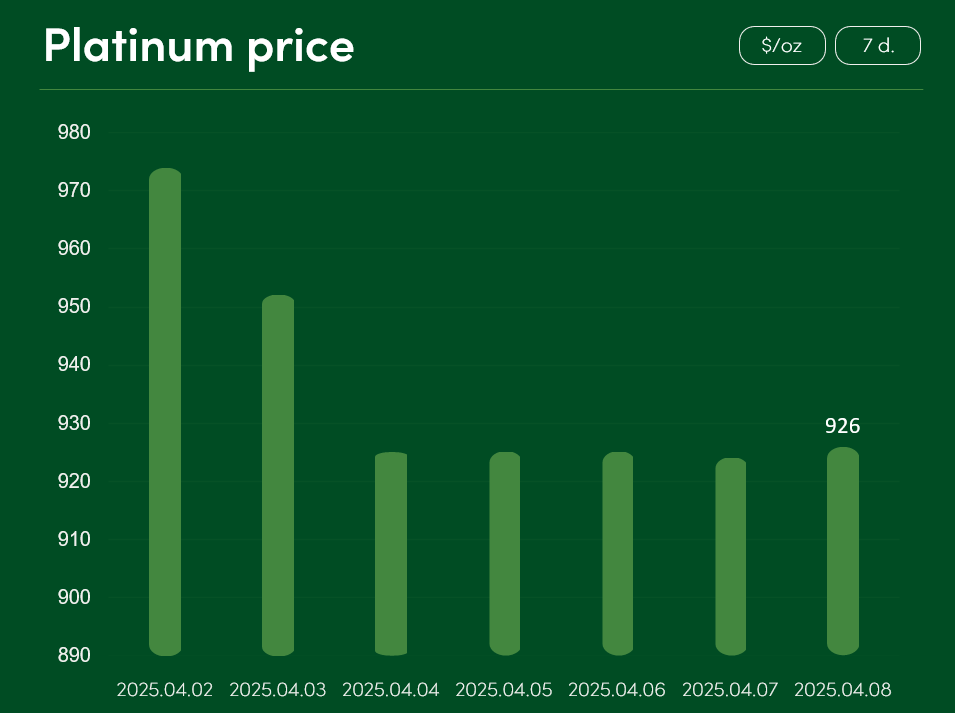

The global platinum price fell by ~4.9% between 2 April and 8 April to $926/oz.

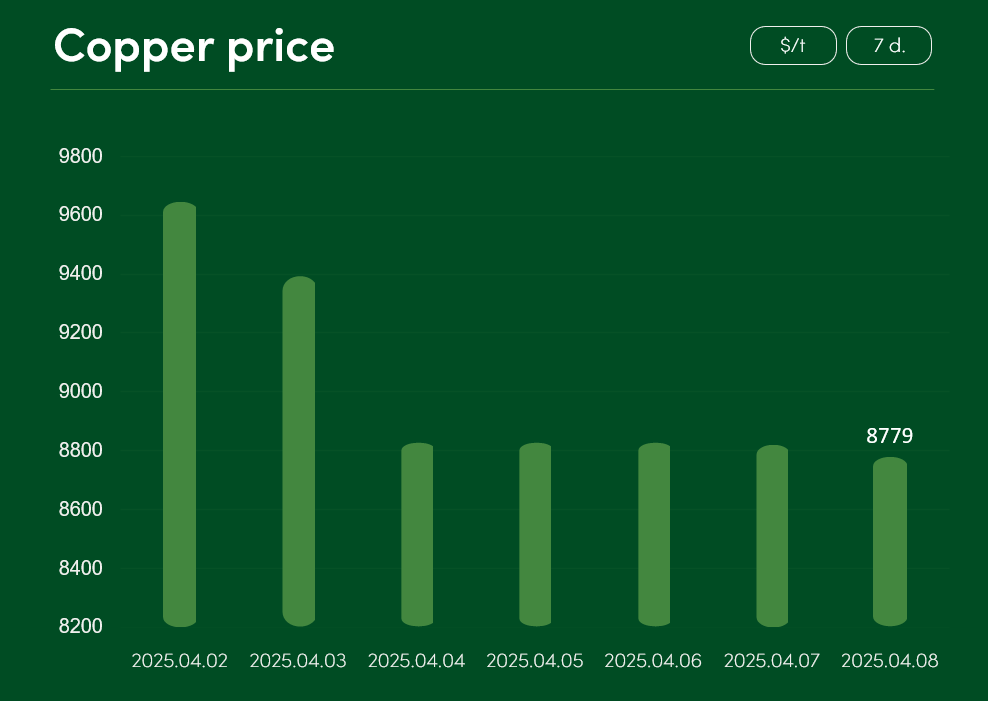

The global copper market price decreased by ~9% between 2 and 8 April to $8779/t.

Although the progressing trade war between China and the US will undoubtedly undermine the stability of copper prices in the short term, most investors have underestimated one significant import-export nuance of this industrial metal.

Following the US announcement of global import tariffs on all trading partners, copper metal was named in a special White House executive order among the products that will be exempt from the latest import tariffs. In the long term, this decision is likely to help to partially avoid copper price speculation linked to trade conflicts and contribute to further growth in copper demand in the US market.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.