October 7, 2025

Market Overview 01-10-2025 to 07-10-2025

Last week, the key precious metals markets continued their price rally, surpassing the previous records recorded at the end of September. Investors’ confidence in precious metals has recently been fuelled by political unrest in France and the United States, the steady purchases of precious metals by central banks, and the US monetary policy favourable to the growth of the precious metals market.

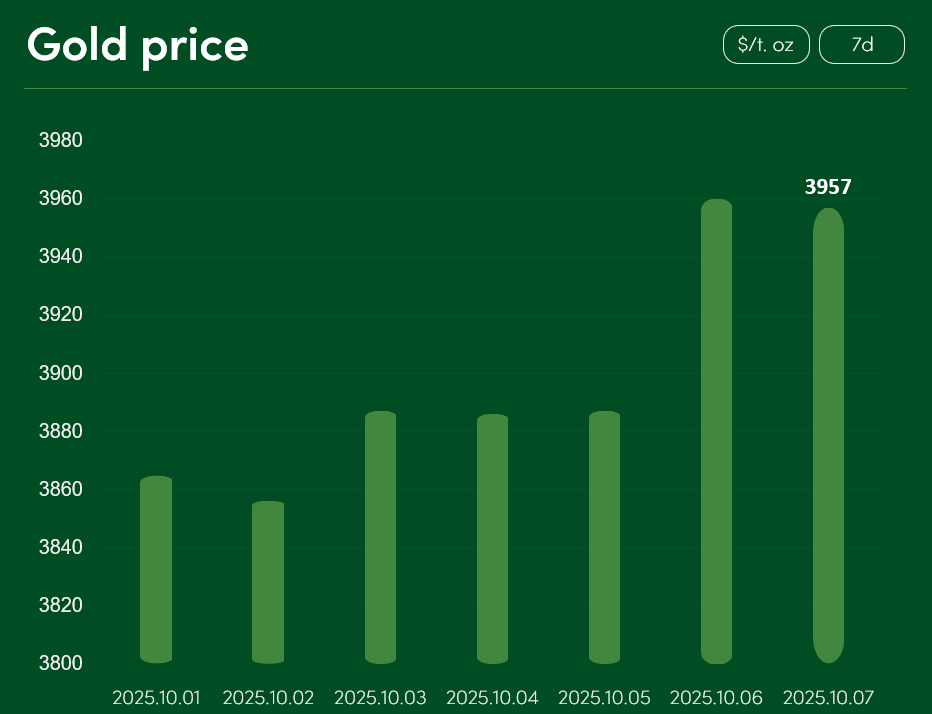

Between 1 and 7 October, the global gold price rose by more than 2.2%, reaching $3,957 per troy ounce.

The new all-time highs for gold were driven by the rising probability of further US interest rate cuts. After the Federal Reserve reduced its benchmark rate by 25 basis points (0.25%) at the end of October, market-based futures analysis indicated a 79% probability of another 50-basis point (0.5%) cut in December.

Gold prices are supported not only by the US monetary policy encouraging consumption and domestic growth. Reports indicate that China’s central bank increased its gold reserves for the 11th consecutive month in September. Given record-high gold prices, investors may interpret this decision by the Chinese government as a signal for a potential further rise in the price of the metal.

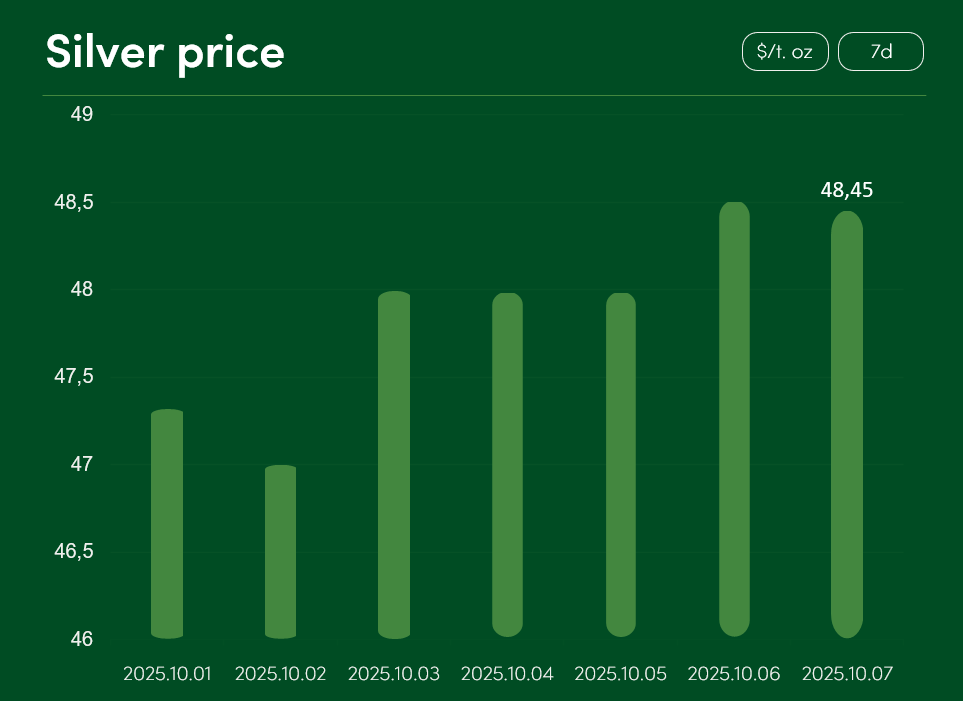

Between 1 and 7 October, the global silver price rose by more than 2.3%, reaching $48.45 per troy ounce.

The recent rise in silver prices has been influenced not only by US monetary policy decisions. With the US government shutdown continuing, France is also facing a more pronounced political crisis. Following the resignation of the French Prime Minister, who served less than a month, the government again faces an early collapse and possible snap elections. Investors are responding to the political chaos in both the US and France by actively increasing their holdings of precious metals.

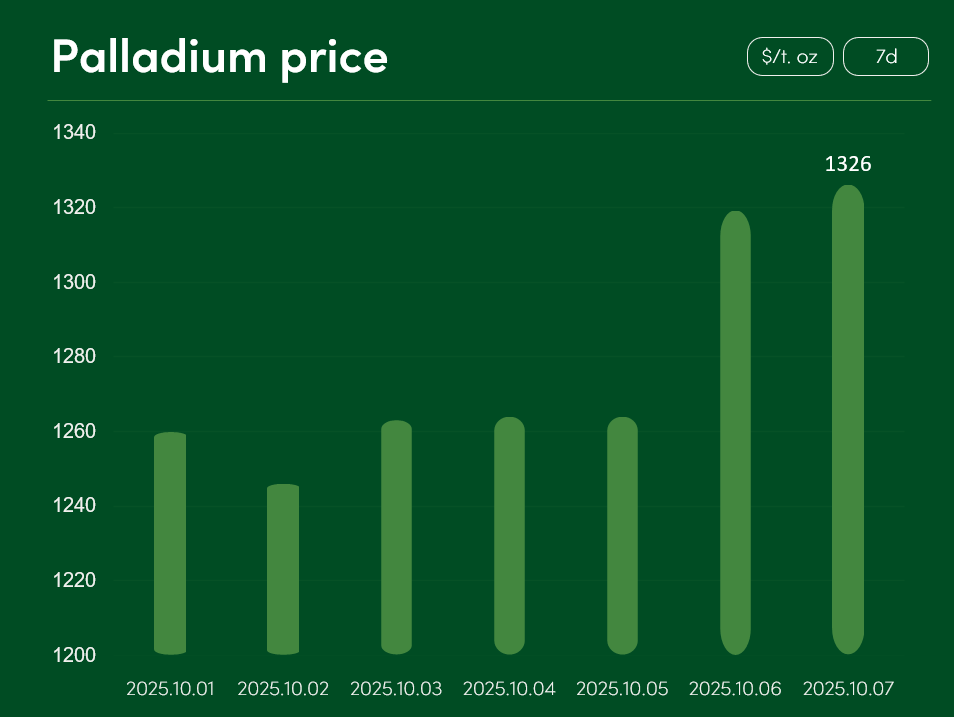

Between 1 and 7 October, the global palladium price rose by more than 5%, reaching $1,326 per troy ounce.

The recent rise in palladium prices has been driven not only by demand for safe-haven assets but also by a favourable market outlook for the metal. The World Platinum Investment Council (WPIC) forecasts that global palladium supply will decline by an average of 1.1% per year through 2029. It is also noteworthy that China has established new financial infrastructure enabling it to act as a precious metals’ custodian for foreign markets — a move likely to further strengthen global demand for palladium.

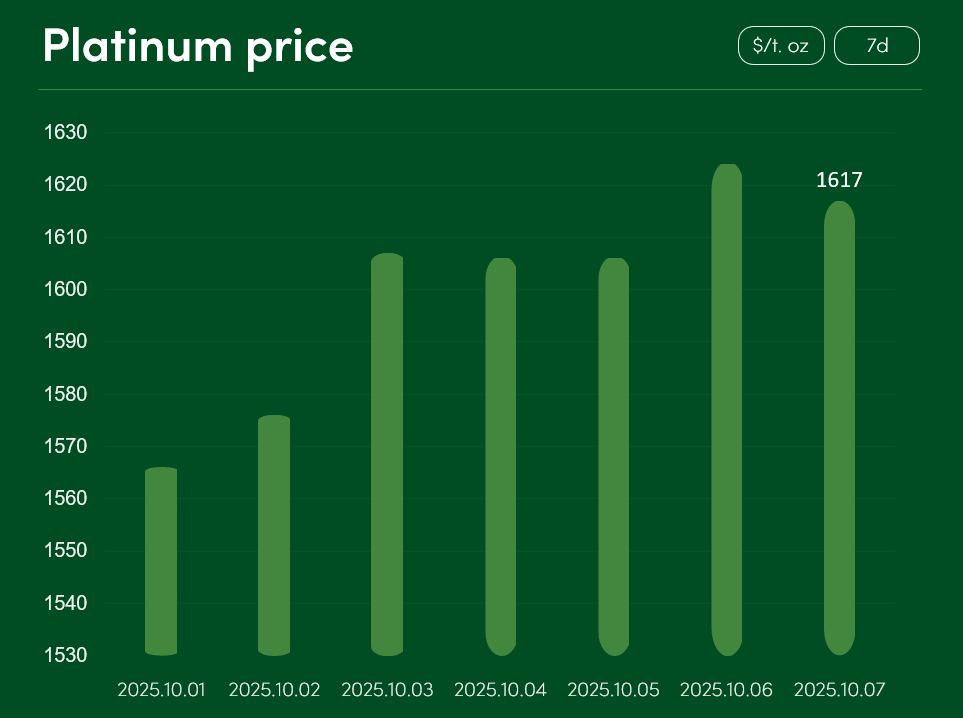

Between 1 and 7 October, the global platinum price rose by more than 3.2%, reaching $1,617 per troy ounce.

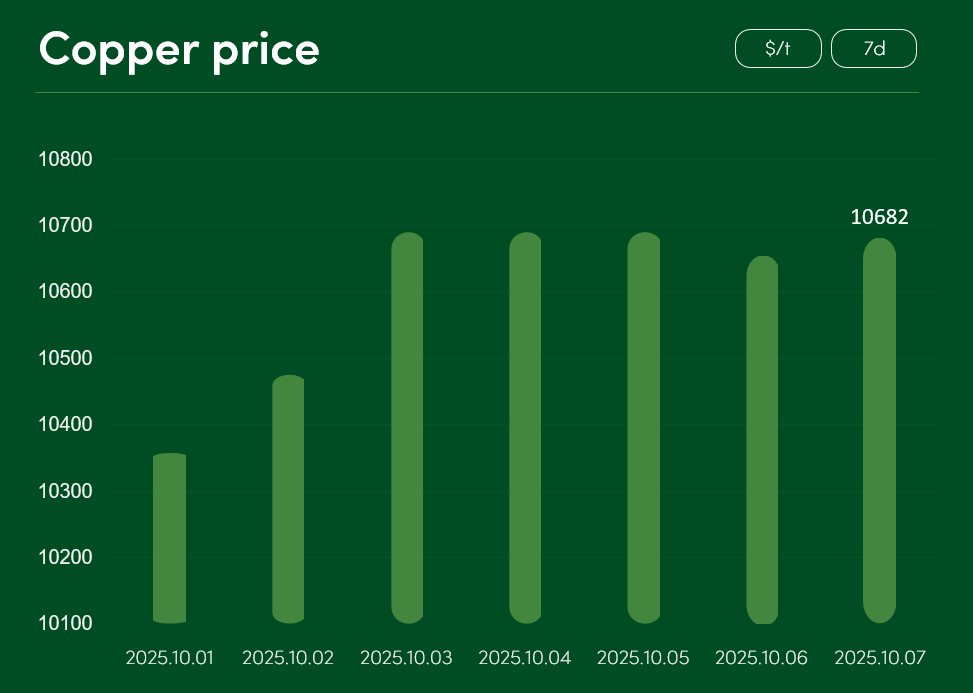

During the same period, the global copper price rose by more than 3%, reaching $10,682 per tonne.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.