January 14, 2025

Market Overview 08-01-2025 to 14-01-2025

Precious metals faced very different price movements last week. The difficult-to-predict market price dynamics were primarily attributed to the unexpected economic update in the United States, as well as to the positive monetary policy decisions and the rising consumption figures in the Chinese market.

The global gold spot price rose by <0.5% between 8 January and 14 January, reaching $2,673/oz.

The moderate gold price dynamics in mid-January is due to the expectant mood on the markets: investors are looking forward to the official inauguration of US President Trump on 20 January. There is a real possibility that if, during Trump’s second term, the US imposes his proposed tariffs on China and other countries, this could escalate new trade conflicts and push gold prices higher due to investors’ desire to protect their money against inflation.

The silver exchange price went through a period of slight growth from 8 January to 14 January, which was overshadowed by the correction of 13 January. This contributed to the silver market price recording an overall decline of 0.8% over the last 7 days, reaching a price of $29.86/oz on 14 January.

The radical change in silver price dynamics and the correction of January 13th seem to have been caused by unexpected results in the US labour market. TheGuardian reports that the world’s largest economy surprised investors when it was announced last Friday that 256 000 new jobs wiere be created in the US in December 2024 (the highest number in the last 9 months).

While the latter figure is positive for the US economy itself, analysts are also aware that the latest data reduces the likelihood of further US interest rate cuts. Maintenance of higher domestic US interest rates would simultaneously help to maintain stronger dollar course and weaken international demand for a range of key commodities (including silver) that are globally traded in dollars. The reason is simple: buyers who exchange local currencies for dollars for their commodity purchases would suffer much higher than usual conversion losses due to the strength of the latter currency.

The global palladium exchange price rose by ~2% between 8 January and 14 January to a point of $950/oz.

In contrast, the platinum price recorded a slight correction between 8 January and 14 January, reaching $951/oz.

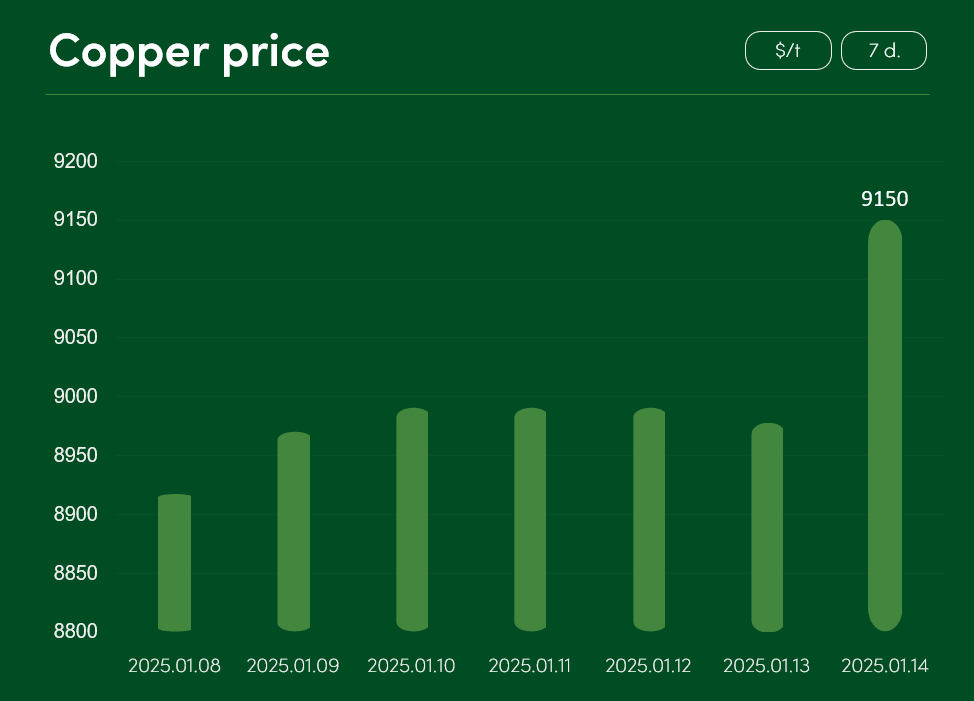

Copper metal appreciated by >2.5% over the last 7 days to reach 9150 $/t.

Copper prices are strongly supported by favourable news from China and signs of country’s recovery at the beginning of the year. Initially, investors were optimistic about the comments of the Chinese Central Bank on its planned interest rate cuts this year. And, during the last week, China’s recovering trade figures have been received as additional positive news.

Analysts at TradingEconomics report that China, the largest copper user, recorded an 18% increase in unwrought copper product imports in December 2024, reaching a total of 559,000 tonnes. This 13-month high in copper imports suggests heightened demand from Chinese copper smelters, potentially signaling an increase in industrial production of China, which is generally viewed positively by investors.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.