January 7, 2025

Market Overview 01-01-2025 to 07-01-2025

During the first week of the year, the precious metal market recorded a period of price increase. It was partly related to the resounding political-economic pronouncements of the world’s most powerful governments and to investors’ uncertainty about the future of economic policy decisions in countries such as the United States.

The global gold price rose by ~1% between 1 January and 7 January to $2649/oz.

Gold, which has been struggling with a more pronounced price correction since the end last year’s autumn, recorded a slight price increase this week after US President-elect Trump soundly denied a report by the Washington Post commentators, which stated that the new President’s team was planning to soften its import tariff policy plan and to concentrate on taxing imported goods from only certain strategic sectors. The continued tough political rhetoric in the US and the uncertainty about the future of country’s trade policy are encouraging further inflows of investing capital into the precious metals sector.

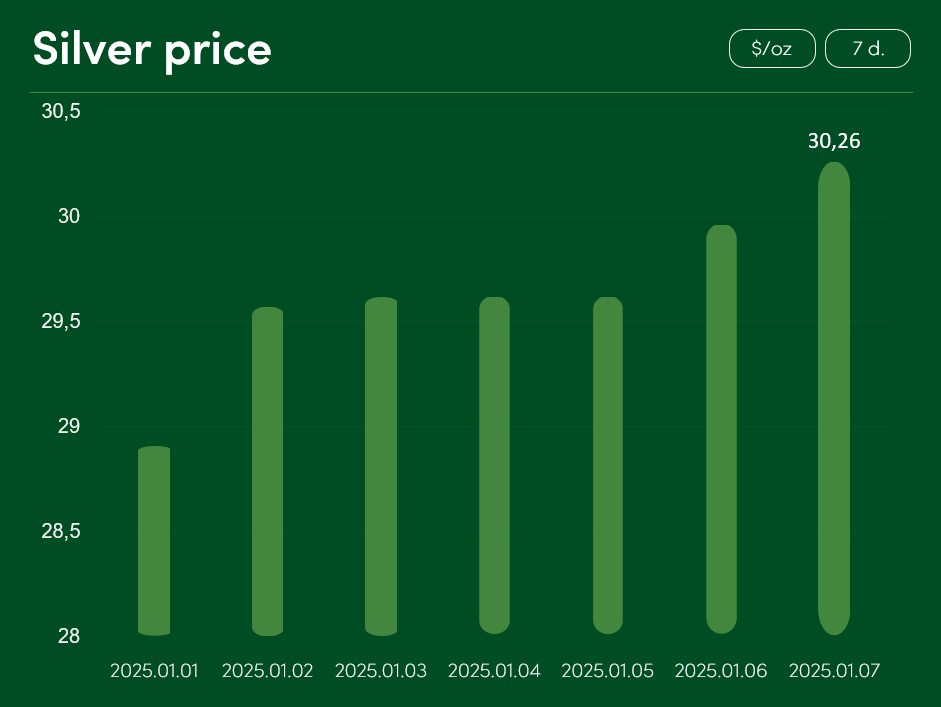

The global silver price recorded an increase of ~4.5% last week and reached $30.26/oz on 7 January.

The success of the second most popular precious metal at the beginning of January is not only due to the economic uncertainty in the US ahead of the inauguration of the new President of the United States, but also due to the favourable news from the Chinese market. China is the world’s largest user of silver. Therefore, silver investors happily welcomed new comments from country’s Central Bank, which hinted at a move to cut back local interest rates in 2025.

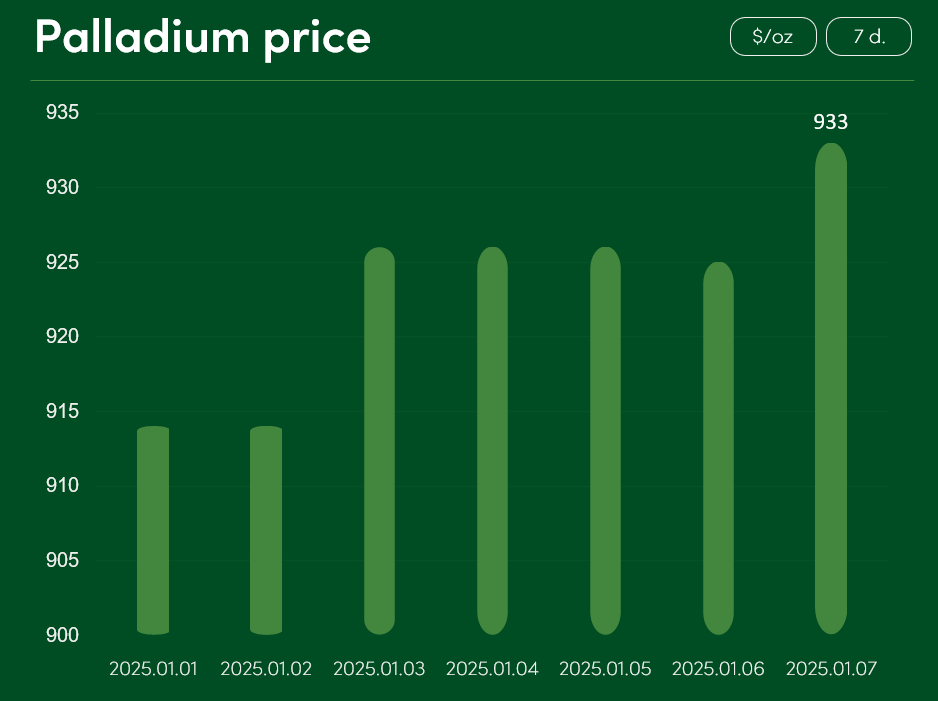

The precious palladium metal recorded a ~2% price increase from 1 January to 7 January, reaching a price of $933/oz.

Platinum also experienced a period of growth that mitigated the correction experienced at the end of last year. The precious metal appreciated by >4% between 1 and 7 January, reaching $949/oz.

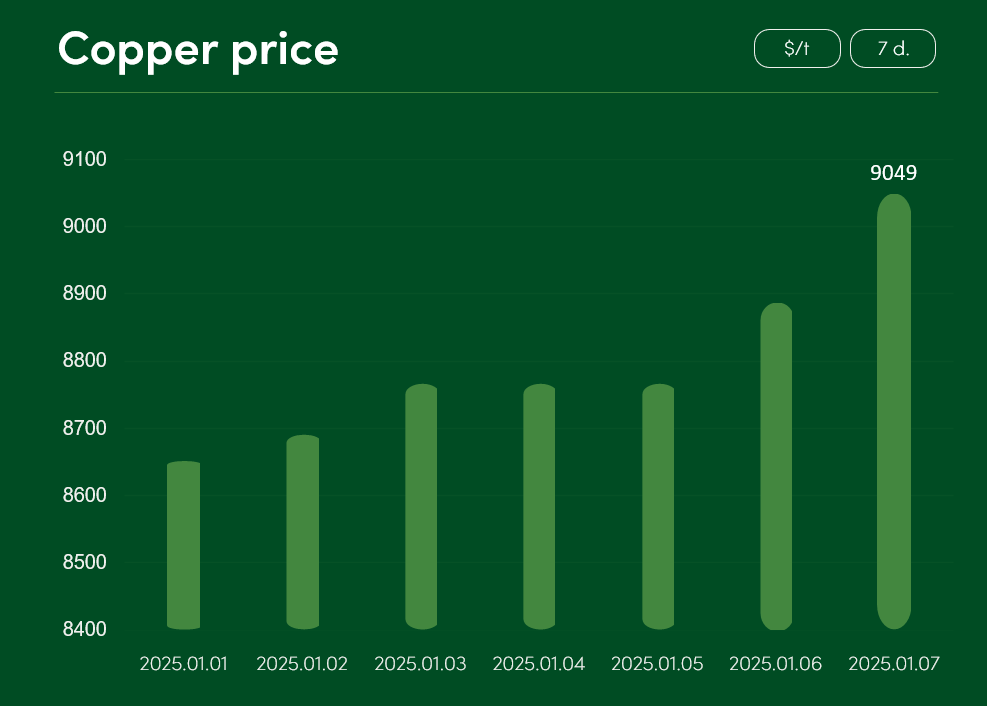

Semi-precious copper metal also recorded a price increase, with global copper prices rising by >4.5% between 1 January and 7 January up to $9049/tonne.

According to TradingEconomics analysts, the rise in copper prices was partly driven by the correction of the US dollar, which was due to analysts’ speculation about softer changes in US import tariff policy. Copper also experienced bullish trend due to favourable monetary policy decisions and statements of the Chinese government.

Copper investors are also optimistic about the recent 2024 report of the Chinese company CMOC, one of the world’s largest copper and cobalt producers. According to the report, this public limited company, which is closely linked to the Chinese government, recorded a 55% growth in copper production last year. Given its close business export links with China and the latter government’s monetary easing measures, it is likely that one of the world’s largest economies will grow its demand for copper in 2025, contributing to a further increase in metal’s global price.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.