June 3, 2025

Market Overview 28-05-2025 to 03-06-2025

Last week, the precious metals market experienced a sudden and somewhat unexpected price rise. This was mainly attributed to the unforeseen escalation of tariff wars, adjustments of economic growth forecasts and the intensification of geopolitical crisis.

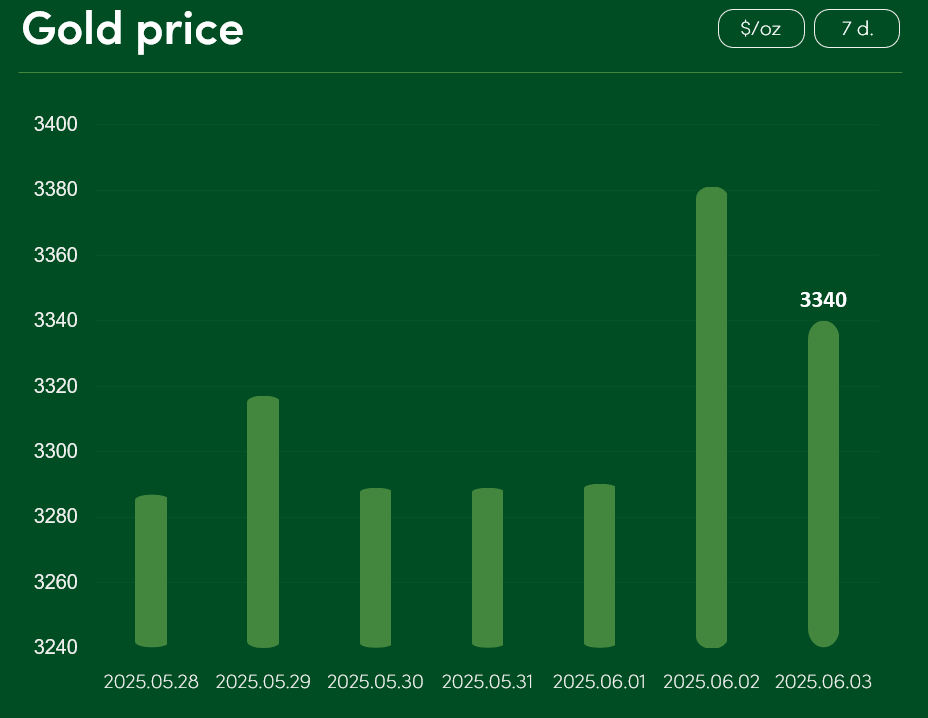

Between 28 May and 3 June, the global gold price rose by ~1.6%. On 3 June, the price reached $3340/oz.

The escalation of trade wars contributed strongly to the rise in gold price. Last Friday, US President Donald Trump announced his decision to raise global import tariffs on aluminium and steel entering the US from 25% to 50%. Mutual allegations of breaches of the China–US trade deal have further intensified the overall turmoil.

The escalation of the war in Ukraine is also fuelling the choice of gold as an investment hedge. Last Sunday, Ukrainian drones struck at least 41 Russian Air Force heavy bombers at 4 Russian air bases.

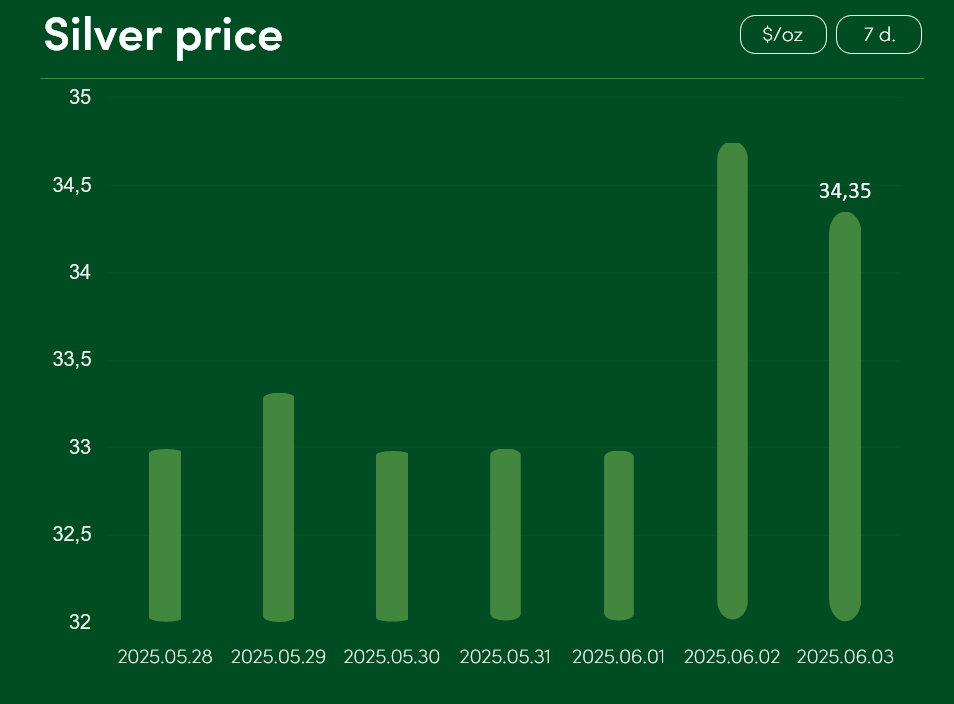

The global silver price rose by >4.1% between 28 May and 3 June to $34.35/oz.

Silver’s rising popularity is due to the discussed trade war crises, escalating geopolitical conflicts, and declining optimism among economic analysts. Experts at the Organisation for Economic Co-operation and Development (OECD) have downgraded their forecast for global economic growth this year to 2.9%. Tariffs and uncertainty over political decisions have been identified as the main reasons for the change in forecasts.

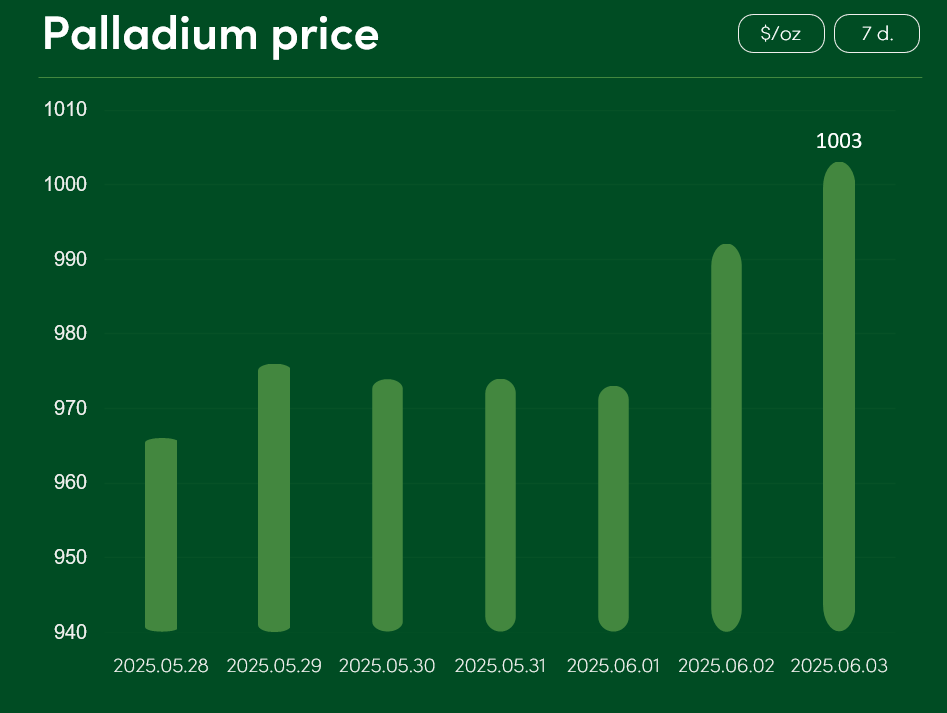

The global price of palladium increased by ~3.9% between 28 May and 3 June to reach $1003/oz.

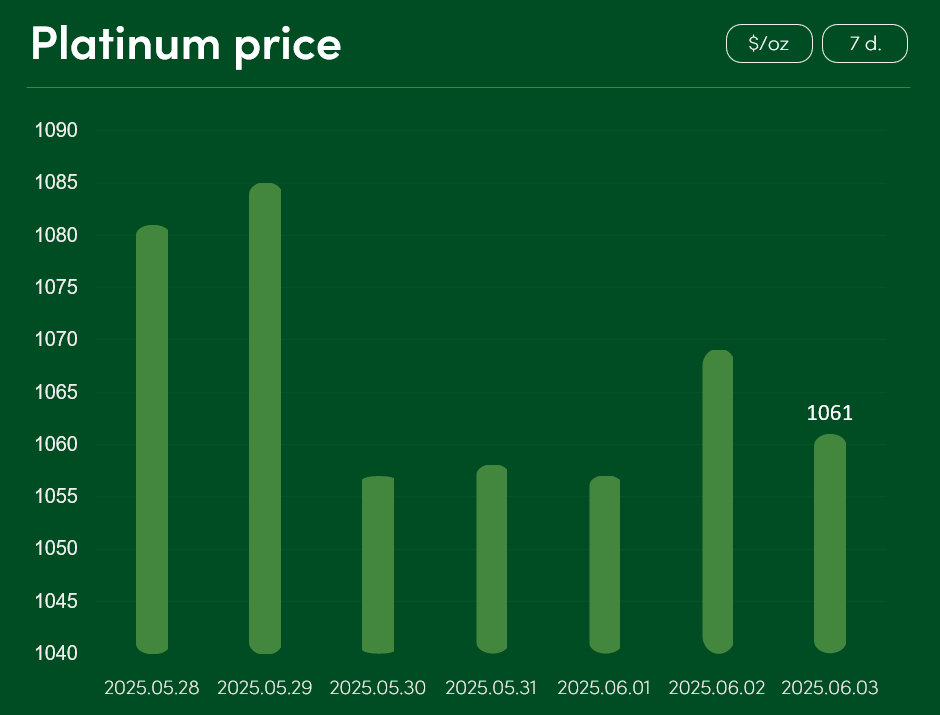

The global platinum price experienced a price correction of 1.85% between 28 May and 3 June to reach $1061/oz.

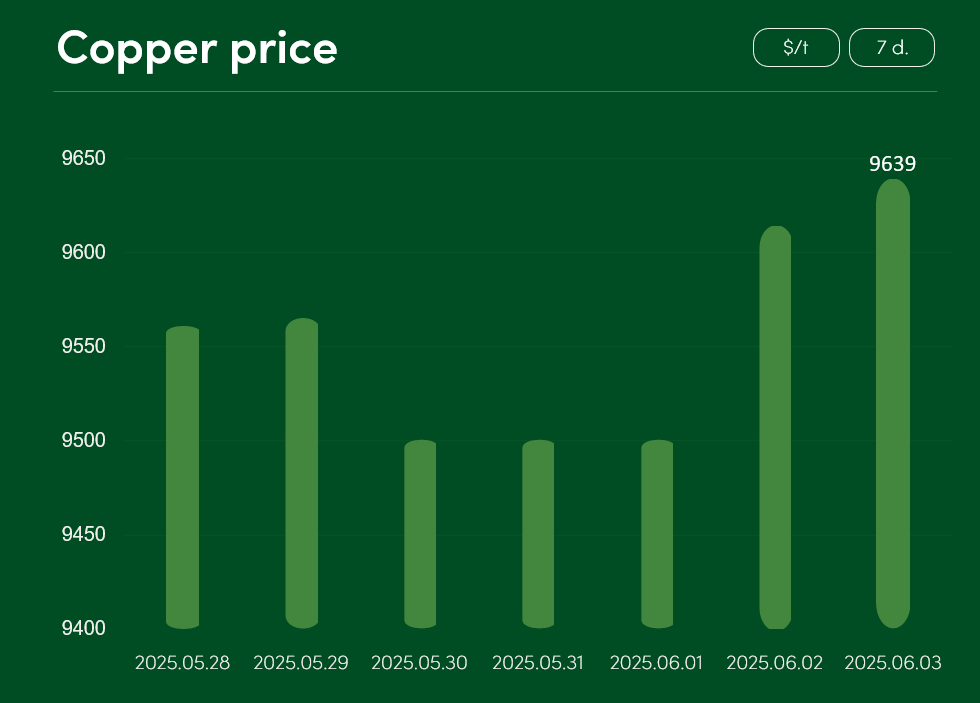

The global copper price experienced an increase of ~0.82% between 28 May and 3 June to reach $9639/t.

The rise in copper prices this week was fuelled by investor speculation that the US will soon impose a specific import tariff on copper metal in the wake of the escalating trade war crisis.

In the short term, possible changes in the Chinese automotive market may also contribute to the rise in prices of this industrial metal. The country’s Ministry of Information Technology and Industry (MIIT) has responded to a notice from the China Association of Automobile Manufacturers (CAAM) calling on the country’s car manufacturers to stop their price-cutting races. MIIT has formally announced that it will step up its efforts to regulate market price competition. Successful implementation of the promise would mean a possible increase in the prices of cars sold in China and of the various components (including copper) used in their production.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.