July 1, 2025

Market Overview 06-25-2025 to 01-07-2025

Last week, price movements in the precious metals market were driven by both U.S. economic challenges and uncertainties in the sphere of global trade agreements.

As the end of Donald Trump’s import tariff pause period approaches, investor anxiety is growing along with the belief that changes in U.S. monetary policy might be forthcoming. If this scenario materializes, such changes may encourage increased investment in key precious metals.

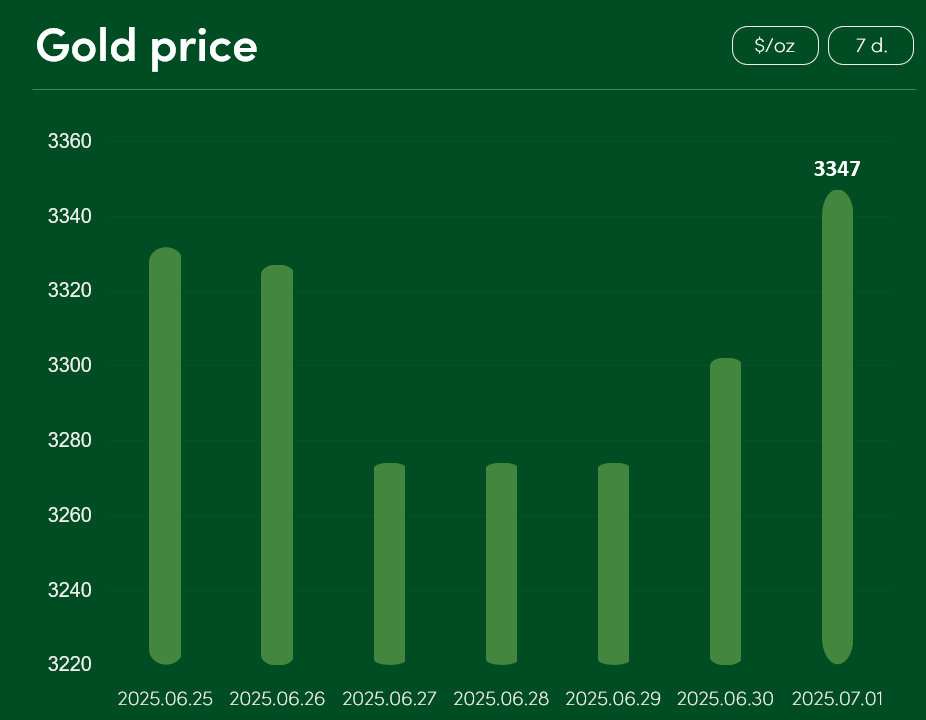

The global gold price successfully overcame a >1.7% price correction from June 25 to July 1.

On July 1, the global price of gold reached $3,347/oz.

Investor interest in gold has recently been strengthened by the uncertain state of the U.S. economy. As the end of Trump’s 90-day tariff pause nears, the world eagerly awaits trade agreements between the U.S. and its main trading partners. Without significant progress in this sphere, the risk of heightened global economic instability and supply chain disruptions grows.

The attractiveness of precious metals is also boosted by unrest in the U.S. domestic market. While the U.S. Senate is debating Donald Trump’s sweeping tax-cut and spending bill, it has been calculated that passing this legislative package would increase the national debt of the world’s most powerful economy by $3.3 trillion.

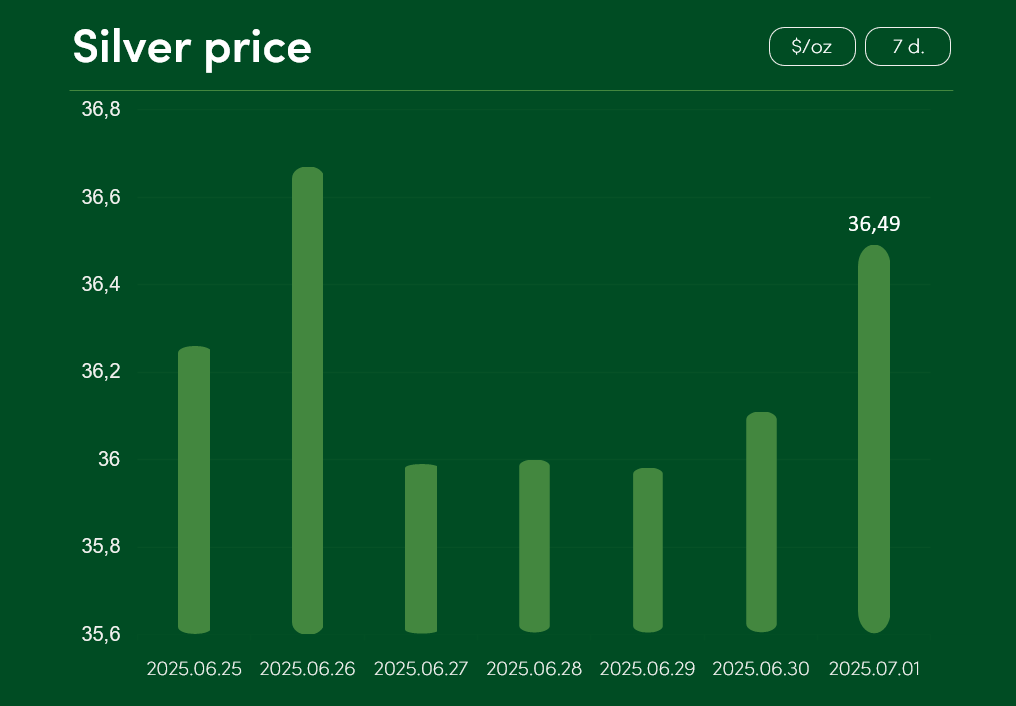

The global silver price rose by >0.6% from June 25 to July 1; on July 1, the global market price of silver reached $36.49/oz.

Silver’s growth as an investment asset is driven by U.S. economic challenges, the uncertain future of international trade relations, and the increasing likelihood of a U.S. interest rate cut.

Although the next Federal Reserve meeting and interest rate review will only take place in 29 days, markets are already pricing in a ~21% probability of a rate cut. Such a decision would contribute to a weakening of the U.S. dollar. This factor typically increases demand for dollar-denominated commodities (such as gold, silver, oil, etc.), as they become more affordable for foreign investors.

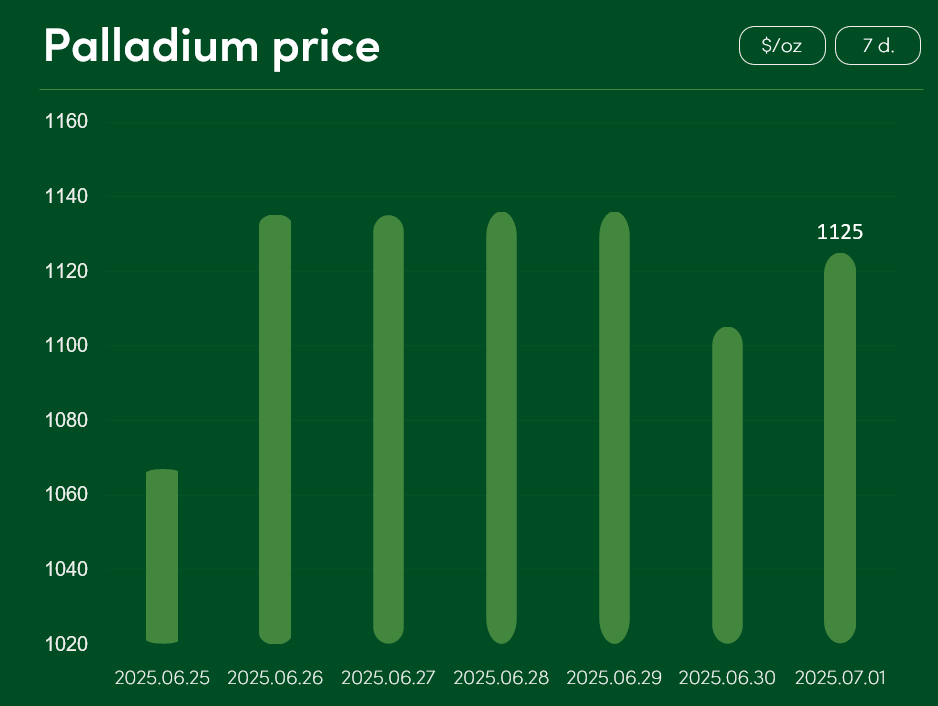

The global palladium price increased by ~5.5% between June 25 and July 1. On July 1, it reached a level of $1,125/oz.

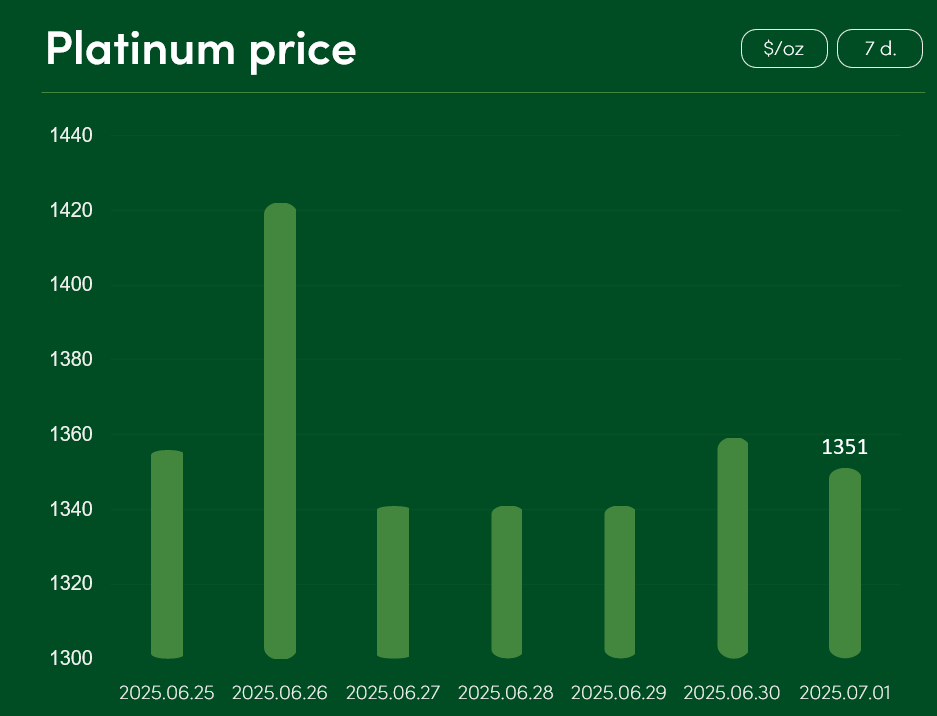

The global platinum price showed minimal change over the same June 25 – July 1 period. On July 1, the global platinum price stood at $1,351/oz.

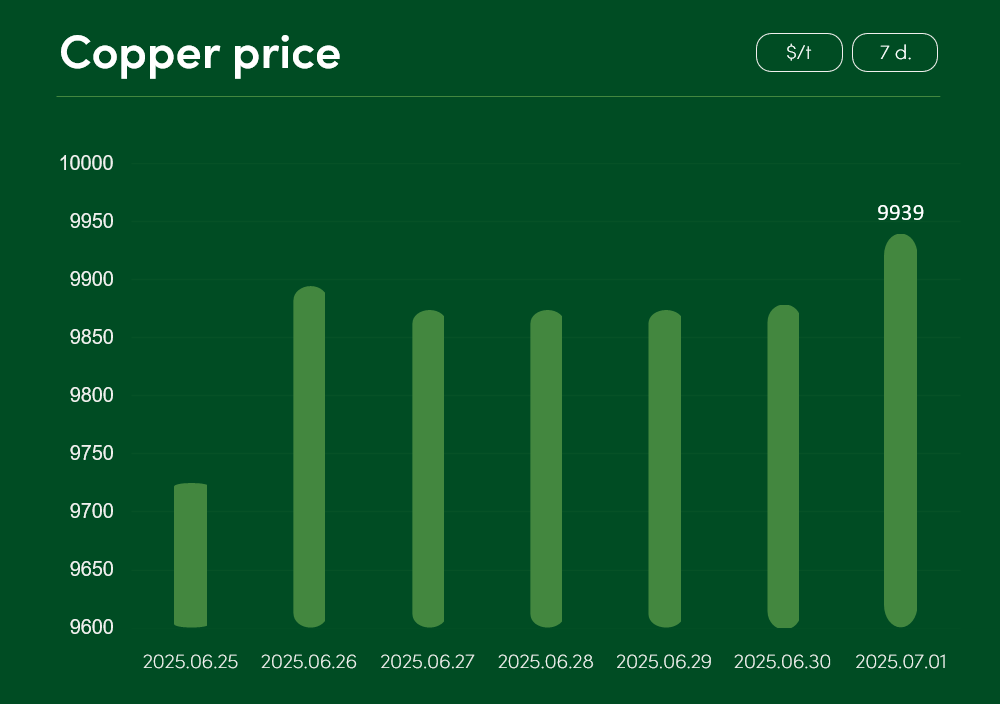

The global copper price increased by ~2.2% from June 25 to July 1. On July 1, it reached a level of $9,939/t.

As copper traders carry out significant transfers of this metal between exchanges, the global market is currently experiencing a so-called supply squeeze – short-term demand for copper significantly exceeds supply of the metal. This factor is strongly contributing to the rise in global copper prices.

Due to sharp inventory shifts, officially available copper stocks on the London Metal Exchange (LME) have decreased by as much as 80% this year.

This year, copper prices have also been driven up by fears of possible U.S. copper import tariffs.

This concern has triggered a wave of industrial metal exports to the United States, while copper reserves on non-U.S. exchanges reached their lowest level in two years this June.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.