January 28, 2025

Market Overview 22-01-2025 to 28-01-2025

Last week, the major precious metals faced more pronounced market pressures, which disrupted price gains. Both price corrections and temporary consolidations were recorded. Such developments were due to the growing threat of a trade war between the US and China and other countries, the declining attractiveness of precious metals as an investment hedge and the pessimistic industrial performance in the Chinese market.

The gold market price remained almost flat from 22 January to 28 January on a 7-day change basis. On 28 January, the global gold price reached $2752/oz.

The slowdown in gold is not only due to the announced ceasefire between Israel and Hamas in the Gaza Strip, but also to a slightly more stable global geopolitical situation. The metal’s growth is also hampered by new headwinds in US domestic and foreign policy. According to APnews analysts, in the first days of his presidency, Trump has already tightened border security, eased oil extraction conditions on US federal lands, and assured that 25% import tariffs on Canadian and Mexican goods are planned from 1 February. Investors are closely watching the White House’s next decisions, with fears of widespread sanctions against China and an escalation of the trade conflict.

While Trump’s “made in America” policy may benefit the US domestic economy, the investment attractiveness of precious metals (and gold in particular) may decline if Trump’s economic innovations (which experts see as inflationary drivers) contribute to the Fed’s decision to maintain higher interest rates. The hazy outlook for the future encourages investors to be cautious about gold prices, which are currently near all-time highs.

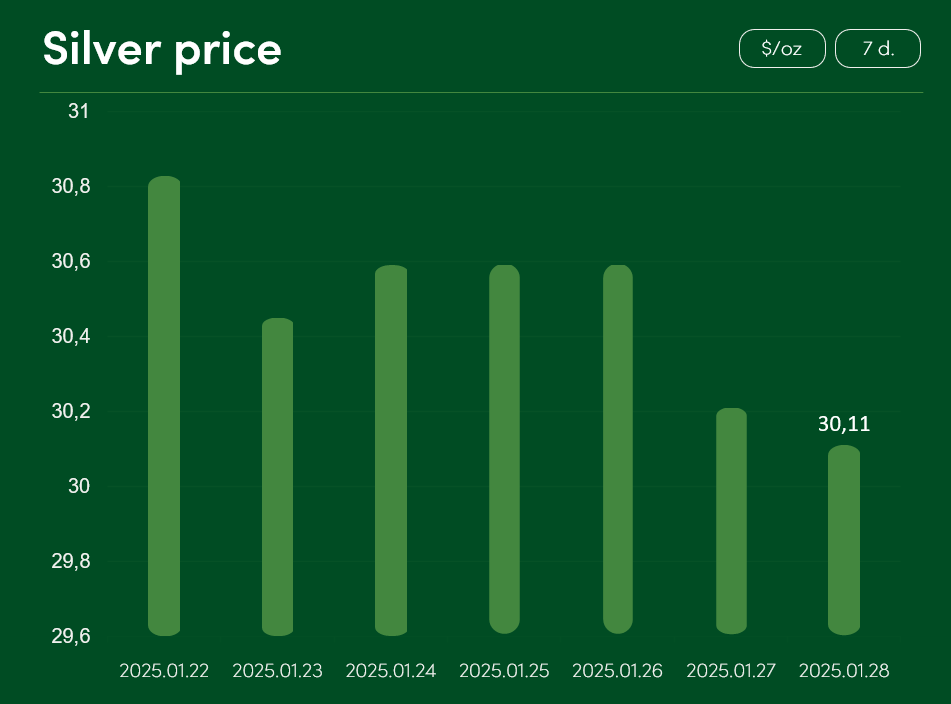

The silver market price experienced a correction of ~2.25% between 22 January and 28 January. On 28 January, the price of this metal reached $30.11/oz.

The passivity and minimal corrections in the silver market are not only due to the uncertainties regarding the impact of US economic decisions on the global market. A problematic situation was recorded on the Chinese market: the country’s solar module industry is facing a problem of overcapacity. This is prompting the country’s solar module manufacturers to join the government’s self-control programme, which will limit the demand for silver in one of the most important industries for this metal.

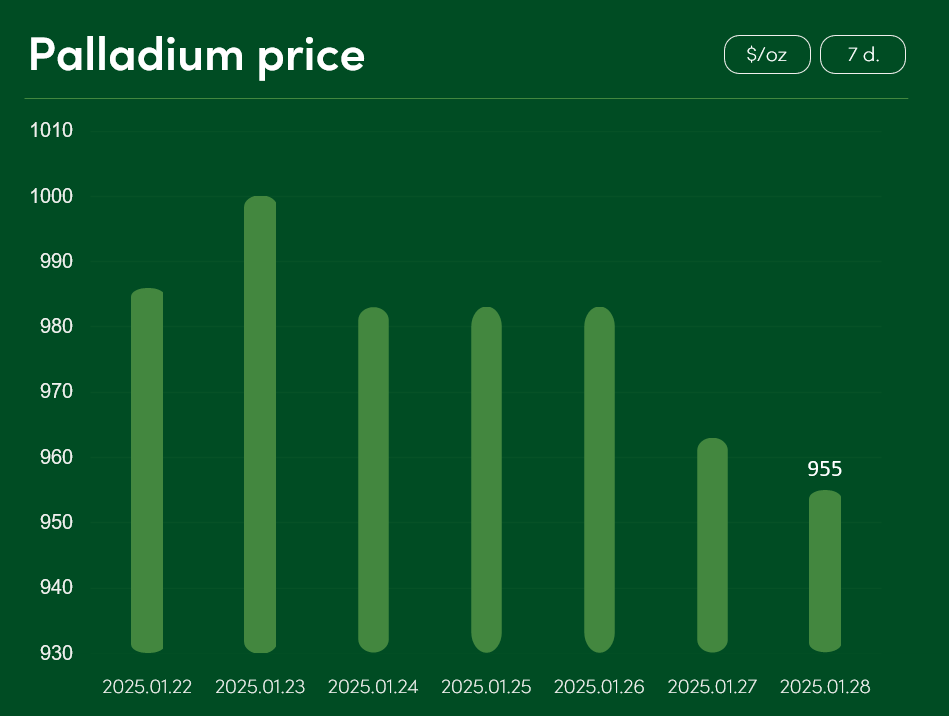

The market price of palladium dropped by >3% between 22 January and 28 January to $955/oz.

The global platinum price has fallen by ~1.3% over the past week to $942/oz.

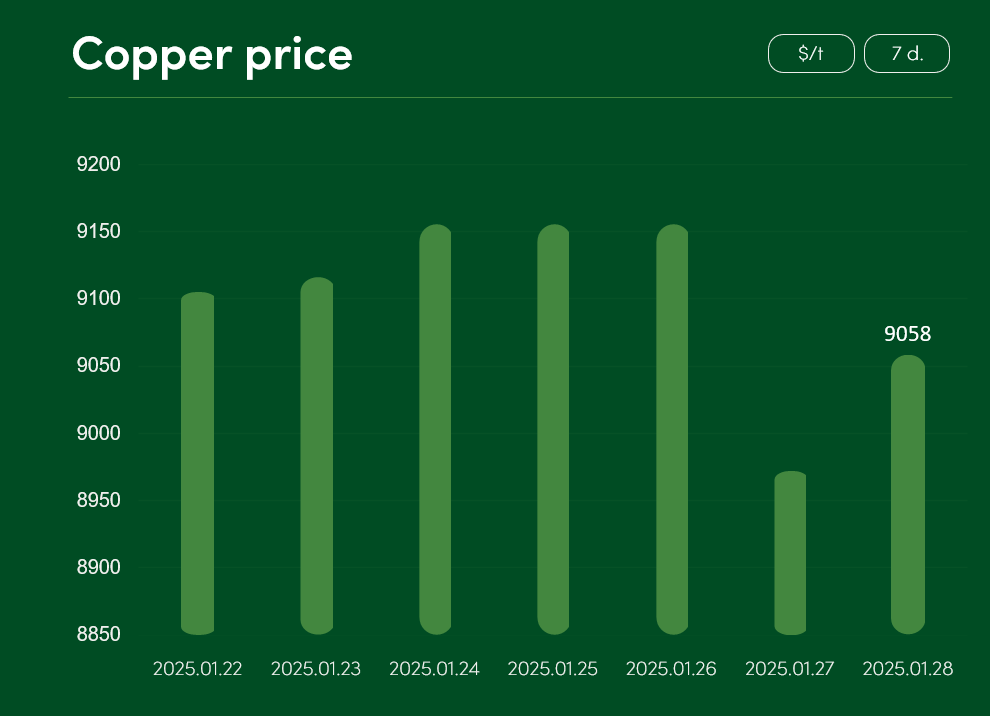

Although copper faced a ~2% price correction this Monday, Tuesday’s price increase offset part of this decline and allowed the copper price to reach $9058/t.

The uncertainty in the copper sector can be attributed not only to the potential threat of a US-China trade war, but also to problematic industrial production signals in the Chinese domestic market. The manufacturing purchasing managers’ index (PMI) of the world’s largest copper user recorded a fall to 49.1 points in January. This worst result since last August also indicates a general contraction in China’s market production. The 50-point threshold of the aforementioned PMI is considered the dividing line between expansion and contraction in the Chinese manufacturing sector.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.