May 13, 2025

Market Overview 07-05-2025 to 13-05-2025

Last week, precious metal prices and near-term price forecasts were shaped by rapid developments in the sectors of global economy and geopolitics. Trade agreements and the de-escalation of geopolitical conflicts contributed significantly to an increasingly unpredictable supply-demand balance, potentially leading to more pronounced future price fluctuations in the precious metals sector.

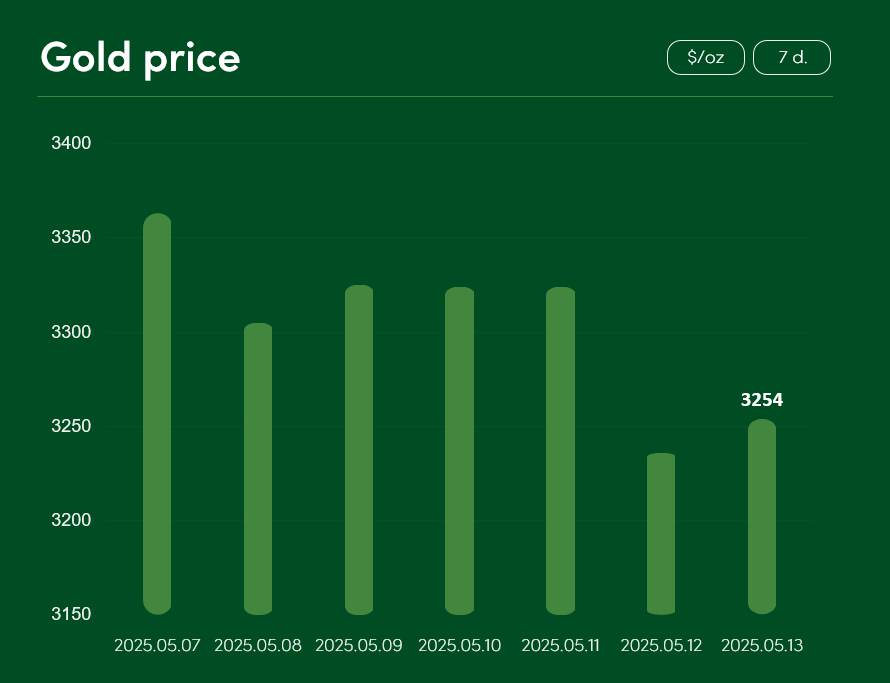

From 7 to 13 May, the global gold price recorded a correction of approximately 3.25%, reaching $3,254/oz on 13 May.

Investor retreat from gold as a safe-haven asset was partly driven by the de-escalation of the US-China trade war. Beijing and Washington reached an import agreement under which both countries committed to lowering recently imposed tariffs from 125% to 10% for a 90-day period.

Gold’s appeal also diminished due to easing tensions between Pakistan and India. Armed conflicts and the threat of full-scale war were unexpectedly suspended following the announcement of an official ceasefire agreement over the past weekend.

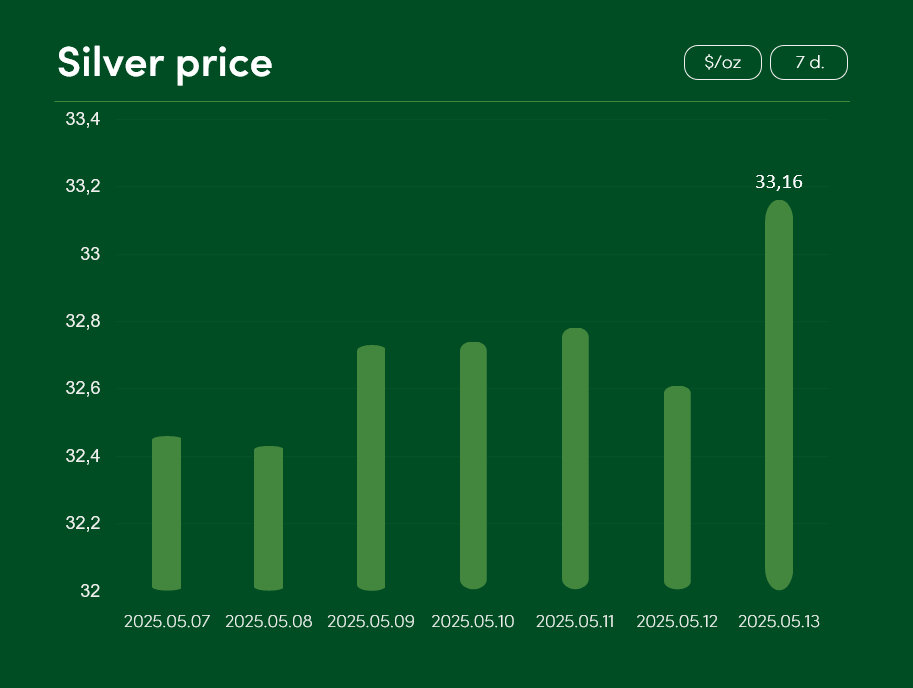

The price of silver – a metal used both as an investment and in industrial production – rose by approximately 2.15% over the same period, reaching $33.16/oz on 13 May.

The demand for silver is being stimulated by trade agreements that are less favourable to gold. The US-China tariff truce enables the world’s two largest economies to conduct silver import-export operations more easily and cost-effectively. This supports industrial demand in sectors such as renewable energy.

Industrial demand for silver may also be indirectly supported by the newly announced US–UK trade agreement. The deal includes tariff reductions on various UK exports to the US, including automobiles, aircraft components, steel, aluminium, and other goods.

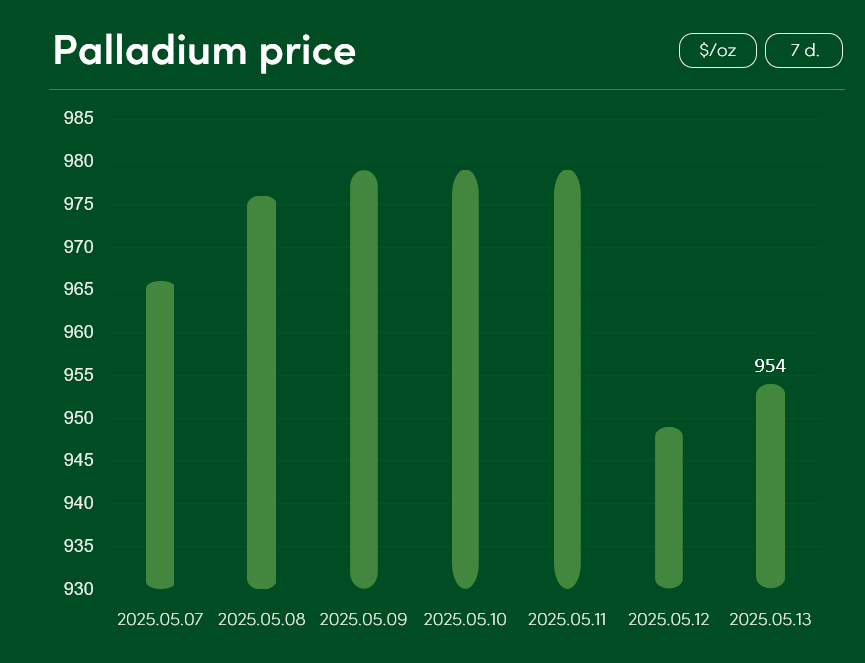

Palladium price saw minimal change last week, decreasing by roughly 1.2% between 7 and 13 May. On 13 May, the metal was trading at $954/oz.

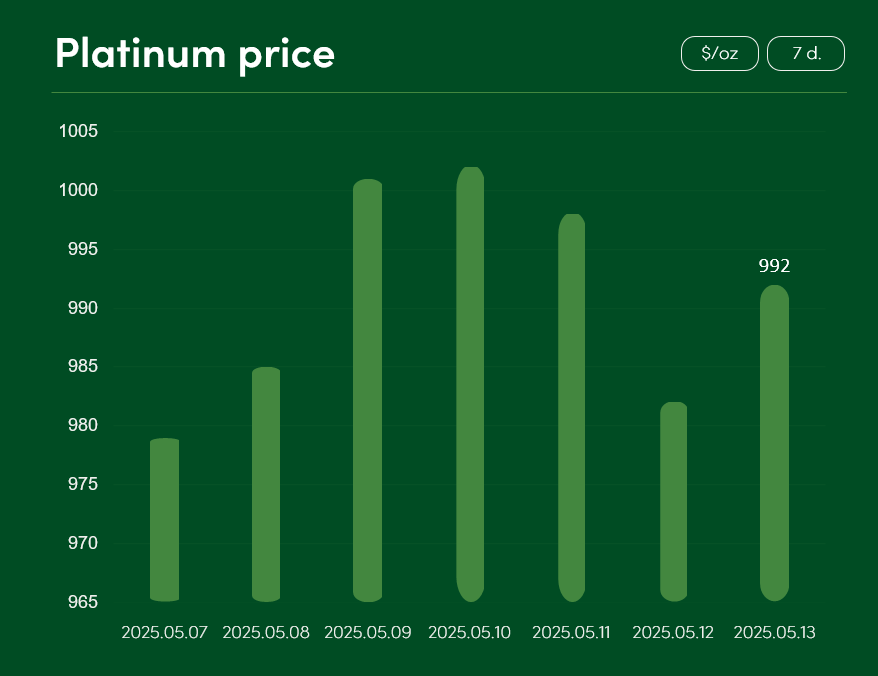

The global platinum price rose by around 1.2% over the same period, reaching $992/oz on 13 May.

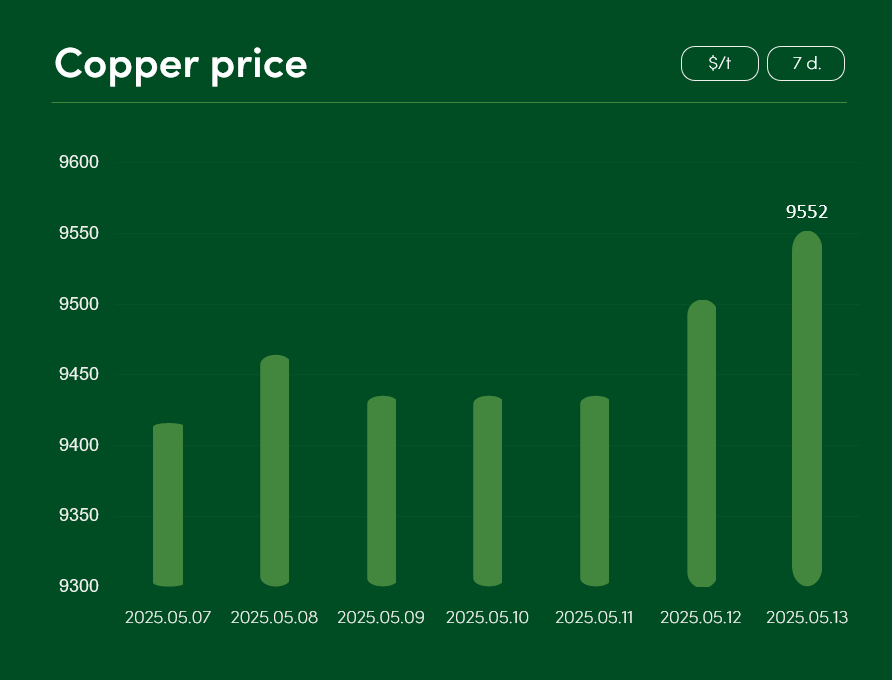

From 7 to 13 May, the global copper price increased by approximately 1.5%, reaching $9,552/tonne on 13 May.

Despite its price rise, driven by fears of potential specific US copper import tariff and the latest US-China trade agreement, copper is also facing the problem of a significant global supply surplus. Experts from the International Copper Study Group (ICSG) forecast that this year’s market surplus could reach as much as 289,000 tonnes. The growing risk of serious oversupply is prompting some traders to unwind copper’s long positions opened in anticipation of optimistic price rise.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.