Review of Metal Market from 1/13/2021 to 1/19/2021

Precious metal prices have been fairly stable this week. Gold, silver and palladium values fell slightly, while platinum and copper rose minimally. This period is not yet clear for precious metals - it is difficult to predict in which direction their prices will turn. The US dollar has been weak for some time, and it does not prevent metals from raising their prices (source: Reuters.com). The new US President, Joe Biden, will also be inaugurated soon - the US sanctions on China may be eased, which will also affect precious metal prices. And, of course, with spring approaching and broader vaccination against coronavirus, we are likely to see changes in precious metal price graphs as well. It looks like everything can be expected in the coming months.

The price of the yellow metal fell to $ 1,837.61 an ounce. At the beginning of the week, the price of the metal had recovered, but then began to fall. The fall in the price of gold has had a positive effect on the jewelry industry, with demand for gold jewelry growing by up to 20% in India (source: Economics.indiatimes.com). Gold.org says that while the value of gold is now falling and fears of inflation are not going away, this year should be good for the yellow metal - investors, as always, see gold as a safe investment.

.png)

Silver currently costs $ 25.02 an ounce. Compared to the last week, its price has changed very little. Ukinvestormagazine.co.uk says that silver will surpass gold this year - the price of silver will rise much faster than yellow metal’s. Reviewers see growing demand and potential for silver and expect its average price to be $ 30 an ounce this year (source: Financialmirror.com). It is worth considering investing in this metal as its price is lower now.

.png)

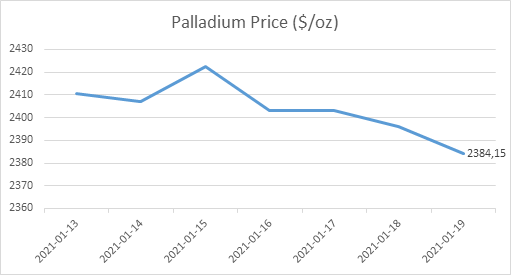

The price of palladium fell slightly this week to $ 2384.15 an ounce, while platinum rose to $ 1098.55 an ounce. Although the price of palladium has fallen, Economies.com predicts that its value will rise sharply this year. One reason for this is the forecast for strong growth in car sales in China this year (source: Autonews.com). Platinum is also promised a bright future - the price of the metal should grow as fast as silver’s (source: Markets.bussinesinsider.com). If the price of platinum continues to rise, it can be expected to rise to as much as $ 1,300 an ounce in the near future (source: Capital.com). It seems to be worth investing in platinum, at least at the beginning of the year, when it is promised such positive forecasts.

.png)

The price of copper rose to $ 8021.08 a tonne. Demand for the metal continues to grow steadily (source: Mining.com). It can be said that copper seems to become a reliable investment without major price deviations for quite a long time.

.png)