Review of Metal Market 2019 08 29 - 09 04

Precious metals’ graphs look very good this week - prices of all metals have risen. The situation deserves a lot of interest, as two important factors, which have had a significant impact on the metal price fall, are currently not affecting metals. For example, the US dollar has reached its highest position in the last two years (source: Cnbc.com). The trade war between the US and China continues (source: Fxstreet.com).

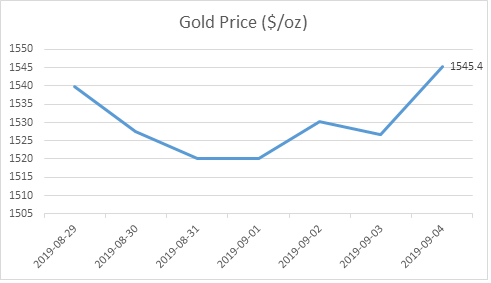

Yellow metal, albeit slightly, rose to $ 1,545.4 an ounce. According to Yourmoney.com, private investors are increasingly investing in gold; it is noted that there are also new investors whose first investment is yellow metal. India has recorded the lowest percentage of gold imports in the last three years - as the metal becomes more expensive, its purchasing power is declining (source: Businesstoday.in). Gold is unlikely to fall in the near future - it is expected to rise to $ 1,600 an ounce (source Bloomberg.com).

Silver has peaked in the last two years - currently at $ 19.31 an ounce (source: Finance.yahoo.com). According to Thenational.ae, white metal will continue to strengthen its position. However, according to Fxempire.com commentators, the value of the metal (that has been rising for a while) may fall quickly - it is advisable to invest carefully. Some experts are saying that silver is likely to cost $ 25 an ounce by November (source: Kitco.com).

.png)

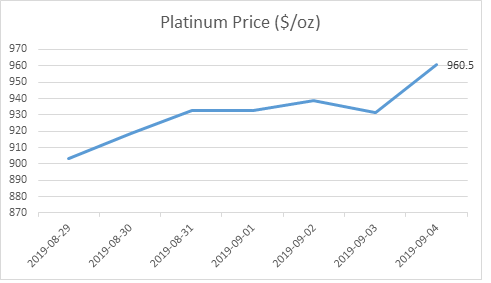

Both palladium and platinum prices have risen. Palladium now costs $ 1,549.5 an ounce; while platinum at $ 960.5 an ounce. For a long time, car sales in China, one of the largest markets in the world, have fallen to record levels. But experts from Xinhuanet.com say, that the situation may improve, with efforts to increase car demand in the country. This will have a good effect on both platinum and palladium. Meanwhile, commentators say platinum is the "new gold" - metal is becoming a reliable investment and its demand for jewellery is growing (sources: Insights.abnamro.nl, Platinuminvestment.com).

.png)

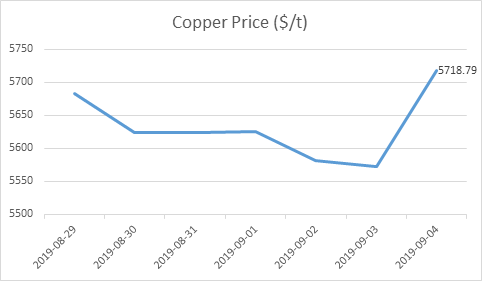

Finally, the price of copper has risen, currently at $ 5718.79 a tonne. The demand for the metal is not diminishing - for example, there are plans to build even more wind farms around the world, and huge amounts of copper are being used to produce them. Major copper mines in Chile have signed an agreement to help smaller mines (source: Reuters.com). China plans to build a new large copper mine (source: Mining.com).