Review of Metal Market 2019 09 019 - 09 25

The final week of September brought better news than the last one - prices of all precious metals, except copper, rose. Commentators continue to believe that metal prices are set to rise further by the end of this year, so it is worth to invest (source: Metalsdaily.com).

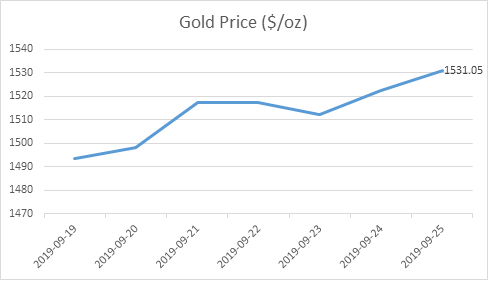

The price of gold rose to $ 1531.05 an ounce. Sources say that the rise in the price of yellow metal is influenced by the US-China trade war, which previously had a negative effect on gold, and now the situation has changed slightly (sources: Investing.com, Bloomberg.com). Kitco.com says that gold is expected to rise to $ 1,600 an ounce by the end of the year.

White metal is following the footsteps of gold and has raised its price to $ 18.61 an ounce this week. The weakening US dollar also contributed to this price increase (source: Econimictimes.indiatimes.com). Experts predict a bright future for silver - as its price rises rapidly, its price is expected to reach $ 23-24 an ounce by the end of the year (sources: Fxempire.com, Finance.yahoo.com). It is a good time to invest more in white metal, as its value is likely to continue to grow rapidly.

.png)

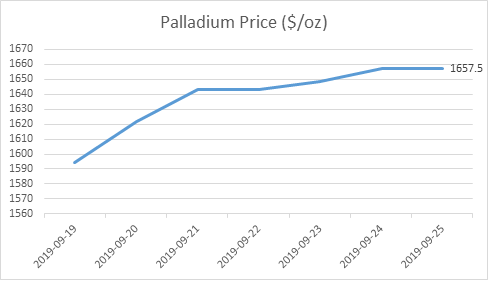

The price of palladium has risen again - currently at $ 1657.5 an ounce. Kitco.com says that this growth is at a record high. It is also important to note that when the value of palladium began to increase rapidly, gold growth declined (source: Fxstreet.com). Palladium is estimated to cost $ 1,700 an ounce in the near future (source: Kitco.com).

Meanwhile, the value of platinum has also risen - the metal is currently priced at $ 955.5 an ounce. The price of this metal is not rising so fast, but commentators believe the metal could cost more than $ 1,000 an ounce by the end of the year (source: Menafn.com). Both platinum and palladium prices will depend on the popularity of electric vehicles. However, platinum is still safer than palladium because it is more widely used (source: News.metal.com).

.png)

The price of copper has fallen slightly - the metal is currently priced at $ 5751.86 a tonne. Although metal prices are falling, they are not in surplus - there has been a worldwide shortage of copper as mining in Chile, Indonesia has dropped significantly (source: Mining.com). But this shortfall should not last long - as much as 2.5 million tonnes of copper are planned to be mined in Peru (source: Mining.com). Codelco, the world's largest copper mining company, is upgrading its mines.

.png)