Review of Metal Market 2019 08 22 - 08 28

The summer ends with a very positive outlook - prices of almost all precious metals, except palladium and copper, have risen. Last year, experts predicted that 2019 will be a successful year for precious metals - as we can see now, they were not mistaken. However, it is worth keeping an eye on the metals’ prices for the last four months - the price-boom may not last long (source: Metalsdaily.com).

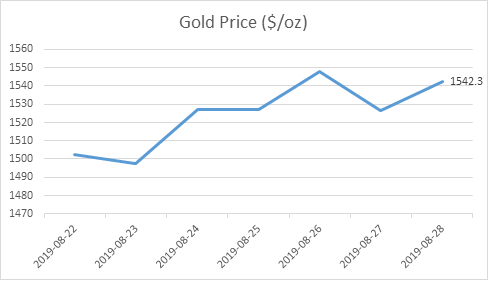

Gold continues to amaze investors - metal seems to be racing with itself and, following recent weeks, is winning again: currently priced at $ 1,542.3 an ounce. Source Zerohedge.com says that the yellow metal will not stop now - its price will continue to rise. As a result, it is advisable not to be afraid to invest in gold even now - there is a good chance that the price it will surge even further. While gold import in China is drastically reduced (because of US sanctions), experts believe the price of the metal could rise as high as $ 1,800 an ounce (sources: Thinkmarkets.com, Fp.brecorder.com).

A rare phenomenon, - the price of silver is over $ 18 an ounce. This is its highest value in the last two years (source: Proactiveinvestors.co.uk). White metal sales have also increased recently (source: Coinnews.com). How high silver prices will rise is not yet clear, but the recent period is expected to be somewhat calmer and more stable (source: Etfdailynews.com). Still, some experts believe that in the next year silver will not shine and remain in the shadow of gold (source: Kitco.com).

.png)

Palladium holds steady - currently priced at $ 1483.5 an ounce; its price has fallen very slightly since the last week. Platinum value rose to $ 866.5 an ounce. Sanctions to reduce harmful emissions have already been in place in a number of countries around the world, causing car sales to fall - as palladium is not as widely used as platinum, it is dependent on car sales (source: Europe.autonews.com). However, the platinum situation is much better - metal demand in the jewellery industry is growing - up 29% in the recent months (source: Timesofindia.indiatimes.com). Fun fact: in Japan, most platinum jewellery is bought by the elderly people (source: Finance.yahoo.com).

.png)

.png)

The value of copper dropped slightly to $ 5648, 24 a tonne. Although the metal is quite vulnerable to US-China trade war sanctions, sources say that China should increase its imports of all metals (source: Mining.com). Interesting: Egyptian millionaire Naguib Sawiri says he is keen on investing in copper and gold mines in Egypt - perhaps it can be a brighter future for these metals (source: Mining.com).

.png)