Review of Metal Market 2019 08 15 - 08 21

Precious metals’ graphs look quite good at the end of August - gold, silver and palladium are adding their value, while platinum and copper prices have fallen just slightly. Looking at recent weeks, the situation could be expected to improve further by the end of this year, if rapid and drastic events in the world's strongest economies will not happen (source: Metalsdaily.com).

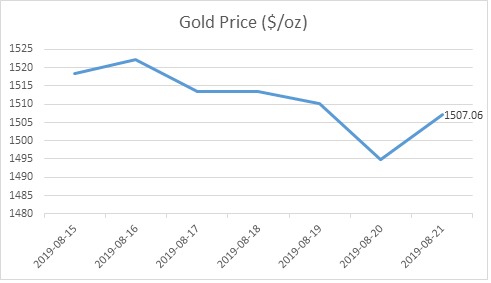

Yellow metal does not stop strengthening its position - it is currently priced at $ 1507.06 an ounce. Gold demand is now at its highest level since 2013 (source: Yahoo.com). Marketoracle.co.uk says, that gold purchases are now at record levels. Yellow metal is also gaining popularity in the jewellery industry (source: Thehindu.com). Cityam.com experts believe that this time is extremely favourable to continue investing in gold.

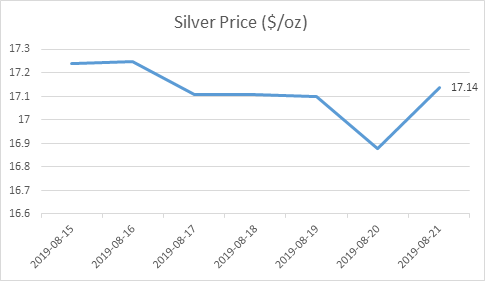

Silver follows gold and continues to increase its value - currently it costs $ 17.14 an ounce. Compared to the previous months, silver growth is steep and even record high. Fxempire.com says, that white metal markets are recovering and are bought successfully. Experts at Kitco.com believe this is just the beginning - the price of white metal is set to rise. The silver price graph is expected to grow as much as $ 23 an ounce on the next year (source: Kitco.com). It is worth to observe, if this statement will become true.

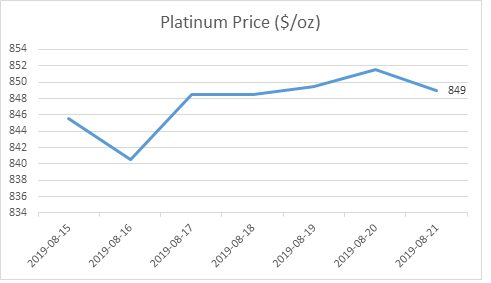

Palladium is slowly recovering - it costs $ 1488.5 an ounce this week. Platinum price dropped slightly to $ 849 an ounce. The car sales situation in China remains unchanged - July figures are the worst of the year (source: Asia.nikkei.com). Still, the situation in the US is easing somewhat - perhaps this year we will see an increase in car demand in this country; this would improve both palladium and platinum prices (source: Uk.reuters.com). According to Mining-journal.com, the demand for platinum is expected to rise to a record high in the future, owing to the widespread use of metal.

.png)

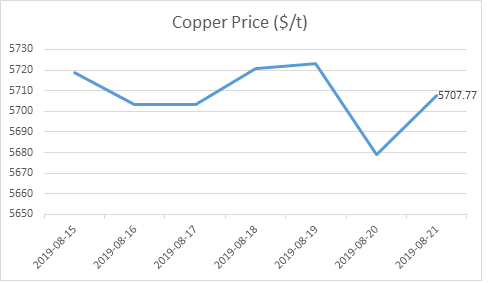

Copper is priced at $ 5,707.77 a tonne this week. Demand for this metal is not diminishing - one of the biggest mines in Congo is losing profits due to the inability to extract the required quantities of the metal (source: Mining.com). Meanwhile, owners of major mines around the world are not sleeping - Los Andes Copper plans to build a giant copper mine in Chile (source: Mining.com).